Editor’s Note: Model Capital Management originally published this article and sent to their clients on Feb. 14, 2020.

By Roman Chuyan, CFA

- Our equity model’s outlook for the S&P 500 remains negative, we maintain defensive positioning.

- I explain why we think that investors are underestimating the damaging effects of the epidemic.

- Corporate earnings continued to stall in Q4-2019.

Stocks rebounded strongly in February from their earlier pullback as concerns about the coronavirus epidemic gave way to renewed optimism. The S&P 500 index has gained 4.9% so far in February, as well as year-to-date. However, non-US equities continue to underperform, dragged down by emerging markets:

The coronavirus epidemic has been the driver behind recent market moves. There are now over 64,000 confirmed infections and almost 1400 deaths from the virus – five times more than I wrote about just two weeks ago. The epidemic originated in Wuhan, China, and remains centered there due to China’s harsh quarantine of the province and to travel restrictions imposed by other countries. Concerns that drove a brief market selloff in January disappeared quickly, and investor consensus now seems to be that the effect of the virus will be limited and temporary.

We think that investors are underestimating the damaging effects of the outbreak. This view is based on already-reported disruptions in supply chains and their potentially significant economic effects, all happening amidst a fragile macro backdrop (extreme valuation, slowing global growth, and high debt). Below are some of the reported effects and assessments.

1. Travel, entertainment, and tourism hit

Most major airlines around the world have canceled or significantly reduced their China flight service. In the US, United Airlines and American Airlines said this week that they would not resume normal service to mainland China until April 24, almost a month later than planned. Among the first tangible effects here in the US is a decline in the number of Chinese tourists – lucrative customers for travel, entertainment, and luxury retailers, with average spending of about $6,500 per person. The number of passengers flying between North America and China is 75% below last year’s level, according to financial data provider Quandl.

2. Supply chain disruptions

Foxconn, a major supplier to Apple, said that it will be the end of the month before even half of its facilities are operating. The auto industry has already been hit hard by the disruption, especially in Asia, but the effect is being felt globally. Nissan temporarily closed one of its factories in Japan after running short of components, after Hyundai in South Korea did the same. Fiat Chrysler warned that it might shutter one of its European plants. This disruption is happening as the US auto industry is already reeling from high costs and declining non-US sales, resulting in declining earnings and cash flow.

3. Fragile macro backdrop

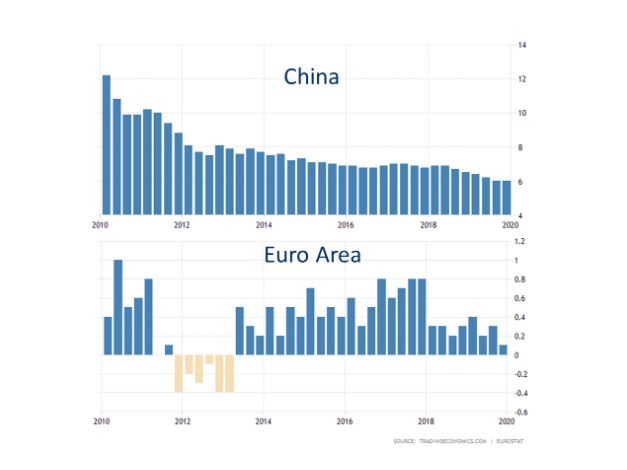

These economic disruptions wouldn’t be nearly as troubling if they occurred during a period of economic strength, but global growth is already weakening. For example, China’s (official) GDP growth at 6% in Q4-2019 is the slowest since 1992, and the Euro Area’s 0.4% annualized is the slowest in seven years, since the European Financial Crisis (see chart on the next page). In one assessment, Capital Economics predicts that the epidemic might cause the global economy to contract this quarter.

The problem is not the brief downturn itself, but that we’re unprepared for it. Financial assets are priced for perfection, and leverage is extreme everywhere. Total US corporate debt is over $15.5 trillion, 74% of GDP. Earnings stalled last year (see Earnings Focus). Losing even a small amount of cash flow in industries that are already overextended might start a credit crunch. The disruption might be just the pin that pricks the bubble.

Fitch just cut the rating of Kraft Heinz from investment-grade to junk, BB+, citing the company’s high leverage. Around 40% of investment-grade debt is like that. Was Kraft Heinz the beginning of a crunch?

Non-US GDP Growth, 10 Years

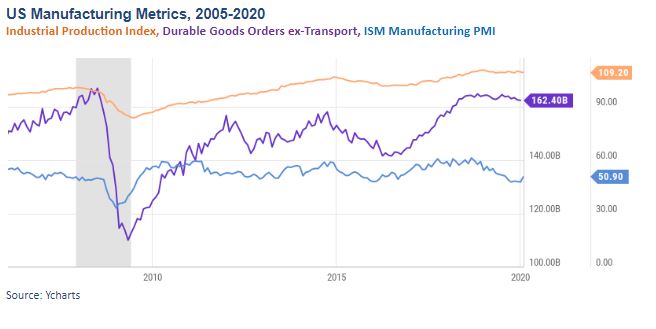

The US remains almost the only reasonably healthy large economy. But even here consumers are alone in supporting growth, while manufacturing stalls:

Earnings Focus

Earnings continue to stall in Q4-2019

Earnings reporting for the fourth quarter of 2019 is nearly complete, with 77% of companies reporting their results. Although the Price-to-Earnings Ratio is currently inactive in our model, quarterly earnings are closely watched by investors. In this section, we provide a regular overview of earnings trends during quarterly reporting seasons.

