By Larry Whistler, CFA, President & Co-Chief Investment Officer, Nottingham Advisors

With all due respect to the good folks at Merriam-Webster, we at Nottingham feel that it is the US Federal Reserve chair’s definition of the word transitory that carries the most weight these days. Barely a reference to inflation goes by without some Fed official using the term transitory in the next breath. A LOT is riding on the Fed’s definition of the adjective, namely the future length of this bull market, which has benefitted both bond and stock investors. Given the rise in the level of inflation that we’re currently seeing, the Fed of 20 years ago (led by legendary Chair Alan Greenspan) would surely be raising short-term interest rates to counteract the pernicious impact of such a rise in the general price level.

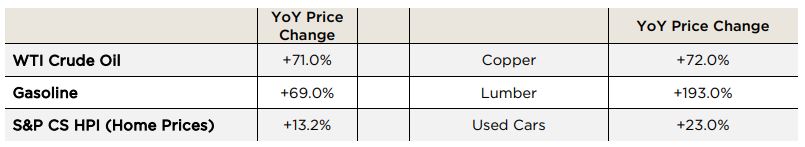

Today’s Fed, however, is sticking by Chair Powell’s infamous utterance of a year ago that the Fed was “not even thinking about thinking about raising rates.” This, despite May’s CPI reading showing a 5.0% rise in year over year (YoY) prices (up from April’s +4.2% YoY surge). Even the Fed’s preferred measure of inflation, the PCE Core Index, rose +3.1% YoY in April. Anecdotal evidence of price increases are everywhere, especially pronounced in recent Q2 earnings commentary from S&P 500 CEO’s & CFO’s. The brief table below highlights some changes from early 2020.

Granted, year over year comparisons do somewhat exaggerate the ramp up in prices given widespread economic closures during the period a year ago; however, the facts are that prices everywhere are surging. Some of the blame can be attributed to supply chain disruptions, exacerbated by intermittent lockdowns due to the pandemic. Many manufacturing firms are only just coming back online, trying to manage through a myriad of bottlenecks including labor shortages. Household goods such as appliances, leisure goods like pools and hot tubs, even vehicles, are all in short supply relative to demand, and waits of 3-6 months for customers to receive their goods are not uncommon.

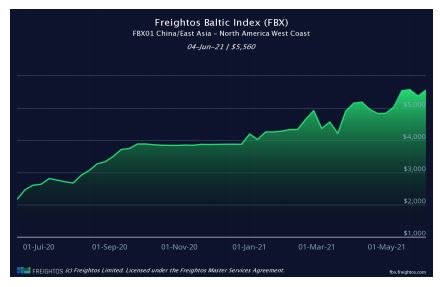

The cost to ship a 40-foot container from China to the US West Coast has surged by +156% over the past year, recently hitting all-time highs. Many of these container ships return to China nearly empty, with container costs averaging $970 per container for the US to Asia leg, or 20% of the Asia to US cost! Of course, higher shipping costs are usually passed along to buyers/consumers regardless of the product being shipped.

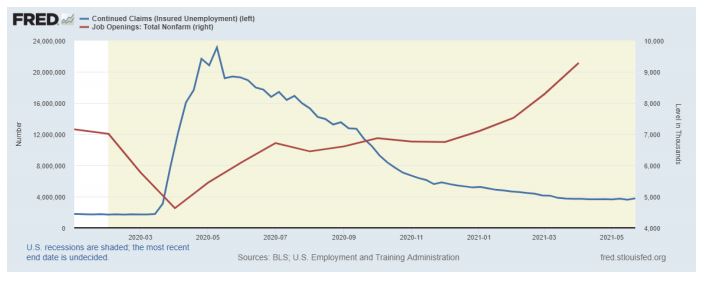

We have yet to mention the most impactful and possibly the most durable of price increases, wage price inflation. The massive dislocation to labor triggered by the pandemic, followed by the even more massive Federal response to the crisis, has brought about a profound shift in the ongoing labor/management compensation battle, with labor gaining an upper hand for now (and the wage increases to prove it!). From a pre-pandemic low of 3.5%, the U.S. Unemployment Rate surged to 14.8% in April of 2020, before gradually trending back down to May’s 5.8% reading. Average Hourly Earnings rose +0.5% MoM in May and continue to trend higher. Fed Chair Powell has stated repeatedly that the Fed is focused on employment and the return to pre-pandemic levels, which happened to have been the lowest in the past 50 years.

The chart above clearly illustrates the push/pull dynamic taking place between Continuing Jobless Claims (Blue) and Job Openings (Red). It’s admittedly a bit challenging to reconcile a 5.8% Unemployment Rate with over 9 million Job Openings currently, except when one considers the extended jobless benefits currently being offered by the federal government and many states. According to the Unemployment Benefit Calculator on Forbes.com, a New York State resident would receive $653 per week in combined state and federal benefits for up to 24 weeks. Based on a 40-hour week, this would be the equivalent of $16.32 per hour. With the first $10,000 exempt from federal tax, this benefit could be worth more than $20 per hour.

