By David Dziekanski, Portfolio Manager and Michael Venuto, CIO

Evolving Expectations

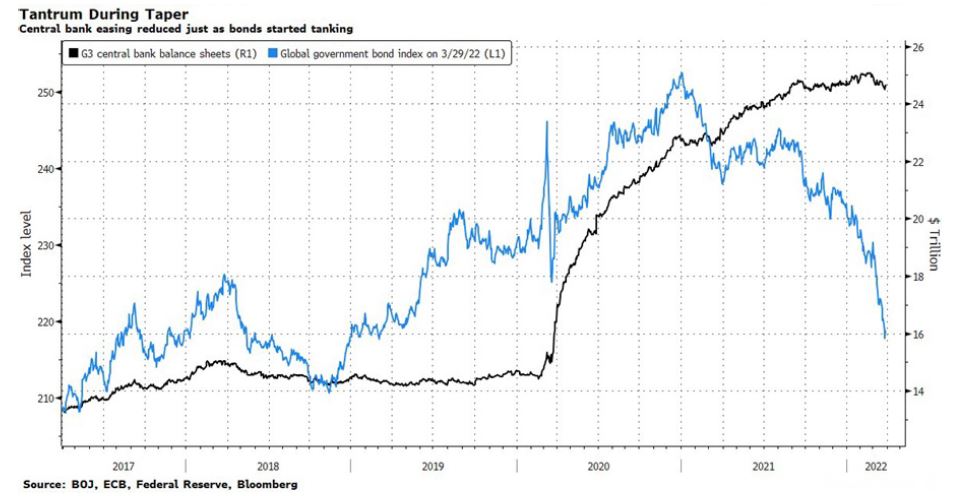

After experiencing the oddity of a booming stock market in the midst of the crippled 2020 economy, many are experiencing the other side of that coin for the first time. Despite a negative -1.5% GDP print for Q1, we currently have a moderately growing economy and somewhat treacherous markets. The 60/40 has seemingly failed as correlations between stocks and bonds have risen in the face of inflation. US investors are feeling the effects of inflation like many of our counterparts in emerging markets have lived and breathed time and time again. The Fed put became widely accepted by all, transitioning to a new form of Fed mandate following Modern Monetary Theory. From there, the Fed has started playing catchup attempting to tame inflation and regain credibility.

The wealth effect caused by the Covid response was disproportionately felt by baby boomers and those with assets, while the millennials and gen-xers were left to create their own concepts of wealth and social norms, whether that be in normal or augmented reality. We’ve mentioned in the last few commentaries that the echo chamber effect of social media has emboldened the masses within their specific perspective. Geopolitical conflicts between Russia and Ukraine have caused the world to choose sides: everything from what currency commodities settle in to sanctions on individuals. Real Estate in the UAE is booming as the place to be for Russian oligarchs looking for a new home.

