REFLECTIONS AND OUTLOOK FROM OUR GLOBAL EQUITY CIO

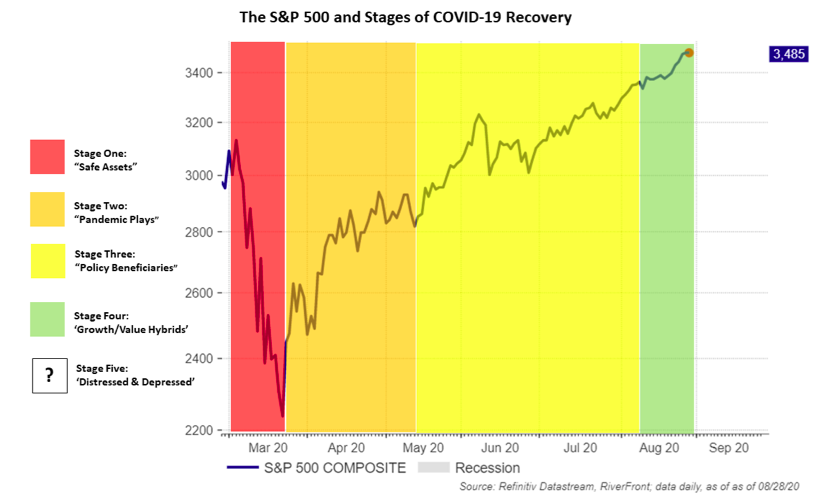

Psychologists often talk about five stages of grief. Similarly, we have witnessed five distinct reactions to the pandemic in asset classes, stocks, and sectors since February. To keep our message simple, we have described these stages sequentially, but we know, that like grief, reality is more complex and that these stages may overlap and repeat themselves.

While the path to a resolution of COVID-19 is unpredictable, we think understanding these stages could help investors with time horizons greater than five years navigate the unique opportunities and challenges that such a pandemic presents. Below, for each stage we attempt to identify the key drivers, what investments may be optimal, and our current fundamental view.

Disclosures: Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures. Governmental Debt is what we believe falls into the “Safe Assets” category.

STAGES ONE THROUGH THREE: WHERE WE’VE BEEN AND WHAT WE’VE LEARNED

- Time Period: February- late March 2020

- What Worked: ‘Safe Assets’ or ‘Governmental Debt’. When a dramatic and unexpected event occurs in the economy, there are very few places to hide. In our experience, the only broad capital appreciation potential available in this type of environment is government debt. Cash can help, but only by not falling in value. Defensive equities behaved better than the market, but still dropped in value.

- RiverFront’s View: Safe assets are overvalued; Due to their very low yields, we use government bonds primarily as a volatility buffer and, along with cash, temporarily to reduce risk.

Stage Two: ‘Pandemic Plays’ Win as the Economy Finds a Floor

- Time Period: Began March 23rd low

- What Worked: ‘Pandemic Plays’. It is very rare for a major industry to benefit so immediately and obviously from a recession, but this time it happened. Technology and ‘online’ stocks entered the pandemic with strong growth and we believe their potential appears to have accelerated throughout the crisis. Outside of technology and certain health care beneficiaries, other industries benefitted from the subsequent quarantine and work-from-home environment like consumer staples, home improvement, and online retail.

- RiverFront’s View: Favor sustained earnings beneficiaries. Some of the ‘pandemic plays’ like software, health care, and home improvement have additional upside, in our view, as their earnings have the potential for sustained strength. On the other hand, we believe that many of the consumer staples companies benefitted from a one-time restocking boost that is unlikely to be repeated, and could underperform as investors rotate into cheaper ways to play a burgeoning economic rebound.

Stage Three: ‘Policy Beneficiaries’ Respond to Policy Support

- Time Period: Began around mid-May

- What Worked: Policy Beneficiaries. In addition to Stage 2 beneficiaries, some consumer, industrial, and material companies benefited when it became clear that policymakers would use significant amounts of monetary and fiscal stimulus to help stem the pandemic’s economic impact. Sentiment around these industries was boosted by government paycheck protection program (PPP) loans, unprecedented unemployment benefits, trillions of dollars of Federal Reserve support, and low interest rates.

- RiverFront’s View: Still favorable on home improvement and global logistics stocks. In our view, loose fiscal and monetary policy is likely to persist, which should continue to help keep the consumer spending. We also think these companies have defensive qualities making them less vulnerable to broad market declines if COVID-19 cases spike again.

WHERE WE MAY BE HEADED…STAGES FOUR AND FIVE

Stage Four: ‘Growth/Value Hybrids’ Start to Emerge as Earnings Outlook Improves

- Time Period: Happening right now

- What May Work: ‘Growth/Value’ Hybrids. These are companies that combine long-term growth characteristics with value attributes. These firms tend to have shares which we believe are attractively valued such that any recovery in earnings should be rewarded by investors, even if business does not fully return to normal in the near-term.

- RiverFront’s View: Keep building our watchlist, focusing first on certain areas of financials and industrials. We believe companies in this group represent a healthy mix of traditional growth companies that we believe have been cheapened by pandemic, and traditional value sectors that are now trading at multiples that are too attractive to ignore. We think this group includes credit card issuers and aerospace companies but think that individual security selection will be critical in sorting out companies that can recover from those permanently impaired by COVID-19.

Stage Five: “Distressed and Depressed’ Stocks Could Benefit from a Full Economic Recovery

- Time Period: Hasn’t really started yet…

- What May Work: Deep Value companies, i.e. ‘Distressed and Depressed’ These include highly cyclical, distressed groups like retail/apparel, office/mall REITs, airlines, hospitality, and hotels.

- RiverFront’s View: Be Careful and Patient…Avoid Potential ‘Value Traps’. One of the realities of big events like a pandemic, is that they can permanently change behavior. Companies that were already struggling with changing consumer habits, like apparel, might only return as a shadow of their prior selves. We think that cyclical companies, along with value stocks in general, will recover before a full recovery is evident in the economic data, but also that many ‘value traps’ will not survive at all. This suggests to us that there may be many false starts before this group can form a solid relative uptrend, and that intense fundamental research is necessary to separate the eventual survivors from the doomed. Tread carefully here.

CONCLUSION: BE FLEXIBLE WITH SECURITY SELECTION AS WE MOVE BETWEEN STAGES

We don’t believe that the pandemic has fundamentally changed the rules of investing, but we do believe it will delay interest rate normalization and create opportunities that active managers can take advantage of. Our continuing philosophy is to remain overweight stocks, especially our preferred themes described in the 5 stages above, knowing we must, as always, be flexible.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.RiverFrontig.com or contact your Financial Advisor.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

You cannot invest directly in an index.

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.RiverFrontig.com and the Form ADV, Part 2A. Copyright ©2020 RiverFront Investment Group. All Rights Reserved. ID 1318422