While we at Nottingham subscribe to the School of Non-Judgment, enhanced benefits can offer a plausible explanation for both the high Job Openings number (would you work for less than $20 per hour if you were paid more to stay home?), as well as the rising Average Hourly Earnings number. Anecdotally, virtually every business owner-client we have is searching desperately for labor help, skilled or non. Further to that, I have three teenage sons, plying their emerging yet dubious talents in the restaurant trade this summer (various stages of dish-washing, sandwich-making and bar-backing), all earning nearly $15 per hour (for decidedly low-skilled labor! Not to worry, they don’t read my letters, nor, to my chagrin, much else).

Higher wages, once locked in, can be somewhat sticky. After much debate and argument for a higher minimum wage, it would appear to be here. A pronounced labor shortage, especially in the dining and leisure space, has caused 26 states (mostly red-leaning) to opt out of the additional $300 per week federal UI benefit program, with some states even offering back to work bonuses of up to $2,000 to get people back on payrolls. The Fed estimates unemployment will reach 4.5% by year-end, and it certainly looks as though there is enough demand for labor currently to get us there.

The implications for higher inflation are profound on many levels, but perhaps most relevantly to our clients is the impact higher rates may have on asset prices. We don’t think it’s any secret that this long bull run in stocks, bonds, gold, real estate and collectibles (okay, nearly every asset we can think of!) has the fingerprints of the Federal Reserve (and to be fair the ECB, Bank of Japan, Bank of Canada, Bank of England….) all over it. Low interest rates, be they artificially induced or otherwise, can prop up asset prices far beyond intrinsic value and for longer than many anticipate.

And yet, despite all the hoopla, and the foregoing survey of rising prices, we have a Federal Reserve that remains convinced that today’s price climbs are of limited duration and that a year or two hence we should see a resumption of sub 2% inflation. Certainly, todays 1.46% yield on the 10-year Treasury would suggest the broader market agrees. On the other hand, maybe that 1.46% yield is due to Fed’s $120 BILLION per month of Treasury and mortgage-backed security purchases.

Regardless, the Fed seems sure enough in their position that it continues to expand its balance sheet (Blue/RHS) – now approaching $7.5 TRILLION, while coincidentally the US Money Supply (Red/LHS) has grown by 50% over the past 5 years alone. The challenge for the investor of today is deciding on whom or what to believe, and what to do about it. Nottingham’s general position is that inflationary pressures are real, they are likely to persist for some time, and bond yields, absent central bank intervention could be measurably higher. That said, I also think my kids spend too much time on their cell phones and a lot of good that does me! The point is, until the Fed pivots, inflation’s true impact on interest rates will remain muted. The old maxim, “Don’t Fight The Fed”, still has merit.

At some point, however, the Fed will signal, hopefully loudly and clearly, that it has changed its stance, it will begin tapering bond market purchases, and it will gradually – ever so gradually, return the interest rate pricing mechanism back to open markets. If they are able to stick the proverbial landing (think of landing a 747 on an aircraft carrier during a hurricane), adjustments to equity prices may prove tolerable. Asset prices of all stripes will likely contract in the short run, as new information is disseminated into the marketplace. Mortgage rates will likely rise, crimping affordability, borrowing costs will likely increase, leading to less debt and lower profit margins, and cash flows will get discounted by a higher interest rate, leading to lower present values. That’s Finance 101.

As much as we love a good bull market, the further asset prices disassociate with intrinsic value, the more painful the ultimate correction. Today’s low interest rates have resulted in many areas of over-valuation in the US stock market, and across many other risk assets. There are still pockets of value, however, and Nottingham is working overtime to identify and gain exposure to areas of the market we feel offer our clients a decent chance for positive returns over the months and years ahead. We think diversification has been underpriced and underappreciated the past couple years, yet we feel it is as important as ever right now. We have some other concerns around changing fiscal policy that may result in a drag on corporate profits in the years ahead, but we will tackle that in an upcoming letter.

For now, we listen to the Fed, and take them at their word that they will be patient with inflation. It is finally warming up here in the northeast and with increasingly positive news on the Covid-front, we hope you are all able to regain some semblance of normalcy in your lives, take nice long mask-less walks and join your neighbors for dinner at your favorite restaurant. It’s time.

Here’s to a good summer.

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client.

For more information about Nottingham’s offerings, visit www.nottinghamadvisors.com or call 716-633-3800.

Nottingham Advisors, LLC (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent, direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in your account will correspond directly to any benchmark index. A description of each index is available from us upon request.

Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.