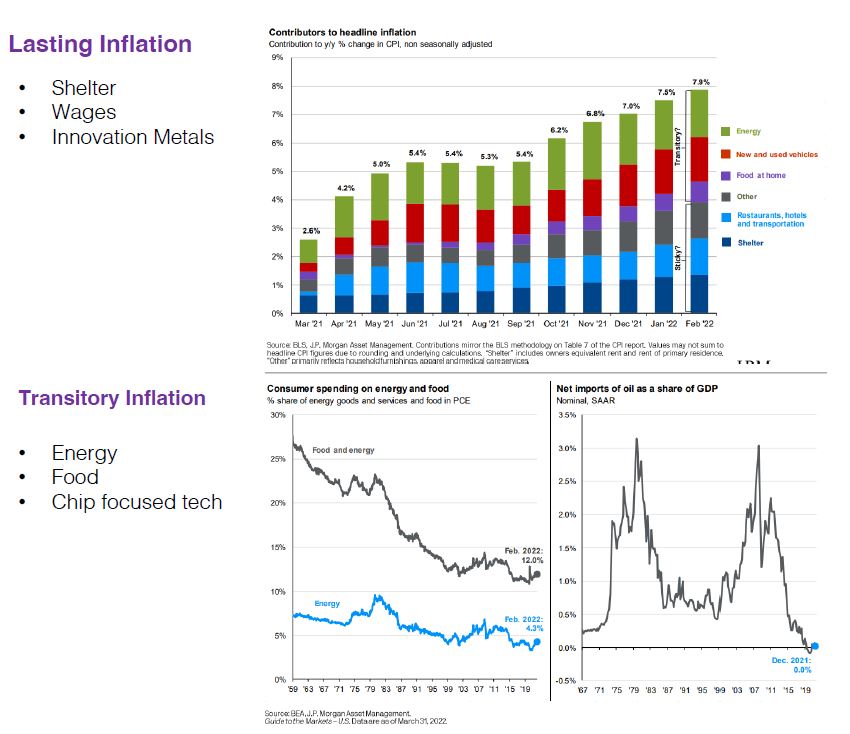

The 60/40 portfolio’s fame in the US came in the time of subdued inflation, and a 40-year cycle of decreasing interest rates. Its underperformance in the depths of Q1 have finally caused the masses to reconsider portfolio construction. This is not to say that rates could not and will not decline again, but the correlation between stocks and bonds seen in the depths of the first quarter have really put into question what a conservative portfolio really is. Our over-simplified inflation expectation is that it is both transitory and longer lasting.

What we don’t expect is a decade of longer inflation as seen in the 1970’s. We simply don’t have the demographics for it. Service heavy sectors such as restaurants, hotels, and transportation will continue to feel the squeeze of the tight labor market. There have only been 5 months since 1969 when unemployment was lower than it is today. The JOLTS job opening index is still spiking, and those not currently in the workforce but have potential to be would only soak up a small fraction of that number. Interesting enough, the labor force participation rate of 18-64-year-olds is higher than it was 3 years ago, but nothing like what we saw in the 70s with strong demographics and women entering the workforce in mass. America is much more energy independent than our European counterparts, and we spend a smaller percentage of our disposable income on oil than we did back then. The American energy producers thriving in this environment can be a contributor to the US economy.

The Recession Truncator that is the Federal Reserve

What the federal reserve system has really done is truncated the duration of recessions. As Bob Hope said, ”A bank is a place that will lend you money if you can prove that you don’t need it.”

Since the great financial crisis, the amount of unique credit that has been made available to those entities and individuals who don’t need it is sometimes beyond comprehendible. The largest VC and PE firms in the world can leverage uncalled capital based on the underlying credit of their limited partners. It’s the duration, not the magnitude of a drawdown that can throw a wrench in the economy. Households, companies, private equity firms and VCs alike can withstand differing lengths of downturn, whether that be a drop in assets, loss of disposable income or a squeeze from inflation and interest rates. The duration of the depths of the financial crisis is what caused lasting effects on all market participants.

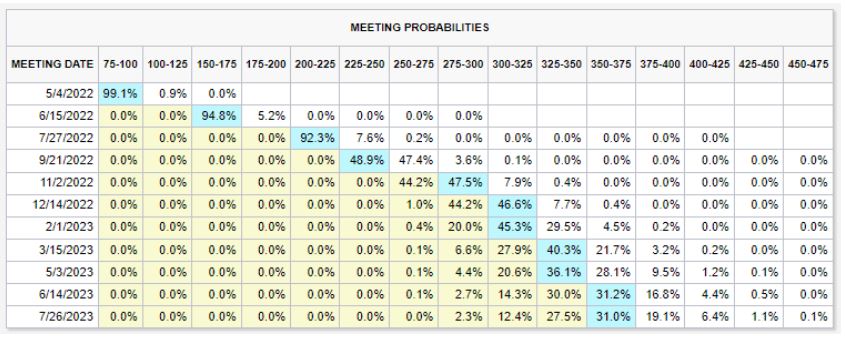

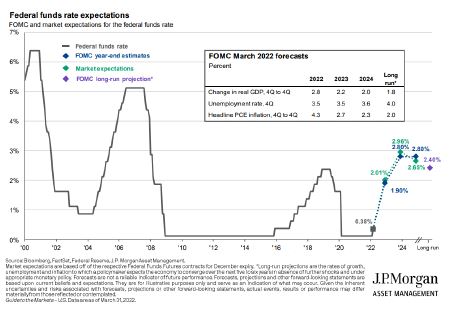

How Many Fed Hikes will Ultimately come in 2022?

