By Chris Konstantinos, CFA

US economy fueled by business sentiment, stimulus, and early vaccination success

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

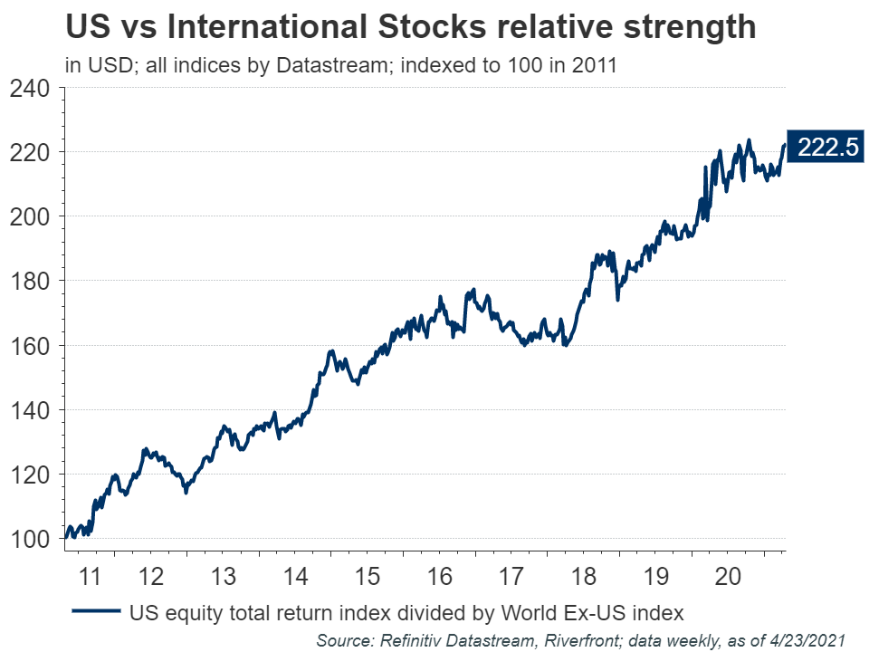

At RiverFront we recognize that, while international markets are priced to deliver better long-term returns than the US, cheap prices are not a timing signal but rather a ‘condition’. The ‘condition’ of cheaper valuation, in our opinion, requires a ‘catalyst’ in order for this value to be realized in the market. Otherwise, a cheap asset class can be simply a ‘value trap’, frustrating investors waiting for fundamentals to turn. This is particularly poignant with regard to countries outside the US, many of which continue to struggle with fractured politics and rigid labor markets along with the corruption and opacity often found in emerging economies. These struggles have led international equities to consistently underperform the US over the last decade (chart, above).

Thus, asset allocators are constantly forced to weigh the lower valuations found overseas against the distinctly worse structural and cyclical fundamentals that exist outside of the US. Is now the time for international value to finally be realized? The weight of the evidence, in our opinion, still points to maintaining an overweight to US stocks for the time being.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance

US: Stronger Economically

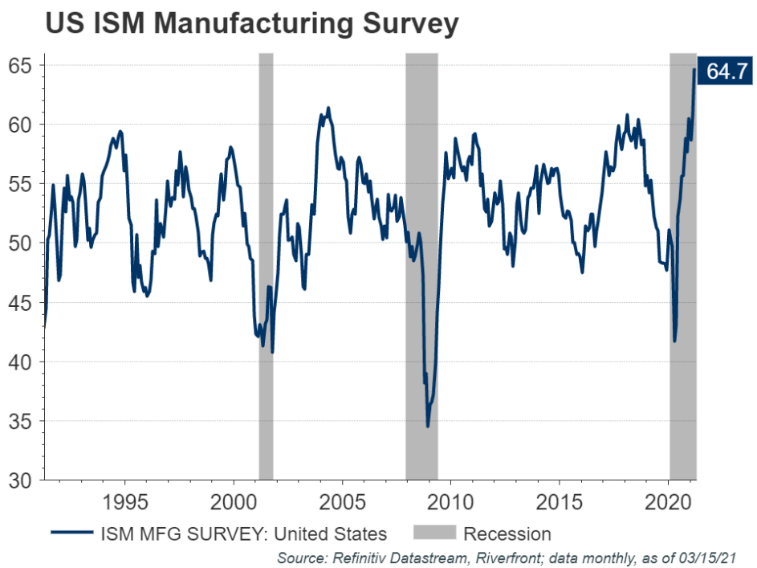

First, there is no getting around the fact that the US economy was stronger heading into the pandemic and remains stronger coming out of it. US Manufacturing sentiment, as gauged by the ISM Manufacturing Index survey, just hit its highest levels in over 30 years (shown in the chart, left), fueling stronger corporate earnings revisions and stock prices, in our opinion. US housing, retail sales, and consumer sentiment also remains remarkably strong in the US.

We think this strength is likely to continue. The International Monetary Fund (IMF), for example, recently released their projected 2024 global GDP forecasts; interestingly enough, the US is the only large economy in the world in which their GDP estimate is actually higher post-pandemic than it was before (source; IMF World Economic Outlook, April 2021).

Why Is the US Stronger?

