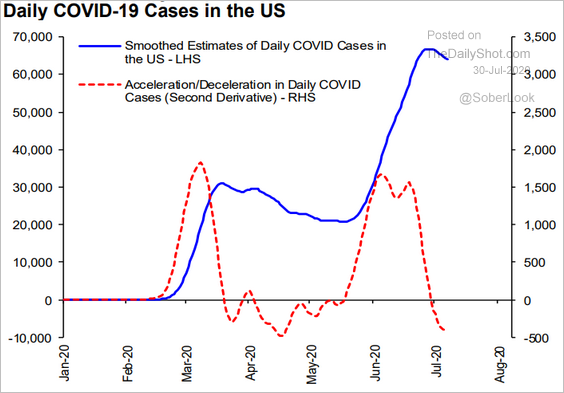

Stocks closed lower on Thursday after a record-setting blow to U.S. GDP revealed the extent of the virus’s economic impact, the contraction was the sharpest in modern U.S. history. Annualized figures (re: the oft-quoted 32.9%) can be deceptive during periods of swift change though, and growth is expected in Q3. And while analysts have largely been shooting in the dark with their Q2 earnings estimates, even the tech bulls were shocked by this one: the combined market value of Amazon, Facebook, Apple, and Alphabet surged by a combined quarter trillion dollars on strong earnings and revenue this week as they continue to massively outperform the rest of the S&P 500® Index, despite their Wednesday appearance before Congress. And as the growth rate of new Covid-19 cases starts to slow, how do the Fed’s tactics compare with the ECB’s?

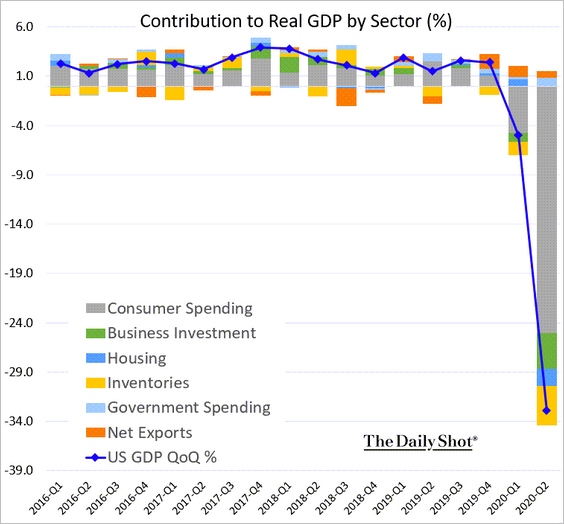

1. No surprise here. As a reminder U.S. GDP is reported as the annualized percent change from the previous quarter. The economy’s real output in the second quarter was about 10% lower than output in the first quarter.

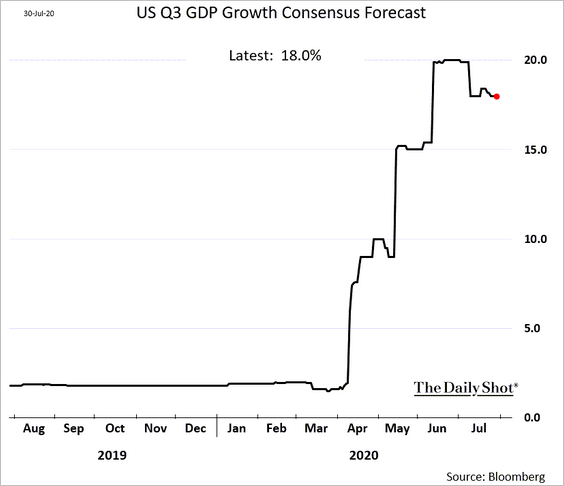

2. There’s likely to be a large rebound in the third quarter, but economic output will still be well below its high-water mark.

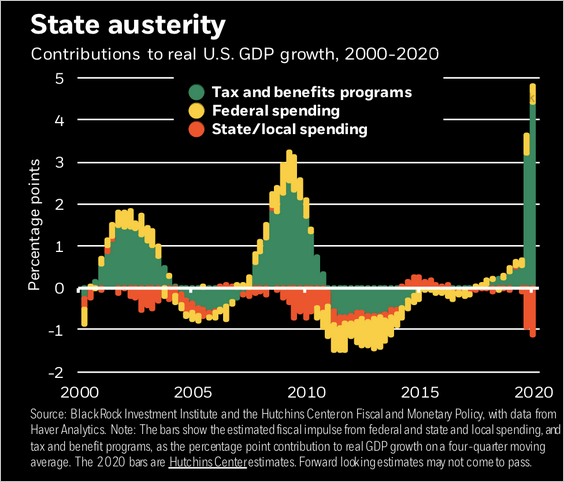

3. Austerity in state and local governments could prolong the recession as they face fiscal constraints that the federal government does not.

