By Grant Engelbart, CFA, CAIA, Director of Research/Sr. Portfolio Manager for CLS Investments

Investors have been on “Tesla watch” lately, after a parabolic move from sub-$200 per share last summer to nearly $900 as of this writing! Tesla has always been a polarizing stock, with massive amounts of short interest and fraud claims on one side and analyst price targets in the tens of thousands of dollars on the other side. Either way, it has been one of the single-stock stories to watch over the past couple of months and has enthralled those who follow all things capital markets (like yours truly).

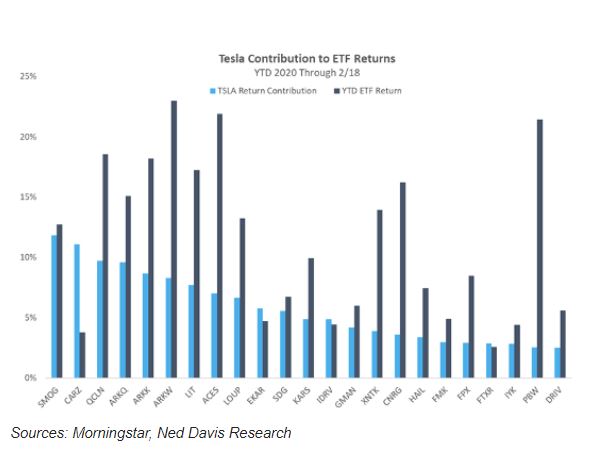

For a stock that is not even in the S&P 500, Tesla resides in more than 110 different ETFs — ranging from some broad indices to ESG products. The stock is now the largest holding in 33 ETFs, and it’s in the top 10 holdings of 47 ETFs. With Tesla up more than 100% so far this year, it has, of course, been a huge driver of returns.

The chart below shows the stock’s impact on several ETFs that hold large amounts of Tesla. In many cases, Tesla accounts for a large majority of the ETF’s return year-to-date. In some cases, the contribution of Tesla is more than the total return of the ETF (suggesting other holdings have lagged).

A Timeless Adage: Know What You Own

Many investors have been pleasantly surprised with their returns recently, without attributing them all to Tesla. Investors in electric cars, clean energy, and innovation likely expect Tesla to be included in their portfolios. What about ESG investors? Tesla has naturally risen to become a large and important holding in many broad-based ESG indices. Mega-caps? IPO Index (Tesla went public in 2010, after all)? Not to mention a bigger weight in consumer discretionary ETFs than Starbucks, Lowe’s, Target, General Motors, and Ford (amongst many others). Take a look at the list of ETFs by category that Tesla currently resides in:

| Morningstar Institutional Category | |

| All-Cap Core | 1 |

| All-Cap Growth | 1 |

| Communications | 1 |

| Consumer Cyclical | 5 |

| Consumer Defensive | 1 |

| Domestic Energy | 4 |

| Giant Core | 3 |

| Giant Growth | 3 |

| Industrials | 5 |

| Large Core | 38 |

| Large Core Growth | 14 |

| Large Deep Value | 1 |

| Large High Growth | 2 |

| Large Relative Value | 1 |

| Materials | 1 |

| Mid Core | 2 |

| Mid Core Growth | 3 |

| Moderate Allocation | 2 |

| Small Core | 1 |

| SMID Core | 1 |

| Technology | 8 |

| Utilities | 1 |

| World All-Cap | 1 |

| World Energy | 2 |

| World Large Core | 11 |

Tesla is in 41 smart beta ETFs, seven actively managed ETFs, and 24 ESG ETFs. Give it a couple more months of this and the number of momentum ETFs holding the name will skyrocket!

I mention all of this not necessarily out of despair — although despair is likely what many short-sellers are currently feeling — but out of curiosity. After all, Apple is in more than 200 ETFs and makes up more than 10% in 15 of those. Amazon has more than a 20% weight in five tickers. However, these companies do, in fact, earn money!

A narrowly led market, fewer publicly traded stocks, and (gasp) more passive money will likely create more single-security risk than investors believe is there. Owning an ETF — or any 1940 Act-regulated fund — should be properly diversified but can still be heavily impacted by the risk and return of large holdings. This has been a benefit to market-cap investors over the past 10 years as large and dominant tech firms have sailed past others.

However, in the near future, more careful attention will need to be paid to single-stock risk. Several firms have developed strategies or mechanisms within their process to diversify this away. These can be as simple as position limits on individual stocks (or bond issuers!). The days of market-cap dominance can’t continue forever, but the days of Tesla bringing simultaneous joy and pain to investors likely aren’t going away anytime soon.

This information is prepared for general information only. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. All opinions expressed herein are subject to change without notice. The graphs and charts contained in this work are for informational purposes only. No graph or chart should be regarded as a guide to investing.

0494-CLS-3/2/2020