Last September we published a commentary and video discussing the narrowness of the stock market recovery to that point. At that time, large cap stocks had outpaced small caps and the growth style had outperformed the value style by the largest spread in more than 20 years. We then took a deeper dive into how the recovery had been dominated by a few sectors as only a handful of stocks had driven market results to that point.

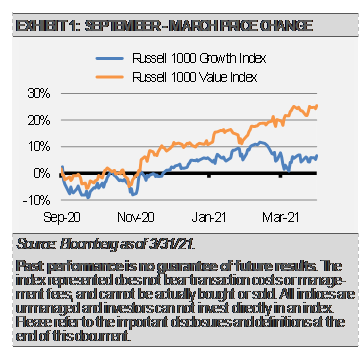

Looking back at the markets since last September, we can see how dramatically the situation has changed. For example, from September through March, the Russell 1000 Value Index has outperformed the Russell 1000 Growth Index 25.43% to 6.65%. Given where we think we are in the economic recovery and comparing our view to historical trends, we think that the value style can continue to outperform growth for months to come.

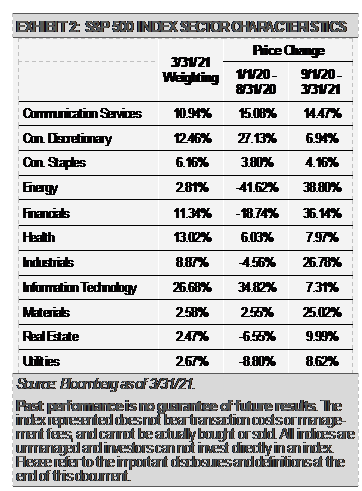

We see a similar shift in market leadership of individual sectors. While the initial phase of the market recovery was led by information technology and consumer discretionary companies, the recovery has since broadened to favor cyclical value sectors such as energy, financials, industrials, and materials.

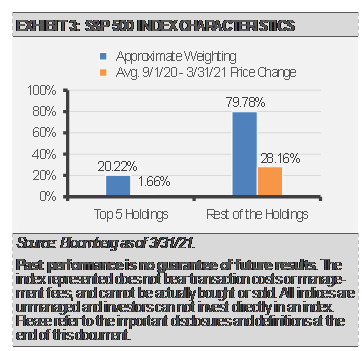

As the market recovery has broadened, the number of stocks that are performing well has also increased. As the chart below shows, the first part of the S&P 500 Index recovery was driven by just the top 5 stocks which make up about 20% of the Index’s market capitalization. The remaining companies, which make up about 80% of the Index, were down during the January through August period. That trend has since reversed with the broader set of companies moving 29.16% higher since September while the top 5 stocks are only up 1.66%.

Going forward, we think there is still plenty of opportunity in this market. While we think that some areas are expensive, we think that the value style can broadly continue to lead. Furthermore, we think that there are certain sectors, especially defensive sectors, that look attractive.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.

Index Definitions:

The S&P 500 Index is a capitalization-weighted index of 500 stocks. The Index is designed to measure performance of a broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The S&P 500 Consumer Discretionary Index is capitalization-weighted and is designed to measure the consumer discretionary sector of the S&P 500 Index. The S&P 500 Consumer Staples Index is capitalization-weighted and is designed to measure the consumer staples sector of the S&P 500 Index. The S&P 500 Energy Index is capitalization-weighted and is designed to measure the energy sector of the S&P 500 Index. The S&P 500 Financials Index is capitalization-weighted and is designed to measure the financial sector of the S&P 500 Index. The S&P 500 Health Care Index is capitalization-weighted and is designed to measure the health care sector of the S&P 500 Index. The S&P 500 Industrials Index is capitalization-weighted and is designed to measure the industrial sector of the S&P 500 Index. The S&P 500 Information Technology Index is capitalization-weighted and is designed to measure the information technology sector of the S&P 500 Index. The S&P 500 Materials Index is capitalization-weighted and is designed to measure the materials sector of the S&P 500 Index. The S&P 500 Real Estate Index is capitalization-weighted and is designed to measure the real estate sector of the S&P 500 Index. The S&P 500 Telecommunication Services Index is capitalization-weighted and is designed to measure the telecommunication services sector of the S&P 500 Index. The S&P 500 Utilities Index is capitalization-weighted and is designed to measure the utilities sector of the S&P 500 Index. The Russell 1000 Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell1000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Growth Index is constructed to provide a comprehensive and unbiased barometer for the large-cap growth segment. The index is completely reconstituted annually to ensure new equities are included and that the represented companies continue to reflect growth characteristics. The Russell 1000 Value Index measures the performance of the large cap value segment of the US equity universe. It includes those Russell1000 companies with lower price-to-book ratios and lower forecasted growth values. The Russell 1000 Value Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The index is completely reconstituted annually to ensure new equities are included and that the represented companies continue to reflect value characteristics.