The Futures market indicates that there is a 99% chance interest rates are within the range of 2.5-3.75% after the December 14th meeting, with only a 1% chance of rates ending the year below that. This would be the highest short-term interest rate in the US since 2008. In addition, the Fed is winding down its balance sheet. While inflation is front and center, equity markets can only fall so far before some of this is reconsidered, especially considering we are in the midst of a mid-term election year.

The Futures market indicates that there is a 99% chance interest rates are within the range of 2.5-3.75% after the December 14th meeting, with only a 1% chance of rates ending the year below that. This would be the highest short-term interest rate in the US since 2008. In addition, the Fed is winding down its balance sheet. While inflation is front and center, equity markets can only fall so far before some of this is reconsidered, especially considering we are in the midst of a mid-term election year.

Opportunity and Risk

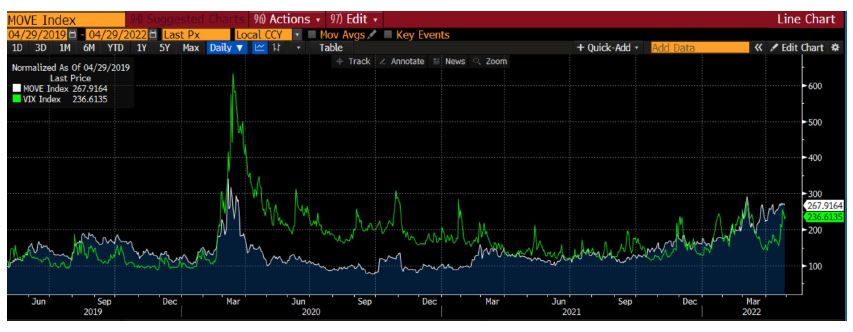

There is opportunity in beaten down tech, whose guidance has brought expectations to reality and risks in service heavy industries, who face labor shortages, union formations (Starbucks and Amazon) and social justice for their employees that may differ from the view of the state they reside in (think Disney). Other risks exist in the online retail space and in other industries that may have overstocked inventory based on overly optimistic growth estimates and fear of inflation on input costs. We’ve had decades of margin expansion pre-Covid, and almost all business inputs have increased in cost since. We expect this to soften in the future, but it is something we are monitoring. The cost of hedges in most liquid markets has risen, and an unwind would prove to be a short-term bounce for all things duration focused, treasuries or growth stocks.

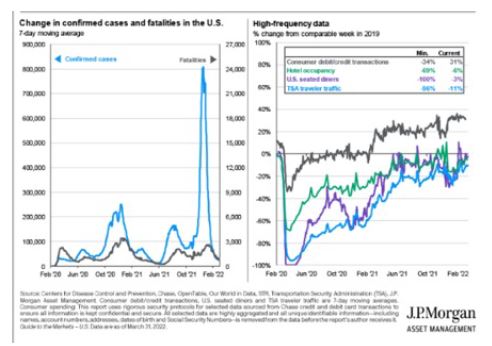

While Omicron spiked Covid cases in the US, it hard muted effects on fatalities. While we won’t pretend to be experts on the subject, we hope this leads to similar results in China. It’s encouraging to see the high frequency consumption data on the right was not significantly affected by the spike experienced over the winter in the US.

While Omicron spiked Covid cases in the US, it hard muted effects on fatalities. While we won’t pretend to be experts on the subject, we hope this leads to similar results in China. It’s encouraging to see the high frequency consumption data on the right was not significantly affected by the spike experienced over the winter in the US.

US Equities

Despite all of the volatility, the iShares Core S&P 500 ETF (IVV) is only down -9.65% for the year as of this commentary. I say “only” because, despite the volatility, US equities continue their outperformance against international equities, and this time against domestic bonds as well. The iShares S&P small-cap ETF (IJR) and mid-cap ETF (IJH) returned -8.26% and -6.74%. The bear market in growth stocks that began last February has bled into the mega cap space, with the Invesco QQQ Trust (QQQ) down -17.42% YTD. Small cap growth stocks performed even worse, while commodity producers benefited from the inflationary tailwinds. Momentum of all sorts has had a difficult stretch. There is some value in a select few mega-cap names, along with plenty of value in growth and value markets if allocated-to correctly.

