Uncertainty is the Enemy

By Rebecca Felton, Senior Market Strategist

SUMMARY

- Markets will be clouded by uncertainty for the remainder of 2022, in our view.

- We agree with Chairman Powell’s view that inflation will remain higher for longer.

- We believe wages and energy prices must lead inflation lower.

Uncertainty is scary. Whether good or bad, once news is known investors can absorb, react, and adjust future actions accordingly. Uncertainty, on the other hand, often creates anxiety or even panic. On November 2nd, the U.S. Federal Reserve (Fed) announced its fourth consecutive 0.75%, (75 basis point) increase in interest rates. While not great news, it was expected as evidenced by the CME’s FedWatch Tool which signaled that the Fed was highly likely to raise rates by 75 basis points. So, the Fed did exactly what was expected, and equity markets rallied immediately after the announcement. Then, Chairman Jerome Powell spoke at a news conference and said it would be “very premature” to consider a pause in their rate hike strategy as they work to tame inflation. The S&P 500 Index quickly reversed lower and ended the day down -2.50%. While the use of the word “premature” may have seemed like a fairly benign choice of words, it reminded investors that the unknowns, as it relates to our economy, outweigh what we do know. That uncertainty rattled investors because it served as a reminder that there remain plenty of unknowns as to the depth to which inflation has dented US growth prospects.

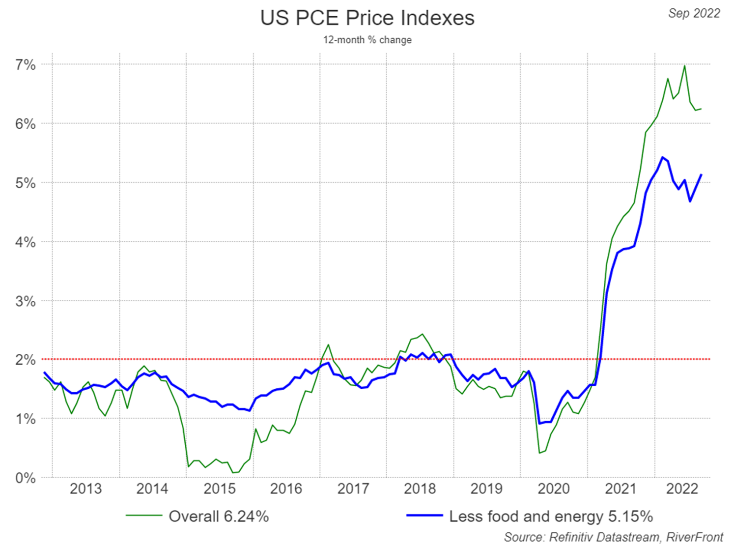

Does it matter if inflation has peaked when it remains so far above the Fed’s target?

Source: Refinitiv Datastream, RiverFront. Data monthly, as of September 15, 2022. Shown for illustrative purposes only. Past Performance is no guarantee of future results.

The Fed’s official inflation target is 2% (red line in chart, below). Whether inflation has peaked or not, there is a long way between the Fed’s 2% target and the current level of the US Personal Consumption Expenditures Price Index (PCE). The most recent overall reading came in at 6.24%, and 5.15% when food and energy prices were excluded (chart, right). The Federal Reserve is known to prefer the PCE Index to the Consumer Price Index (CPI) because the PCE takes into account consumer behavior, such as substituting for less expensive items, versus simply measuring price movement. The Consumer Price Index for October will be released this week. The September

reading was 8.2% and consensus for October is 8%, according to FactSet. Regardless of which index one uses to measure inflation, the fact remains that it must cool significantly in order to be close to the 2% target, making attempts to call the peak an exercise in futility. Given our view that inflation will stay higher than desired for longer than expected, we do not expect the Fed to pivot away from their current policy path. As a result, we believe rates will remain elevated until there is clear evidence that there is a balance between supply and demand, which would lead to lower inflation.

