By Rebecca Felton, Senior Market Strategist

SUMMARY

- Consumer spending will continue to trend higher, in our view.

- We believe inflation will settle into a range of approximately 2-3%, year over year.

- We believe the market will absorb policy changes under the Biden Administration in an orderly fashion.

RiverFront’s Take on Current Risk Factors

The cover of our 2021 Outlook featured a light at the end of a tunnel. Acknowledging that while challenges were still ahead, we expressed our optimism around the US recovery as we emerged from the pandemic. The economy and the stock market have continued to rebound, and we remain optimistic about the fundamental underpinnings for both. We believe it is normal for the path of a recovery to have bumps along the way. Over the past few weeks, it has felt as though the bumps have been more frequent with increasing COVID-19 case numbers, as well as downside misses on important data such as nonfarm payroll and consumer confidence. Add to that the fact that September and October are months that have historically been unkind to stocks (as mentioned in last week’s Weekly View), and it is reasonable that investors’ anxieties could be increasing.

Even though it is normal for headlines around the disappointments to dominate our thoughts, we rely on RiverFront’s risk management discipline to help us navigate through periods of stress. Our team regularly debates the bull and bear cases around the issues that are scrolling across the screens. With that in mind, we are dedicating this edition of the Weekly View to some of those headlines. Rather than signaling a reversal in the recovery momentum, we believe many of today’s anxieties will prove short-lived.

Risk Factor: Delta Variant of COVID-19

- RiverFront’s Take: The Delta variant is likely to lead to slower economic growth rates during the third quarter, but we believe a ‘low and slow’ growth rate can prolong the recovery. Over the past two weeks, some Wall Street economists have lowered their gross domestic product (GDP) forecasts for the third quarter as they now believe the Delta variant will have a more negative impact on growth, particularly as it relates to personal consumption expenditures. We are realistic enough to understand that the Delta variant is the wild card for our assumptions, but we also think the jury is still out as to whether this is a speed bump or a true roadblock as it relates to the recovery.

- What we are watching: CDC guidance and 7-day moving average of case counts: The CDC’s recent announcement regarding the high rates of transmission is cause for concern, but we remain encouraged by the continued increases in vaccination rates. Particularly encouraging is recent data from Johns Hopkins University Corona Virus Resource Center which showed that the 7-day moving average for case counts had declined in most of the states for which data was available.

Risk Factor: Unemployment

- RiverFront’s Take: We expect unemployment to continue to trend lower: The disappointment in the nonfarm payroll data for the month of August was noteworthy, particularly given the weakness in the services sector, but there is good news on overall employment. First, the unemployment rate, now at 5.2%, continues to trend lower, and that is significant in our view. Second, the most recent Job Openings (JOLTS) report set a record high and bodes well for future employment growth. Third, the weekly jobless claims have been mixed, but the most recent report revealed the number of Americans filing new unemployment claims had fallen to the lowest level in over a year.

- What we are watching: Absent additional COVID-19 disruptions, we believe the tone of the labor market will be clearer when the September nonfarm payroll data is released given that it will encompass schools reopening and the end of extended unemployment benefits.

Risk Factor: Declining Consumer Confidence

- RiverFront’s Take: Surveys conflict with data: The dramatic drop in consumer sentiment, as evidenced in two of the most widely watched sentiment surveys, is worrisome given the importance of consumer spending trends relative to US GDP. However, retail sales have recovered to pre pandemic trend levels despite fluctuations in sentiment throughout the year (generally associated with rise/fall in COVID-19 cases). We believe there may be a difference in what consumers say and what they spend.

