By: BCM Investment Team

Manufacturing remains strong in the U.S. and saw more gains in February—even in the frozen Lonestar state—but producer prices are also climbing without accompanying gains in prices charged, and it could spell trouble. Home prices saw their biggest annual gain since 2006—11.2% year-over-year—in January and are significantly outpacing wages, but how will climbing interest rates come into play? And the eviction moratorium has been extended through June, but what lies ahead for the sector though when it finally expires? Over in the equity markets, valuations are at extremes, as is margin debt. If hedge funds are falling to leverage and margin, how vulnerable is the ever-expanding population of novice retail investors? Big Tech stocks tumbled after the 10-year Treasury yield hit its highest level in over a year to close out March, but overall, correlation between equities and bonds is climbing. What lies ahead though as infection rates also climb across the country?

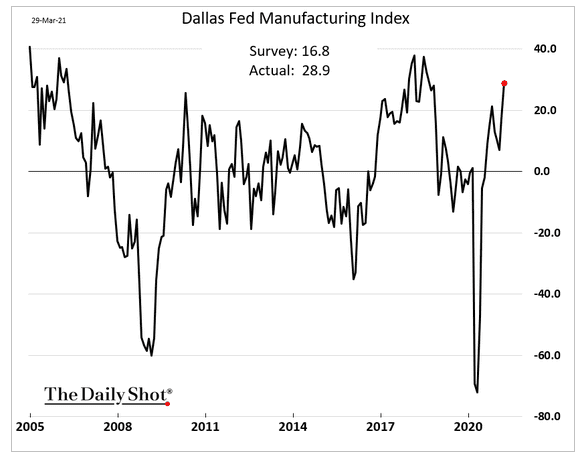

1. Despite the deep freeze, the Dallas FED’s manufacturing report was strong, similar to the other regional surveys:

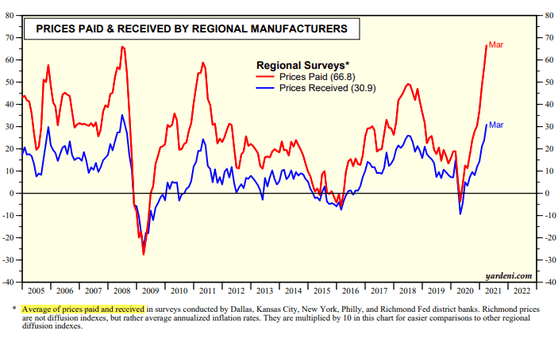

2. The aggregate of this month’s FED surveys indicates that the prices paid for the costs of goods sold has far exceeded the prices received by manufacturers; this will squeeze margins, cause an inflationary increase in prices, or some of both:

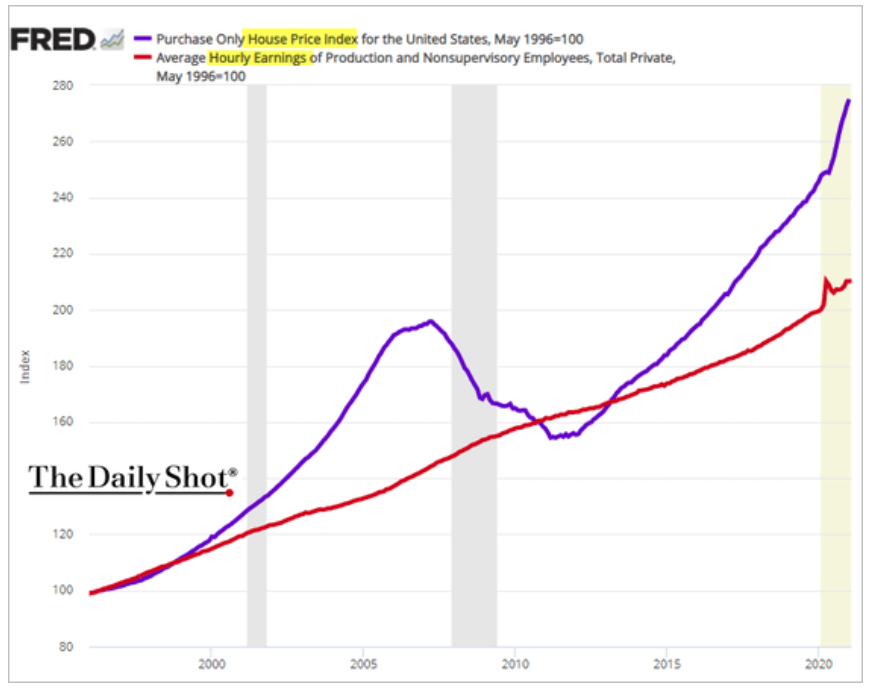

3. Housing price increases are easily outpacing income growth. With mortgage rates rising, will this important growth segment of the economy get choked off?

