By Kevin Nicholson, CFA, Global Fixed Income Co-CIO | Co-Head of Investment Committee

Summary

- China may eventually have the world’s largest economy, but that alone will not make it the preeminent superpower.

- The US is nearly 6 times more productive per citizen than China.

- Despite China’s rise, the dollar remains the reserve currency of the world, while the yuan has garnered little adoption.

Several weeks ago, we reached out to our sales team to find out questions they were receiving from Financial Advisors that they wanted us to answer in our Weekly View. There were several questions that we have addressed recently and then there was one that stood out above the rest: The rise of China and the potential diminishing influence of the US. Thus, we will highlight why we believe the US remains the world’s preeminent economic superpower in terms of productivity, currency, and center of influence.

Several weeks ago, we reached out to our sales team to find out questions they were receiving from Financial Advisors that they wanted us to answer in our Weekly View. There were several questions that we have addressed recently and then there was one that stood out above the rest: The rise of China and the potential diminishing influence of the US. Thus, we will highlight why we believe the US remains the world’s preeminent economic superpower in terms of productivity, currency, and center of influence.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

The United States has enjoyed its status as the world’s superpower since the fall of the Soviet Union in 1991. However, some would argue that the title is in jeopardy with the meteoric rise of China over the last 20 years. Since joining the World Trade Organization (WTO) on December 11, 2001, China’s nominal GDP (Gross Domestic Product) has grown from approximately $1.3 trillion to $15.67 trillion at the end of first quarter this year. Comparatively, the US’s nominal GDP has grown from approximately $10.6 trillion to $22.04 trillion over the period. The gap has been closed largely due to China being a low-cost exporter for years. Now other countries are taking over that role as China attempts to move up the value chain and become more consumption-focused domestically. In our opinion, given the large population difference between China (1.4 billion) and the US (332.3 million) it is not a question of if China’s nominal GDP will pass the US’s but rather a matter of when this will occur. However, we submit that economic supremacy is about more than just the size of nominal GDP. We believe that other factors must be considered, such as nominal GDP per capita, to get a sense of which economy is more productive, along with which country’s currency is used more for global trade.

Nominal GDP per Capita (Productivity):

While China has the upper hand on growing nominal GDP due to its population being approximately 4.2 times that of the US, there are some cracks in the foundation when inspected closely. As highlighted in the chart above, even though China’s economy is the second largest in the world behind the US it is far behind the developed world economies of the US, Japan, UK, and Eurozone on a per capita (per citizen) basis. Nominal GDP per capita helps economists measure a country’s prosperity because it focuses on the output per citizen. By this measure, China is far from an economic superpower relative to the US, as the US is nearly 6 times more productive per citizen. China has made strides getting its citizens to move from rural areas to cities, but a lot more needs to be done and thus highlights the problem China faces in the race to be an economic superpower. China must educate its population and continue to urbanize to increase productivity per capita, in our opinion. China has made great strides in urbanization since it opened to the West in the late 1970s; however, China’s urban population is still roughly 15 points below the US currently (see chart right). For comparison, China’s urban percentage now sits close to where the US did in 1950 (source: University of Michigan Center for Sustainable Systems).

Currency:

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

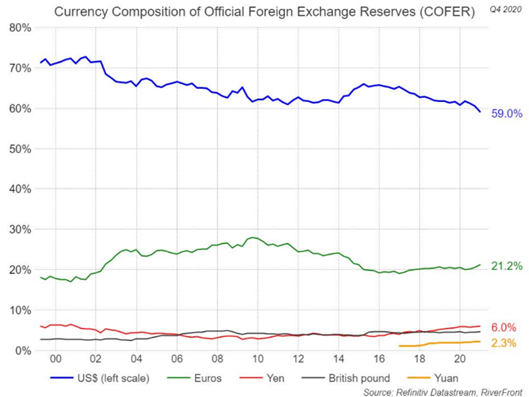

Another important indicator of a country becoming an economic superpower is measured by the adoption of its currency for global trade. The US has enjoyed having the dollar hold the title of the ‘reserve currency of the world’ since the Bretton Woods Agreement in 1944. Some have argued that the US’s rising government debt load could compromise the dollar’s status. However, compared to other global currencies it is still much more widely held in official foreign exchange reserves at the world’s central banks. For example, the US still commands 59% of all global reserves, while the yuan only has roughly 2.3% (see chart right). Granted the dollar is less widely held today than 20 years ago but it is still well ahead of China’s yuan that only accounts for roughly 2.3% of global reserves. In addition, the opacity of the Chinese economy and artificial management of the yuan by Chinese authorities tends to diminish the potential usefulness of the yuan as a global reserve currency, in our opinion.

Center of Influence:

China’s “Belt and Road Initiative” (BRI), an attempt by the government to widen Chinese influence via joint venture infrastructure projects in foreign countries, has been met with suspicion and controversy since its launch in 2013. In our opinion, BRI has had little impact on the yuan’s adoption outside of China’s borders. China’s center of influence remains strong in Asia but as the US attempts to regain a more influential position globally, we expect more drama between the opposing sides. After witnessing China’s heavy-handed tactics against democracy in Hong Kong, there is now a tug-of-war between the US and China over the influence of Taiwan. While the US has become more inwardly focused over the last decade, recently it has engaged with its allies to re-establish its center of influence in Europe and Asia.

Conclusion:

Despite the mounting debt load of the US and the rise of China, the US remains the preeminent global economic superpower, in our opinion. Ultimately, the US may not end up with the largest economy, but we believe it will remain the most productive for the foreseeable future. Thus, we continue to see opportunity by investing in domestic stocks and remain overweight US companies which we believe have the wherewithal to find efficiencies to drive higher profitability.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Nominal gross domestic product is gross domestic product (GDP) evaluated at current market prices. Nominal GDP includes changes in prices due to inflation, which reflects the rate of price increases in an economy.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1651572