Thus far, the old adage that high prices are the cure for high prices has not proven accurate. The combination of robust demand across most goods and services categories, lingering supply chain issues and continued labor shortages have all worked to push the cost of just about everything higher. This has led to a growing belief amongst Wall Street strategists that something has to “break” in our economy in order for inflation to move meaningfully lower. Jerome Powell’s comments to the effect that the Fed has seen little progress in its’ efforts to control inflation since their last meeting, underscored their resolve to do whatever it takes to curb inflation. Even though the interest rate “lever” is a powerful mechanism to cool an overheated economy, there remains supply-side inflation drivers beyond the Federal Reserve’s control. A look at two of the largest inputs– wages and energy prices – helps to illustrate the stubborn nature of the problem we are facing.

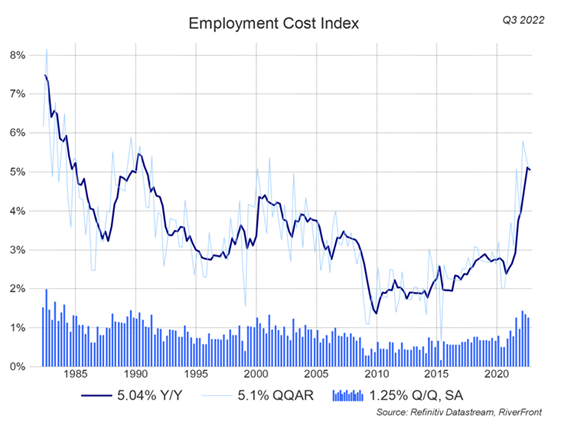

More Uncertainty – Wages are outside the Fed’s control.

Source: Refinitiv Datastream, RiverFront; Data as of September 30, 2022. Shown for illustrative purposes only. Past Performance is no guarantee of future results.

The Fed cannot directly control wages in either the public or private sector. For example, in the public sector retirees are getting an 8.7% increase in their social security benefits in 2023. In the private sectors, The Great Resignation, which started in 2021 saw workers quit their jobs at rates not seen since the 1970s, as they felt confident about finding another higher-paying job. According to the Pew Center, an estimated 60% of the workers who changed jobs did enjoy an increase in their earnings. This left companies having to raise wages to remain competitive. As good as wage growth is for employees, it is not helping when it comes to curbing inflation. The Employment Cost Index (ECI), shown to the left, has been noted as one of the statistics that the Fed regularly watches to gauge wage inflation. During last week’s press conference, Chairman Powell noted the impact of wages on inflation. Further he noted that the latest ECI data, which grew over 5% on a year-to-year basis, was disappointingly high and not at a level consistent with 2% inflation.

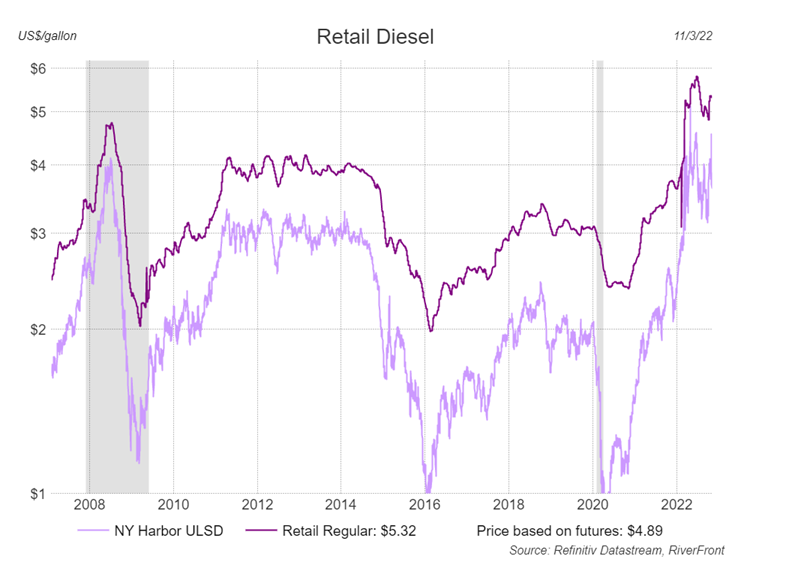

Energy prices, especially diesel fuel, remain problematic as we head into the winter months with uncertainty.

