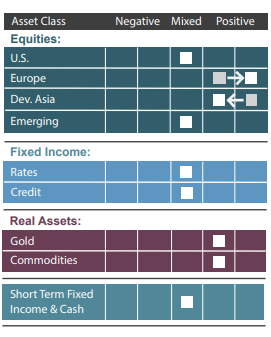

Equities:

▶ U.S. Equities: By our measures the U.S. equity markets remain significantly overvalued as they continue to hover around all-time highs which is indicative of lower expected returns on average

over the longer-term. While Fed Chair Powell indicated at the June FOMC meeting that the time

had come to begin to consider tapering the Fed’s current $120 billion in monthly bond purchases

(a potential negative for the markets), he also indicated that it was too early for the Fed to consider

raising short-term interest rates. Continued easy monetary policy may be supportive of further

gains in U.S. equities. However, weaker than expected growth in the second half of the year due to

continuing supply chain disruptions, labor shortages and the recent surge in the coronavirus Delta

variant may collectively prove to be a net drag on the economic rebound. Flattening yield curve

measures and a recent widening of our high yield credit spread measures heightens the risk of an

equity market correction in the near term.

▶ Japan Equities: Based on our current valuation measures Japanese equities remain relatively

attractive on a longer-term basis. However, a recent deterioration in our high yield credit spread

measure alongside the potential for negative investor psychology has indicated that Japanese

equities are currently somewhat less attractive.

▶ European Equities: The European equity markets remain relatively undervalued, particularly in

comparison to U.S. equities. Moreover, monetary and fiscal policies in Europe continue to be highly

accommodative helping to bolster the region’s economic rebound making European equities somewhat more attractive.

▶ China Equities: Chinese equity markets were shaken recently by the Chinese government’s

crackdown on technology companies and the large private for-profit educational tutoring sector.

Negative investor psychology, recent flattening of the yield curve, and widening of our high yield

credit spread measure are negatives for the Chinese equity market.

▶ India Equities: Our model research continues to indicate that India equity markets remain attractive on a projected risk-adjusted return basis. The steepening yield curve and low interest rate environment in India are both positive contributors. India is also making better progress on vaccinating

their population although this is a huge task which will take time. As noted previously, upcoming

elections should encourage continued highly accommodative monetary and fiscal policies for an

extended period and leave room for economic improvement once vaccinations ramp up. Two areas of concern in India are increasing inflationary pressures and the potential for widening credit

spreads which we continue to monitor.

Fixed Income:

▶ Bonds: Even though the recent decline in interest rates has helped to somewhat boost the outlook

for bonds, at current extraordinarily low yields the risk/return trade-off for U.S. Treasury securities

is not compelling. In addition, U.S. Treasuries continue to maintain deeply negative real interest

rates, meaning that yields are well below inflation expectations.

▶ Credit: The outlook for credit remains mixed. While there has been some widening in high yield and

investment grade credit spreads recently, investors’ seemingly insatiable search for yield in today’s

low-rate environment could continue to be supportive of corporate bond markets. However, any

trouble in the credit markets could lead to a rapid widening of credit spreads which could prove to

be a decidedly negative event for corporate bond holders.

Real Assets:

▶ Gold: The recent decline in real yields (nominal yields less inflation expectations) has improved

the relative attractiveness of gold. In addition, although current investor consensus is for inflationary pressures to be transitory, should inflation prove to be more persistent and instead economic

growth perhaps more transitory, the U.S. economy could face the prospect of stagflation, which

is characterized by slowing economic growth and rising prices (i.e., inflation). Gold represents an

asset class that could benefit from potential stagflation.

▶ Commodities have enjoyed strong year-to-date performance, but may face shorter-term headwinds as market participants become more concerned about economic growth prospects particularly in China. In addition, the current consensus among investors that the threat of inflation may

have receded somewhat has led to some profit taking in commodities. However, Commodities remain attractive in the medium-term due to their longstanding relative undervaluation versus equities

as well as the continued prospect for a strong global economic recovery in the second half of 2021.

Originally published by 3EDGE, August 2021

DISCLOSURES: This commentary and analysis is intended for information purposes only and is as of August 7, 2021. This commentary does not constitute an offer to sell or solicitation of an offer to buy any securities. The opinions expressed in View From the EDGE® are those of Mr. Folts and Mr. Biegeleisen and are subject to change without notice in reaction to shifting market conditions. This commentary is not intended

to provide personal investment advice and does not take into account the unique investment objectives and financial situation of the reader. Investors should only seek investment advice from their individual financial

adviser. These observations include information from sources 3EDGE believes to be reliable, but the accuracy of such information cannot be guaranteed. Investments including common stocks, fixed income, commodities, ETNs and ETFs involve the risk of loss that investors should be prepared to bear. Investment in the 3EDGE investment strategies entails substantial risks and there can be no assurance that the strategies’

investment objectives will be achieved. Real Assets (Gold & Commodities) includes precious metals such as gold as well as investments that operate and derive much of their revenue in real assets, e.g., MLPs,

metals and mining corporations, etc. Intermediate-Term Fixed Income includes fixed income funds with an average duration of greater than 2 years and less than 10 years. Short-Term Fixed Income and Cash includes

cash, cash equivalents, money market funds, and fixed income funds with an average duration of 2 years or less. Past performance is not indicative of future results.

Intermediate-Term Fixed Income includes fixed income funds with an average duration of greater than 2 years and less than 10 years.