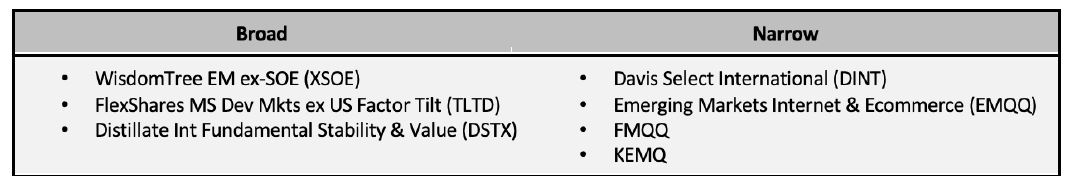

International Developed & Emerging Markets

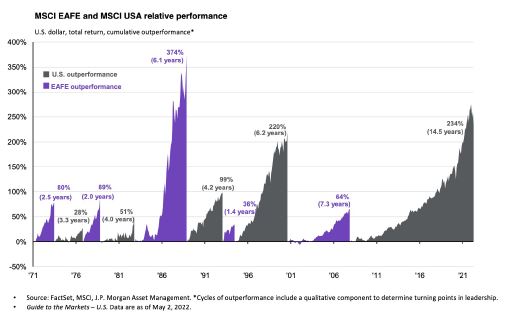

Not all value plays are created equal. The US outperformance of international equities is now a teenager (14.4 years). While you might be feeling the pain of US gas prices, Europe has it worse with minimal national companies adding to GDP. iShares MSCI EAFE ETF (EFA) is down -11.97% for the year, while the iShares MSCI Emerging Markets ETF (EEM) is down -13.43%. Politics aside, Russia and Ukraine were huge suppliers of energy and food for Europe. After almost 18 months of scaring capitalists off, China appears to be loosening its reigns on tech giants, for now. The EMQQ Emerging Markets Internet & Ecommerce ETF (EMQQ) is down -31.21% on the year, but has shown signs of life (and massive beta) on up-days, and positive news announcements out of China.

Not all value plays are created equal. The US outperformance of international equities is now a teenager (14.4 years). While you might be feeling the pain of US gas prices, Europe has it worse with minimal national companies adding to GDP. iShares MSCI EAFE ETF (EFA) is down -11.97% for the year, while the iShares MSCI Emerging Markets ETF (EEM) is down -13.43%. Politics aside, Russia and Ukraine were huge suppliers of energy and food for Europe. After almost 18 months of scaring capitalists off, China appears to be loosening its reigns on tech giants, for now. The EMQQ Emerging Markets Internet & Ecommerce ETF (EMQQ) is down -31.21% on the year, but has shown signs of life (and massive beta) on up-days, and positive news announcements out of China.

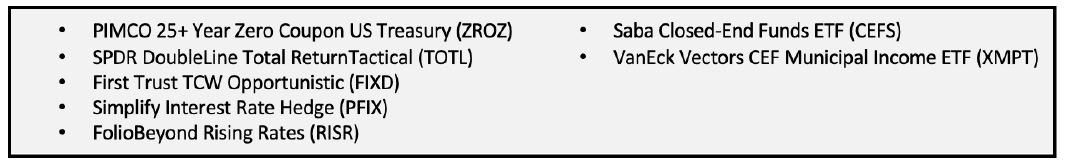

Fixed Income

The iShares Core US Aggregate Bond ETF (AGG) is down -8.95% YTD, underperforming corporate bonds and high yield bonds. The iShares High Yield Corp Bond ETF (HYG) is down -7.74%. This actually makes some sense. Duration has been punished much more than credit, and a decent portion of the high yield bond market is focused in energy, which is doing quite well. But this isn’t what anyone wanted out of the 60/40. The Saba Closed-End Fund ETF (CEFS) was down only 5.04%. The Simplify Interest Rate Hedge ETF (PFIX) is up 51.6% on the year, and FolioBeyond Rising Rates ETF (RISR) is up 29.67%. Both achieve negative duration, in unique ways. One though swaptions on treasuries and the other using MBS IOs. Both are fantastic tools to manage overall portfolio duration, and have also been very negatively correlated to growth stocks.