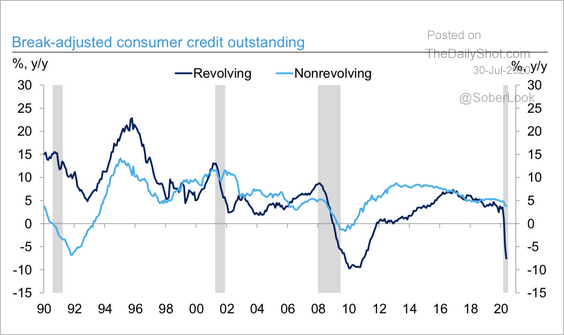

4. Consumers are paying down credit card debt.

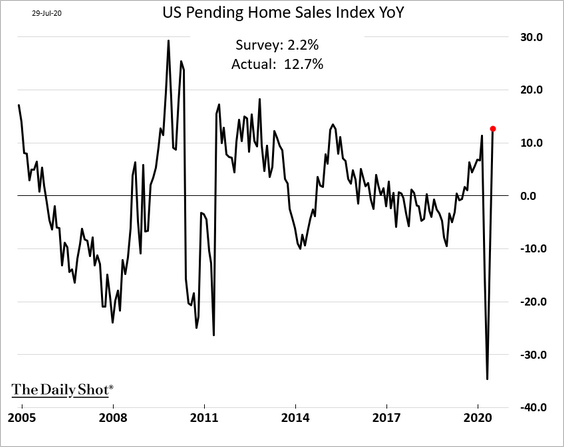

5. You would think this was an incorrect data-point if we hadn’t just lived through it.

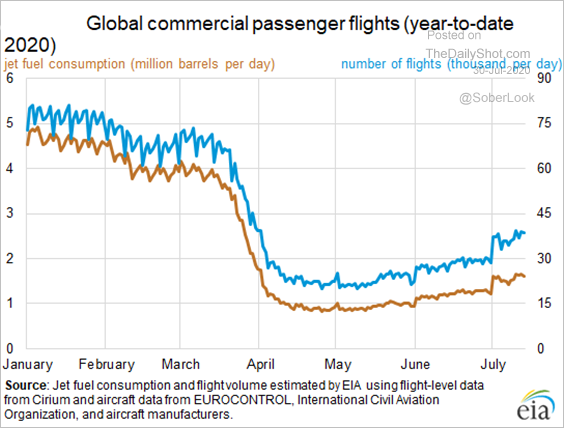

6. Airlines are still operating at about 50% of potential capacity.

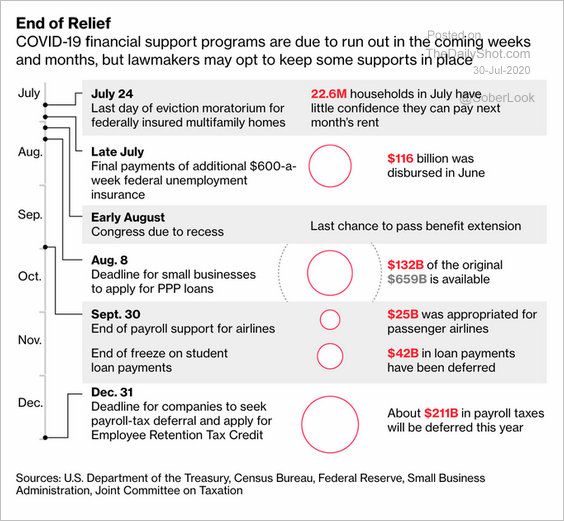

7. Continued legislation and fiscal stimulus will be a focus for markets in the coming weeks.

Source: WSJ Daily Shot, from 7/30/20

8. Analysts expectations for second quarter earnings are a guess at best.

Source: @iamstacetheace, from 7/30/20

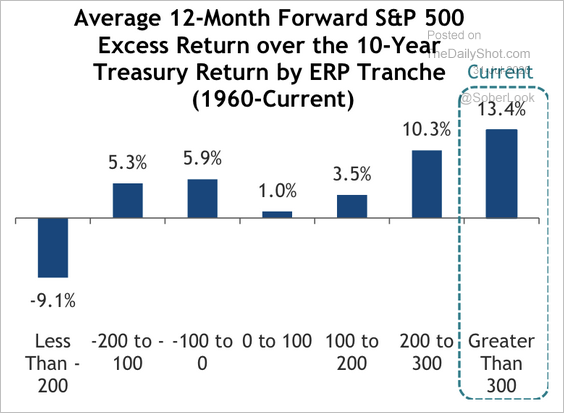

9. Stocks are expensive compared to historical valuation metrics, but attractive compared to other investment options. Tactical can help to manage risk in an environment that may necessitate it.

