Establishing Value Tilts in Your ETF portfolio

As top-down, big picture investors, we at Hillswick Asset Management avoid stock-picking, making ETFs a natural fit for our investment style. We are also value investors, preferring to tilt our portfolio towards Value as a factor.

But isn’t value investing all about picking obscure stocks shunned by other investors? Not necessarily.

In this article, we would like to demonstrate how investors can utilize ETFs to help establish value tilts in their portfolio.

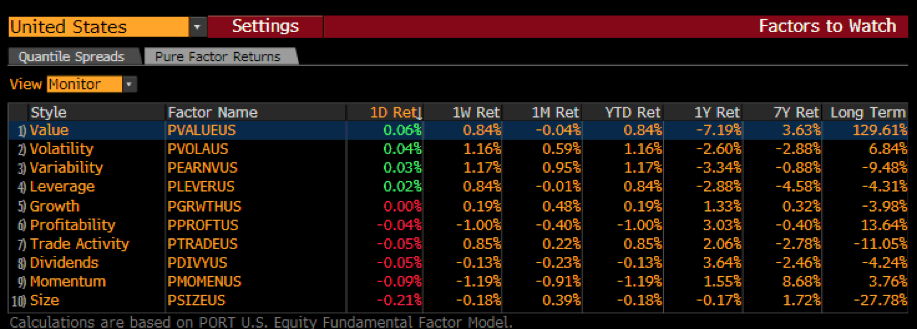

First, let us explain why we believe Value is an attractive factor. Below is a table of pure factor returns for the U.S. Equity market as of January 8, 2019. The table shows that the Value factor, while trailing other factors on a 1-year basis, has had the best Long Term return over time. Long Term, in this case, goes back to Jan 1 2000, so we are looking at 19 years of performance. Over this period, Value is by far the best performing pure factor.

But what is Value?

In its simplest form, Value is an investment that is “cheaper” than its Index, meaning it has a lower Price-to-Earnings (P/E) multiple and/or a lower Price-to-Book value ratio (P/B) than the median stock in the index.

Of course, we are unlikely to have a pure Value portfolio, as we also want diversity and all diverse portfolios have exposure to multiple factors. It is our belief though that having more Value than the Index portfolio should allow us to outperform over the long term, if history is any guide.

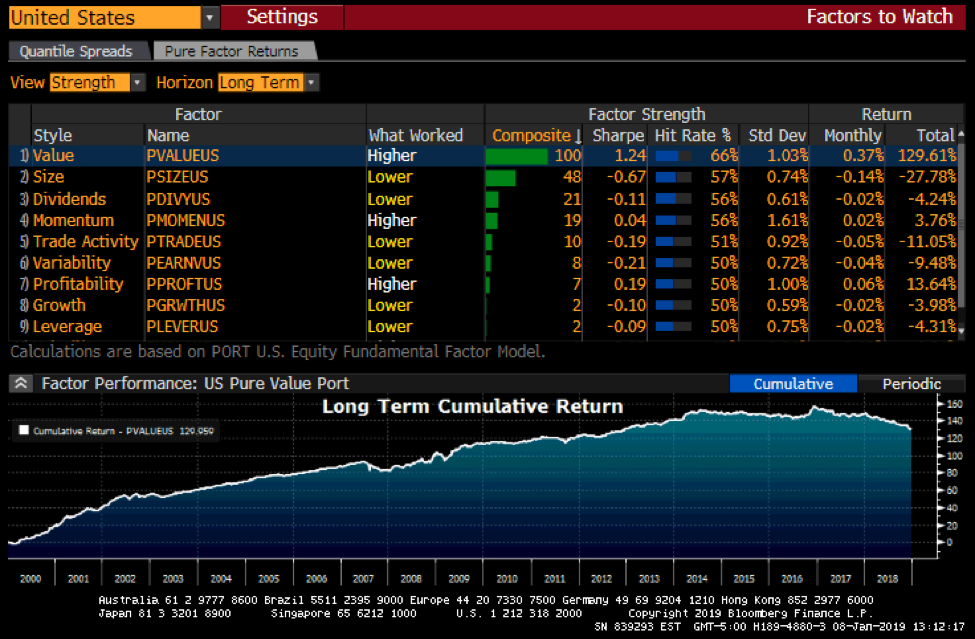

Here’s another view of Value as a factor, also courtesy of Bloomberg.

Note that Value outperformed until about 2014, which was around the time the FAANG boom started in earnest . Could this mean that Value is going to make a comeback if the enthusiasm for FAANG is fading?