Alternatives

Oil is up 38% this year, at $104 a barrel after peaking at $123. Agricultural commodities are up 28%. The dollar, measured by the Invesco DB US Dollar Bullish ETF (UUP) is up 8.13%. Gold, measured by the SPDR Gold Shares ETF (GLD) is up 3.62%. Bitcoin is down 15.65% on the year, but its relative lack of volatility when compared to historical data is one of the under-spoken growing benefits of crypto in a time of heightened volatility in both bond and equity markets.

A hypothetical high-active-share reconstruction of a traditional 60/40:

• 5% PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ)

• 5% PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ)

• 7.5% Saba Closed-End Funds ETF (CEFS)

• 5% AGFiQ US Market Neutral Anti-Beta (BTAL)

• 2.5% Simlify Interest Rate Hedge (PFIX)

• 2.5% FolioBeyond Risign Rates (RISR)

• 2.5% WisdomTree Enhanced Commodity Strategy (GCC)

• 5% SPDR Gold MiniShares Trust (GLDM)

• 5% Amplify Inflation Fighters (IWIN)

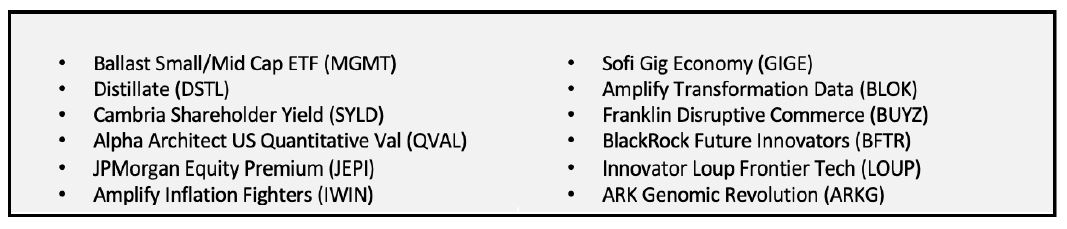

• 5% Amplify Transformational Data Sharing ETF (BLOK)

• 5% Sofi Gig Economy ETF (GIGE)

• 5% Franklin Disruptive Commerce (BUYZ)

• 5% BlackRock Future Innovators (BFTR)

• 4% Ark Genomic Revolution (ARKG)

• 4% Emerging Markets Internet & Ecommerce (EMQQ)

• 2% FMQQ The Next Frontier Internet & Ecommerce (FMQQ)

• 5% Ballast Small / Mid Cap ETF (MGMT)

• 5% JPMorgan Equity Premium Income (JEPI)

• 5% ETF 6 Meridian Small Cap Equity (SIXS)

• 5% Alpha Architect US Quantitative Val (QVAL)

• 5% Cambria Shareholder Yield (SYLD)

• 5% Distillate International Fundamental Stability Value (DSTX)

• 5% Distillate US Fundamental Stability & Value ETF (DSTL)

Disclaimer: This commentary is distributed for informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice. Nothing in this commentary constitutes an offer to sell or a solicitation of an offer to buy any security or service and any securities discussed are presented for illustration purposes only. It should not be assumed that any securities discussed herein were or will prove to be profitable, or that investment recommendations made by Toroso Investments, LLC will be profitable or will equal the investment performance of any securities discussed. Furthermore, investments or strategies discussed may not be suitable for all investors and nothing herein should be considered a recommendation to purchase or sell any particular security.

Investors should make their own investment decisions based on their specific investment objectives and financial circumstances and are encouraged to seek professional advice before making any decisions. While Toroso Investments, LLC has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed in this commentary are Toroso’s current opinions and do not reflect the opinions of any affiliates. Furthermore, all opinions are current only as of the time made and are subject to change without notice. Toroso does not have any obligation to provide revised opinions in the event of changed circumstances. All investment strategies and investments involve risk of loss and nothing within this commentary should be construed as a guarantee of any specific outcome or profit. Securities discussed in this commentary and the accompanying charts, if any, were selected for presentation because they serve as relevant examples of the respective points being made throughout the commentary. Some, but not all, of the securities presented are currently or were previously held in advisory client accounts of Toroso and the securities presented do not represent all of the securities previously or currently purchased, sold or recommended to Toroso’s advisory clients. Upon request, Toroso will furnish a list of all recommendations made by Toroso within the immediately preceding period of one year.