The Fed also has little control over energy prices. Fuel costs are not only impacted by the economy, but a number of other variables like refinery shutdowns, drought, OPEC supply cuts, and wars like the one in Ukraine. While gasoline prices have started to cool over the past several months, diesel fuel remains elevated and reached record high levels in 2022 (chart, right).

As few passenger cars in the United States use diesel fuel, most of us do not think about how record high diesel fuel costs are impacting our everyday lives. However, most of the products we use are transported by trucks and trains with diesel engines, and most construction, farming, and military vehicles and equipment also have diesel engines.

Source: Refinitiv Datastream, RiverFront; Data as of November 4,.2022. Shown for illustrative purposes only. Past Performance is no guarantee of future results.

It will also cost more to heat homes this winter. Last month, the U.S. Department of Energy projected sharp price increases for home heating costs compared to last winter. Whether used for transportation or heating, energy prices across the board have remained stubbornly high throughout the year. There is no one single factor to blame, rather global demand resumed more quickly than supply production.

We believe it is important to control what we can.

The Federal Reserve did what was expected at the most recent meeting, but Chairman Powell’s comments signaled that rates may need to rise higher than the market had been expecting. In the days following, the market’s reaction signaled, once again, that investors do not like uncertainty. It works to undermine our resolve, often leaving us feeling as though we are not in control. The next potential uncertainty for investors is this week’s mid-term elections, which we will be writing about next week.

As portfolio managers, we cannot control markets, but we can control our portfolio decisions by relying on our process. We believe markets will remain volatile throughout the remainder of 2022, awaiting clarity on both growth and policy changes. Each of RiverFront’s balanced portfolios have reduced their stock allocation throughout the last 12-months and currently carry fewer stocks than they would in a bull market. Given the short-term uncertainties discussed in this piece, we are cautious on equities across all balanced portfolios. As a result, in our shorter-horizon portfolios, we are close to our COVID-19-level lows in equities, and our fixed income strategy still favors corporate bonds with shorter maturities.

Our longer-horizon portfolios are also below their long-term equity targets, but less so. In these portfolios, we have sought out high yield bonds and other alternative yield-oriented securities in an effort to increase expected yields across the portfolio. The reason we are not at historically elevated levels of cash is that stocks and bonds have already fallen significantly, making them both attractive to us on a longer-term basis. Given this, we think there is a case for longer-term optimism even as the shorter-term tactical outlook remains fraught with uncertainty.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

A basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. (bps = 1/100th of 1%)

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. Changes in the CPI are used to assess price changes associated with the cost of living. The CPI is one of the most frequently used statistics for identifying periods of inflation or deflation.

The PCE Price Index is the primary inflation index used by the U.S. Federal Reserve when making monetary policy decisions. Personal consumption expenditures (PCEs) are imputed household expenditures defined for a period of time.

Employment Cost Index measures compensation costs such as wages and benefits paid by employers.

Federal Open Market Committee (FOMC) refers to the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy in the United States by directing open market operations (OMOs). The committee is made up of 12 members, including seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining 11 Reserve Bank presidents on a rotating basis.

The CME FedWatch Tool analyzes the probability of FOMC rate moves for upcoming meetings. Using 30-Day Fed Fund futures pricing data, which have long been relied upon to express the market’s views on the likelihood of changes in U.S. monetary policy, the tool visualizes both current and historical probabilities of various FOMC rate change outcomes for a given meeting date. The tool also shows the Fed’s “Dot Plot,” which reflects FOMC members’ expectations for the Fed target rate over time.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2578811