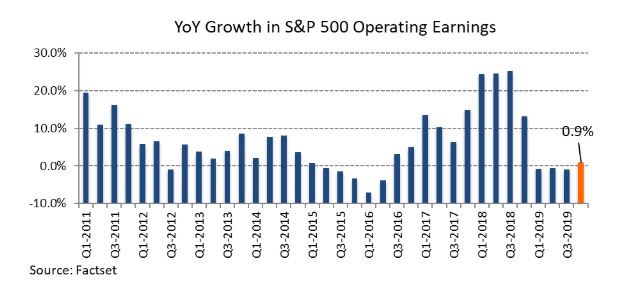

Operating earnings for the fourth quarter grew by 0.9% year-over-year – a positive but low rate of growth. This is the fourth consecutive quarter of near-flat earnings, which previously happened in 2016 (see chart). Non-U.S. economic woes, rising labor and material costs, and a currency effect (the strong dollar) contributed to weaker profits in Q4, according to Factset.

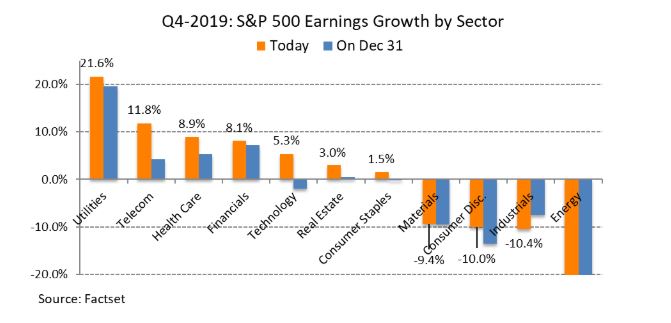

The Industrials, Consumer Discretionary, and Materials sectors all exhibited declines in earnings of around 10% from the same quarter last year (see chart on previous page). The Energy sector lagged the most, with a whopping 43% decline in Q4 earnings. The typically defensive Utilities sector leads growth at 21.6% YoY EPS growth. The Telecom, Financials and Health Care sectors have also reported strong results, all growing their earnings at more than 8%. The Telecoms beat earlier analyst estimates by the widest margin, 7.5%, followed by Technology at 7.2%.

About Model Capital Management LLC

Model Capital Management LLC (“MCM”) is an independent SEC-registered investment advisor, and is based in Wellesley, Massachusetts. Utilizing its fundamental, forward-looking approach to asset allocation, MCM provides asset management services that help other advisors implement its dynamic investment strategies designed to reduce significant downside risk. MCM is available to advisors on AssetMark, Envestnet, and other SMA/UMA platforms, but is not affiliated with those firms.

Notices and Disclosures

- This research document and all of the information contained in it (“MCM Research”) is the property of MCM. The Information set out in this communication is subject to copyright and may not be reproduced or disseminated, in whole or in part, without the express written permission of MCM. The trademarks and service marks contained in this document are the property of their respective owners. Third-party data providers make no warranties or representations relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages relating to such data.

- MCM does not provide individually tailored investment advice. MCM Research has been prepared without regard to the circumstances and objectives of those who receive it. MCM recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of an investment adviser. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. The securities, instruments, or strategies discussed in MCM Research may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them. The value of and income from your investments may vary because of changes in securities/instruments prices, market indexes, or other factors. Past performance is not a guarantee of future performance, and not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized.

- MCM Research is not an offer to buy or sell or the solicitation of an offer to buy or sell any security/instrument or to participate in any particular trading strategy. MCM does not analyze, follow, research or recommend individual companies or their securities. Employees of MCM may have investments in securities/instruments or derivatives of securities/instruments based on broad market indices included in MCM Research.

- MCM is not acting as a municipal advisor and the opinions or views contained in MCM Research are not intended to be, and do not constitute, advice within the meaning of Section 975 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

- MCM Research is based on public information. MCM makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to tell you when opinions or information in MCM Research change.

- MCM DOES NOT MAKE ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THIS MCM RESEARCH (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, MCM HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND/OR FITNESS FOR A PARTICULAR PURPOSE).

- “Model Return Forecast” for 6-month S&P 500 return is MCM’s measure of attractiveness of the U.S. equity market obtained by applying MCM’s proprietary statistical algorithm and historical data, but is not promissory, and, by itself, does not constitute an investment recommendation. Model Return Forecasts were calculated and applied by MCM to its research and investment process in real time beginning from 2012. For periods prior to Jan 2012, the results are “back-tested,” i.e., obtained by retroactively applying MCM’s algorithm and historical data available in Jan 2012 or thereafter. Source for the S&P 500 actual returns: S&P Dow Jones.

- Index returns referenced in MCM Research, if any, are gross of any advisory fees, fund management fees, and trading expenses. Fund or ETF returns referenced, if any, are gross of advisory fees and trading expenses. Returns will be reduced by fees and expenses incurred.