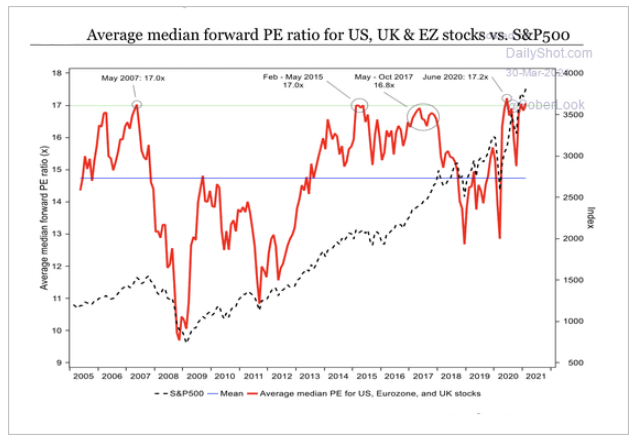

4. While global equity earnings have continued to improve, the markets’ P/E ratios are also near historic peaks:

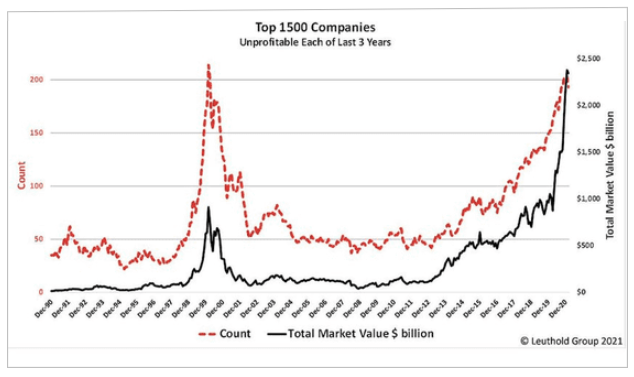

5. Investors are pouring more capital into more unprofitable companies than during the previous peak, the dot.com bubble in the late 1990s. When and how will the air come out of this bubble?

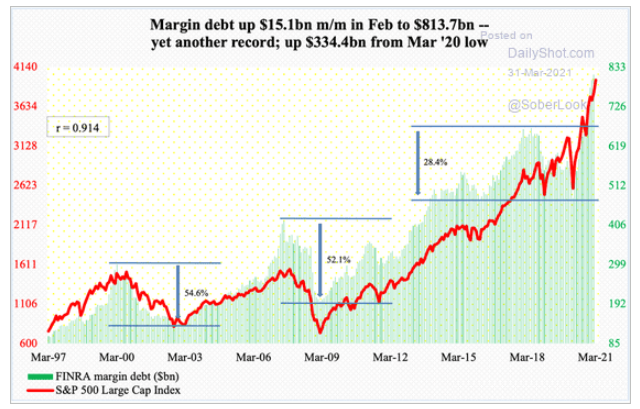

6. Do the new do-it-yourself investors understand the risks of margin? We will find out!

7. The markets are breaking an old maxim: “Don’t fight the FED”. Of course, the FED didn’t know about the upwards of $7.7 trillion ($1.9 + $0.9 + $1.9 and now possibly +$3 trillion) in new federal spending…

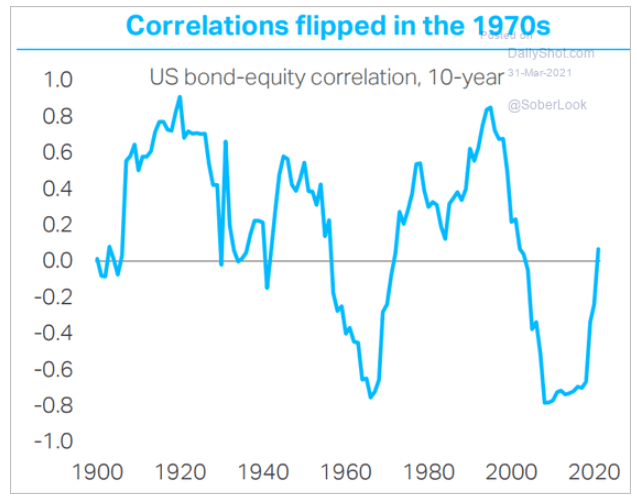

8. A great historical chart showing equity and bond correlations over time.

9. Inflation and interest rates are, in general, rising across the globe. Much of this is due to the rise in oil prices:

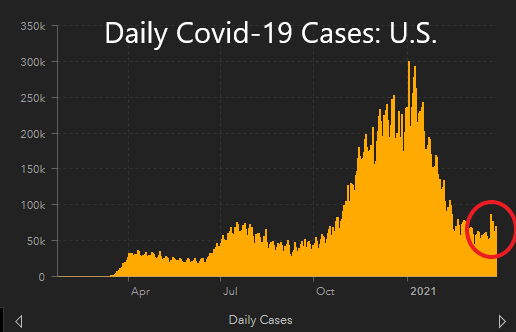

10. Here are the daily number of U.S. Covid cases. We have circled what our CDC director spoke to and is worried about:

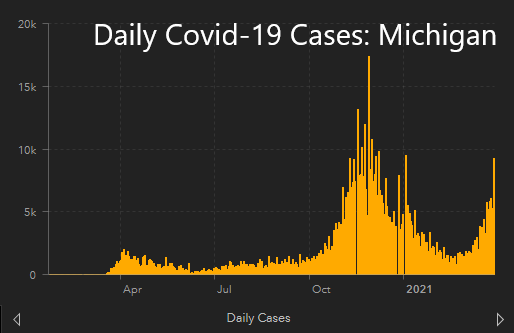

11. In some States, including Michigan below, the third wave has already begun.

This article was contributed by Beaumont Capital Management, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.