By DeFred Folts III, Managing Partner, Chief Investment Strategist, and Eric Biegeleisen, CFA, Managing Director, Research Portfolio Manager

Equities:

Equities:

-

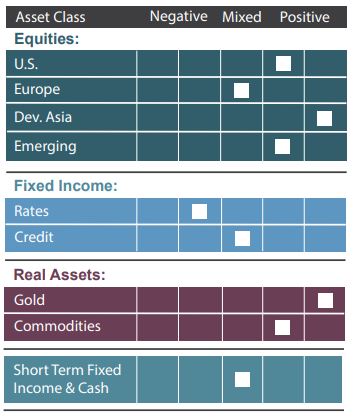

- Japanese equities remain the most attractive of the equity asset classes we model. These factors include: more compelling valuations; a steepening yield curve; and a continued narrowing of high-yield credit spreads. The Japanese economy may benefit from improved growth prospects supported by sustained monetary and fiscal stimulus. The potential for improving investor psychology could further enhance the outlook for Japanese equities.

- U.S. equity markets continue to hover around all-time high levels of overvaluation by our measure. However, monetary and fiscal stimulus remains supportive. In addition, high-yield credit spreads continue to narrow as high-yield bond yields decline while investment-grade yields increase in line with the U.S. Treasury market. U.S. equities also continue to benefit, at least in the short-term, from favorable investor behavior which at this point could be described as market euphoria.

- Emerging Market equities are slightly more attractive this month due to a steepening of our yield curve measure in China and narrowing high-yield credit spreads. The steepening of the U.S. yield curve also supports EM equities which typically benefit from easy U.S. monetary policy. However, EM equities remain somewhat overvalued.

- The outlook for European equities is mixed; they remain overvalued, but like other equity asset classes European equities benefit from tightening credit spreads. There are however some early warning signs of inflation rising faster than expected in the European economy which clouds the outlook for European equities somewhat.

Fixed Income:

- In February, interest rates for both U.S. 10-year and 30-year Treasuries continued to move higher as investors prepared for the potential of a strong economic rebound in the second half of 2021 which could trigger an increase in inflationary pressure. Even at these higher yields, U.S. Treasuries represent an unattractive risk-return trade-off as they continue to yield less than the market’s expected inflation rate across nearly all maturities. Should interest rates continue to move higher, bond market investors would also face the prospect of capital depreciation.

- Caused in part by investors searching for yield, expectations for economic recovery and the Fed’s continued tacit support of the credit markets (corporate bonds), credit spreads – the difference between high-yield and investment-grade bond yields – have narrowed even further. As investors continue to reach for higher yields, prices of the lowest quality (CCC credit) high-yield bonds are actually increasing, as yields have declined to near all-time lows. Furthermore, with record amounts of corporate debt outstanding and with record low yields for high-yield bonds, there is heightened risk that any accident in the financial markets could cause credit spreads to widen abruptly.

Real Assets:

- Although gold has struggled recently, it continues to be supported by negative real (inflation-adjusted) interest rates. Gold could benefit from a major coronavirus relief package from the Biden administration which would raise the prospects of future inflation, especially if the Fed also acts to further repress long-term bond yields. However, sustained downward pressure on the price of gold could encourage further selling and negatively impact the model outlook, at least in the short term.

- Commodities remain attractive due to the longstanding relative undervaluation of real assets. In addition, the prospect of a strong global economic recovery in the second half of 2021 combined with the potential for U.S. dollar weakness could lead to outperformance of real assets going forward.

3EDGE Solutions Designed to Smooth the Ride

Seeking to manage volatility and downside risk while providing the potential to be additive to investment returns

About 3EDGE

3EDGE Asset Management, LP, is a global, multi-asset investment management firm serving institutional investors and private clients. 3EDGE strategies act as tactical diversifiers, seeking to generate consistent, long-term investment returns, regardless of market conditions, while managing downside risks.

The primary investment vehicles utilized in portfolio construction are index Exchange Traded Funds (ETFs). The investment research process is driven by the firm’s proprietary global capital markets model. The model is stress-tested over 150 years of market history and translates decades of research and investment experience into a system of causal rules and algorithms to describe global capital market behavior. 3EDGE offers a full suite of solutions, each with a target rate of return and risk parameters, to meet investors’ different objectives.

DISCLOSURES: This commentary and analysis is intended for information purposes only and is as of March 2, 2021. This commentary does not constitute an offer to sell or solicitation of an offer to buy any securities. The opinions expressed in View From the EDGE® are those of Mr. Folts and Mr. Biegeleisen and are subject to change without notice in reaction to shifting market conditions. This commentary is not intended to provide personal investment advice and does not take into account the unique investment objectives and financial situation of the reader. Investors should only seek investment advice from their individual financial adviser. These observations include information from sources 3EDGE believes to be reliable, but the accuracy of such information cannot be guaranteed. Investments including common stocks, fixed income, commodities, ETNs and ETFs involve the risk of loss that investors should be prepared to bear. Investment in the 3EDGE investment strategies entails substantial risks and there can be no assurance that the strategies’ investment objectives will be achieved. Real Assets (Gold & Commodities) includes precious metals such as gold as well as investments that operate and derive much of their revenue in real assets, e.g., MLPs, metals and mining corporations, etc. Intermediate-Term Fixed Income includes fixed income funds with an average duration of greater than 2 years and less than 10 years. ShortTerm Fixed Income and Cash includes cash, cash equivalents, money market funds, and fixed income funds with an average duration of 2 years or less. Past performance may not be indicative of future results.

View from the EDGE is a registered trademark of 3EDGE Asset Management, LP