By Rebecca Felton, Senior Market Strategist

SUMMARY

- We do not believe the Federal Reserve will slow or reverse the current policy as long as inflation remains above their stated target.

- We believe consumer demand needs to slow for inflation to moderate.

- Stocks may have further to fall until Fed becomes less restrictive, in our opinion.

US Economy Stuck in a ‘Phantom Traffic Jam’

Everyone understands the angst you feel when driving at normal speed and suddenly, traffic crawls to a halt for no apparent reason. As the line of stopped vehicles ahead grows longer, so does the curiosity over what caused this annoying sequence of go, stop, crawl, go. When congestion clears, and traffic begins to move at normal speed, you are convinced the cause of your inconvenience will soon materialize. However, it often does not. When we cannot see or pinpoint the single cause for the delay, it can become even more frustrating. Even if we did not slam on the brakes, we feel the impact of someone ahead who did.

Just as with the phantom traffic jam, inflation’s impacts have spread, and businesses and consumers alike are feeling the chain reaction impacts of an event that occurred over two years ago. The “feel good” rally that marked the first few trading days of the fourth quarter was attributed to oversold conditions, bearish sentiment, and continued hopes for a policy pivot from the Federal Reserve. Reality quickly set in as stronger economic news, chiefly in the form of employment data, was interpreted as fuel for the central bank to stay the course in the quest to achieve lower inflation levels. As we navigate towards the end of the year, we believe the actions of consumers and large corporations may “speak” loudly in influencing market direction.

‘Bad News Is Good News’ for the Market: Consumer Demand Needs to Cool Off

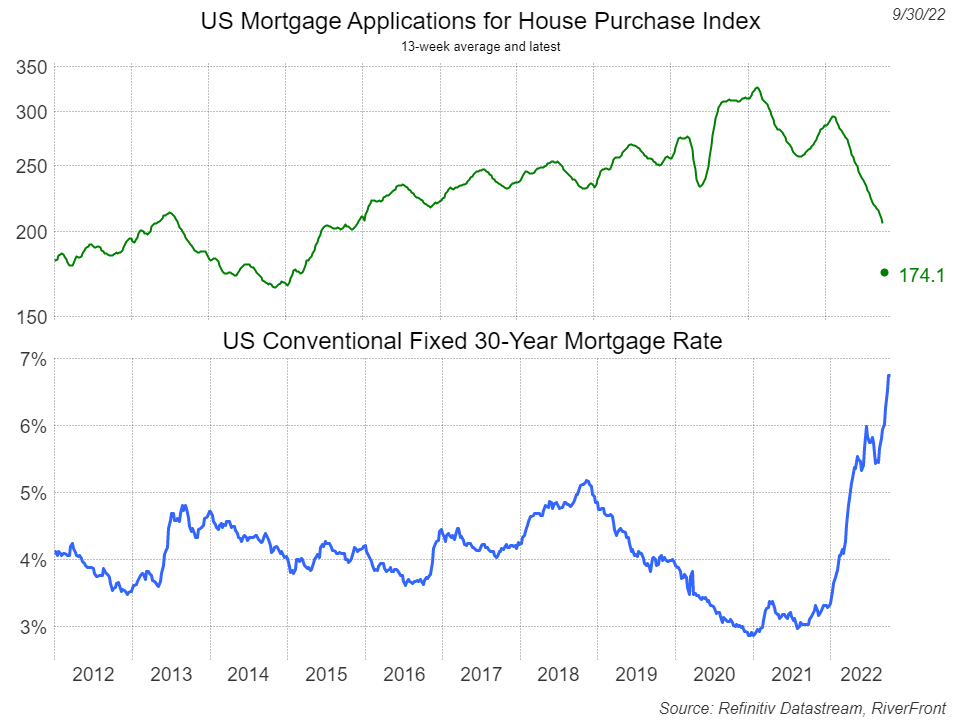

Source: Refinitiv Datastream, RiverFront. Data as of 9.30.22. Chart shown for illustrative purposes.

It is estimated that personal consumption expenditures account for over 60% of US GDP, and consumers are feeling the pinch of inflation on food, fuel, and other necessities. A couple great illustrations of inflation’s impact on consumers are spikes in credit and housing-related inflation. For instance, consumer credit increased by over $32B in August and owners-equivalent rent rose over 6%, to its’ highest levels since the 1980s. Furthermore, as the chart to the right illustrates, mortgage rates have moved above 6% – a 14-year high – and mortgage applications have fallen sharply. According to The Atlanta Federal Reserve, Americans have now experienced a 25% decrease in housing affordability. Not only are mortgage applications falling, but home purchase contracts are also being cancelled. In August, approximately 64,000 contracts for home purchases were cancelled. That equals just over 15% of home contracts initiated during the month, similar to the number in July. As the “ultimate” long term purchase, when a consumer buys a home, it signals confidence about their current financial condition and their expectations for stability of employment. Outside the housing industry, the holiday shopping season is approaching, and a recent survey suggests that one-third of Americans are planning to spend less as a result of inflation. Additionally, consumer sentiment measures have improved in recent months, but remain well below pre-pandemic levels according to the most recent report from The University of Michigan. In conclusion, many believe surging consumer demand was the key to inflationary pressures; consequently, now we believe the economy needs consumer demand to slow to ease those pressures.

Q3 Earnings Likely to Be Solid but Forward Guidance May Be an Issue

We believe that earnings can prove resilient, but as we head towards Q3 earnings season, the various pressures on consumers and cost inputs make this an exceptionally low visibility quarter, in our view. Wall Street analysts will once again focus more on what companies say than what they report, in our opinion. Throughout the past year, strong pricing power and demand have been a mainstay. We believe those will be the buzzwords analysts will key in on over the next few weeks to determine forward estimates. A number of high-profile companies have lowered forward guidance due to inflationary pressures, making both profit margins, unit demand, and revenues important metrics to discern underlying growth.

Another headwind for companies in the S&P 500 is the strength of the US dollar. Over 30% of S&P 500 revenues are generated overseas, meaning their goods are more expensive in foreign markets which could make them less competitive and profitable. Earnings estimates for the third quarter have already come down meaningfully, but longer-term estimates have remained resilient. In our view, stock prices are likely to remain volatile but range-bound until earnings visibility improves.

Conclusion: We Remain Cautious on the Stock Market

The adjectives assigned to the “state” of inflation over the past year have ranged from ‘transitory,’ to ‘persistent,’ to ‘peak.’ We believe it is important to call it what it is and that is ‘PAINFUL’. Federal Reserve Chairman Jerome Powell’s comments following the recent Federal Open Market Committee (FOMC) meeting reminded investors that the committee’s inflation target remains much lower – 2%. We continue to believe that headline inflation is unlikely to fall meaningfully by the end of the year. The reality that it has been higher than expected and is lasting longer than feared, underscores the lingering impacts from an event that is in our rearview mirror. This suggests to us that stocks may have further to fall until it becomes more evident the Fed is able to pivot to a less restrictive stance.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero).

Gross Domestic Product (GDP) is the monetary value of all finished goods and services made within a country during a specific period. GDP provides an economic snapshot of a country, used to estimate the size of an economy and growth rate.

Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2466770