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

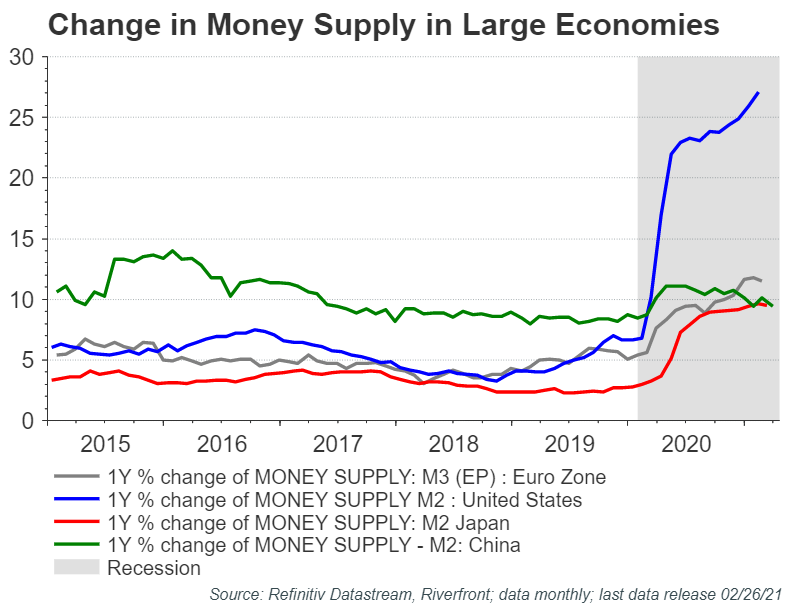

Flexible US labor markets and a focus on shareholder returns have led to both higher levels of productivity, as well as faster productivity gains over the last few decades. In addition to these structural advantages, we believe the US currently enjoys a number of cyclical advantages. These relate to the dramatic response of US policymakers to the pandemic in the form of monetary and fiscal stimulus. The stimulus has caused aggregate money supply to grow 25% year-over-year, as compared to ~10% in other developed economic blocs such as the Eurozone, Japan, and China (see chart, right).

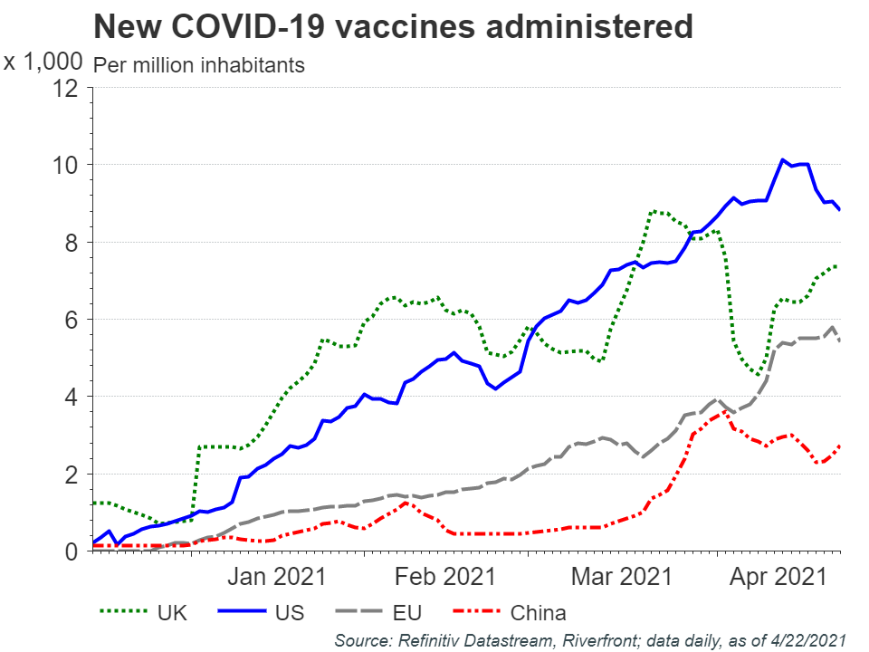

Another cyclical advantage, in our opinion, has been a more organized and widespread vaccine distribution network than much of the rest of the world (see chart, right). Broad vaccine distribution is allowing the US economy to recover more quickly and more

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

sustainably, even as new variants threaten safety and economic growth in other parts of the world. We would note that large emerging economies such as India and Brazil are now seeing COVID-19 infection rates spike, a disturbing turn of events.

Potential Catalysts for Better International Performance

Our recently released long-term Capital Market Assumptions (CMA) analysis suggests that we expect developed international and emerging market equities to produce superior returns to the US over the next 7 years, in our base-case scenario. However, as we state above, unlocking this value will require catalysts. Potential catalysts include: a continuation of the global economic growth rebound, a continued move higher in global interest rates, a weakening of the US dollar, and/or any widespread improvements on vaccine distribution in large economic blocs such as the Eurozone and China.

CONCLUSION

With the weight of the evidence still pointing to the US as the ‘King of the Hill’ among global economies, RiverFront maintains an overweight to US stocks across our balanced asset allocation portfolios.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Index Definitions:

S&P 500 Index TR measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market

MSCI ACWI ex US NR: captures large and mid cap representation across 22 of 23 developed markets (DM) countries (excluding the US) and 23 emerging markets (EM) countries. Net total return indices reinvest dividends after the deduction of withholding taxes, using (for international Indices) a tax rate applicable to non- resident institutional investors who do not benefit from double taxation treaties.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1621713