The June jobs report made headlines with an additional 372,000 jobs created during the month, which equates to more than 2.7 million new jobs added to payrolls in only the first half of this year. But did you know that payrolls are growing so fast that workers are beating the high rate of inflation overall?

Below are the Indexes of Aggregate Weekly Payrolls for both Production and Nonsupervisory Employees and All Employees compared to inflation as measured by the Consumer Price Index (CPI). As you can see, despite how we may feel about the current economic environment, U.S. workers are powering through. While we all feel the pain at the pump and in our utility bills, the reality is that workers in the U.S. are, generally speaking, still making more income than ever before, even after inflation.

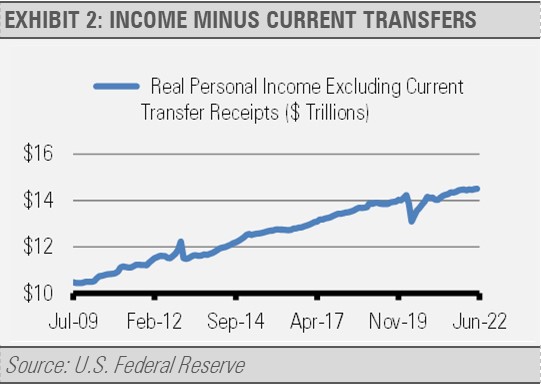

We think these trends speak to the bottom-up strength of the U.S. labor force that drives our economy. In addition, while it did not make headlines in the press, real (inflation-adjusted) personal income less transfers, such as social security benefits, made a record high in May at $14.5 trillion on a seasonally adjusted basis. This is one of the measures that the National Bureau of Economic Research uses when judging the timing of economic expansions or recessions. While economic growth has slowed, the labor market remains resilient.

We expect overall household balance sheets to remain strong and the U.S. labor force’s response to the economic realities on the ground to continue driving U.S. economic growth forward despite the challenges facing the global economy.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.