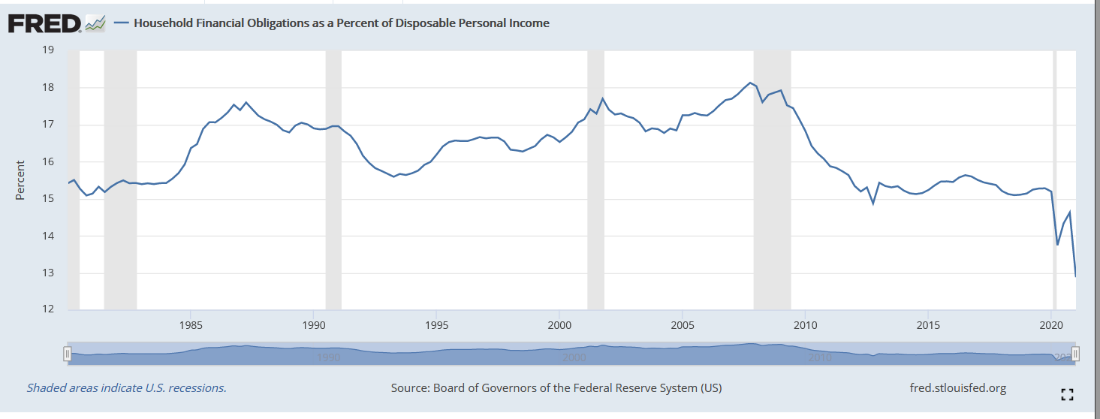

- What we are watching: This week’s release of August retail sales numbers, which include the important “back-to-school” component will be an important gauge as to the health of the American consumer. Additionally, the savings rate in the US remains well-above average and the financial obligations ratio continues to trend lower (chart below). The financial obligations ratio is the ratio of household debt payments to total disposable income. As you can see, obligations are at a record low since 1980.

HOUSEHOLD FINANCIAL OBLIGATIONS AS A PERCENT OF DISPOSABLE PERSONAL INCOME

Source: https://fred.stlouisfed.org/series/FODSP; Household Financial Obligations as a Percent of Disposable Personal Income, Percent, Quarterly, Seasonally Adjusted; as of September 13, 2021. Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative

Risk Factor: Inflation

- RiverFront’s Take: We believe year-over-year inflation can remain elevated as we work through supply disruptions/labor issues but expect levels will ultimately normalize in the 2-3% range, year over year: Unfortunately, it is likely supply chain disruptions will run into 2022 which will keep upward pressure on prices as we work through the supply and demand imbalances. We are encouraged that supply shortages, rather than demand shortages, are the drivers behind higher prices.

- What we are watching: Looking below the attention-grabbing numbers generated comparing 2021 to 2020, we also monitor the month-to-month changes which are increasing only moderately.

Risk Factor: Washington Policy Changes

- RiverFront’s Take: Things are heating up in Washington as leaders make decisions about massive levels of government spending, and we believe investors will start to care again. Over the past few months, it seems as though Wall Street has been focused on everything but the impending pieces of legislation that the House and Senate will work on this month. As the House and Senate continue to debate the size and scope of the legislative packages, we believe tensions will run high and there will be more press coverage. Partisan battle lines are being drawn as Republicans, as well as some centrist Democrats, balk at the size of the packages and the tax increases that will be necessary to pay for them. This sets the stage for uncertainty around potential policy changes.

- What we are watching: Neither the level at which corporate taxes will be raised nor the timing of implementation are known, making it difficult to factor these changes into earnings forecasts. We do expect corporate taxes to move higher and earnings estimates will be adjusted, but we do not believe tax increases will derail the market’s overall uptrend.

In conclusion: We expect equities could experience a period of consolidation as headline headwinds persist. Ultimately, we believe:

- The US economic recovery will remain on track.

- Consumer spending will continue to trend higher.

- Inflation will settle into a range of approximately 2-3%, year over year.

- The market will absorb policy changes under the Biden Administration in an orderly fashion.

Given this, our message for the three types of investors is:

- Accumulate: Market consolidations are not tradeable events, in our view, for long-term investors.

- Sustain and Distribute: An unbalanced portfolio can make it more difficult to endure rising volatility. To rectify, we have slightly trimmed our equity allocations to bring our balanced portfolios closer to alignment with their long-term strategic allocations.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.

The Job Openings and Labor Turnover Survey (JOLTS) tells us how many job openings there are each month, how many workers were hired, how many quit their job, how many were laid off, and how many experienced other separations (which includes worker deaths).

For each outcome category (accumulate, sustain and distribute) RiverFront’s portfolio management team has assigned one or more RiverFront product(s) based on their assessment of the product’s investment objective as it relates to a typical client’s return and risk objectives when seeking investment outcomes of accumulating wealth, sustaining wealth and distributing wealth. The team has also designated RiverFront product alternatives for those clients looking to take more or less risk with the outcome category. The ‘more aggressive’ (or more risk) alternatives will generally have greater equity and international exposure as well as longer time horizon targets, while those designated as ‘more conservative’ (or less risk) will have fewer equities, a lower exposure to international and shorter time horizon targets. Since the risk assessments are dependent on the outcome category selected, RiverFront products may fall in multiple categories. For example, the Advantage Global Allocation portfolio, may fall under ‘more aggressive’ to those with the outcome of ‘sustain’, but ‘more conservative’ for investors interested in ‘accumulation’. All investments carry a risk of loss and there is no guarantee that an investment product or strategy will meet its stated objectives.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1834526