Source: WSJ Daily Shot, from 7/30/20

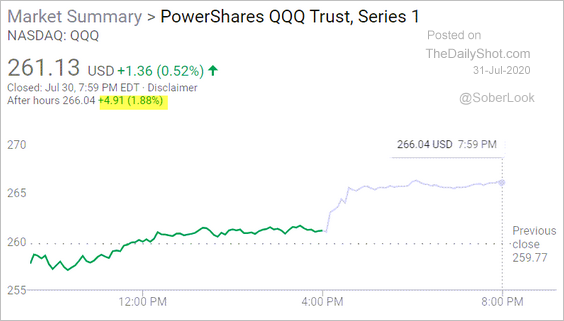

10. Big tech posted impressive revenue and earnings numbers.

Source: Google, as of 7/30/20

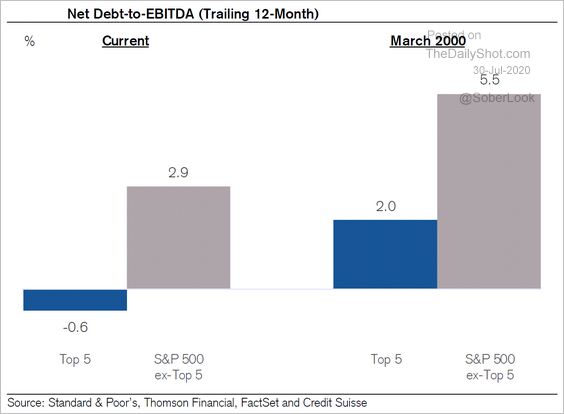

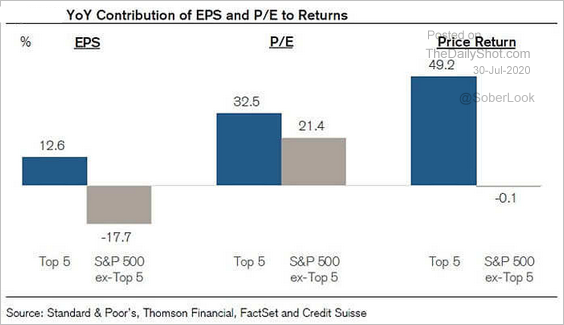

11. Facebook, Apple, Amazon, Microsoft, and Google (FAAMG) are faring much better than the average S&P 500 stock.

Source: WSJ Daily Shot, from 7/30/20

12. But the market knows this and assigns a premium to those companies.

Source: WSJ Daily Shot, from 7/30/20

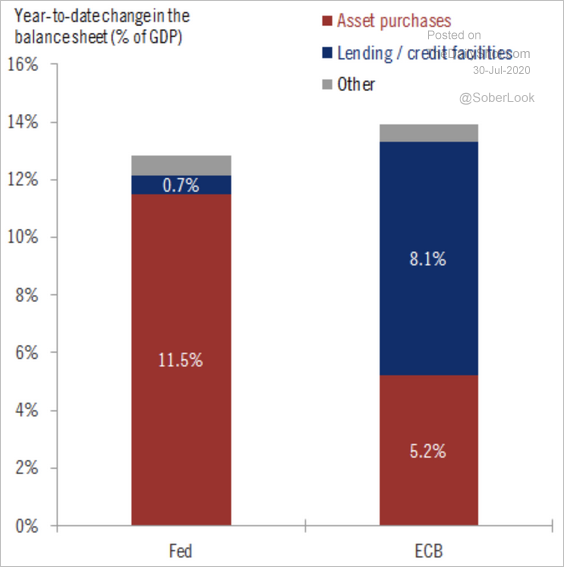

13. The majority of the Federal Reserve’s intervention has been buying existing assets, as opposed to extending credit to companies directly.

Source: WSJ Daily Shot, from 7/30/20

14. New daily cases are no longer growing, hopefully they continue to fall.

Source: WSJ Daily Shot, from 7/30/20

15. Another FAAMG sighting:

Source: Statista, from 7/30/20

Did you miss us on AssetTV? Click below to watch BCM Lead Portfolio Manager Dave Haviland discuss strategies for taking risk opportunistically, managing loss avoidance, and meeting clients’ return and income needs in this new decade’s distinct investment climate.