By Cinthia Murphy

This has been a great year for portfolio diversifiers that in ETF land populate what’s known as the alternatives category.

Highly correlated markets have made it challenging to find much of a diversification punch among traditional assets, but alternatives ETFs are reminding us that diversification is out there if you are willing to look into some of the more-complex, and often actively managed, parts of the ETF ecosystem.

Alternatives ETFs have seen their value proposition tested this year, and many have more than confirmed that value prop with results that are delivering on intended design.

As you know, at the ETF Think Tank we are in the business of research and conversation – not investment advice. So, for the purpose of illustrating what ‘alternatives’ are doing, we are looking at three of the best performing alternatives ETFs this year, each offering a slightly different take on this broad category:

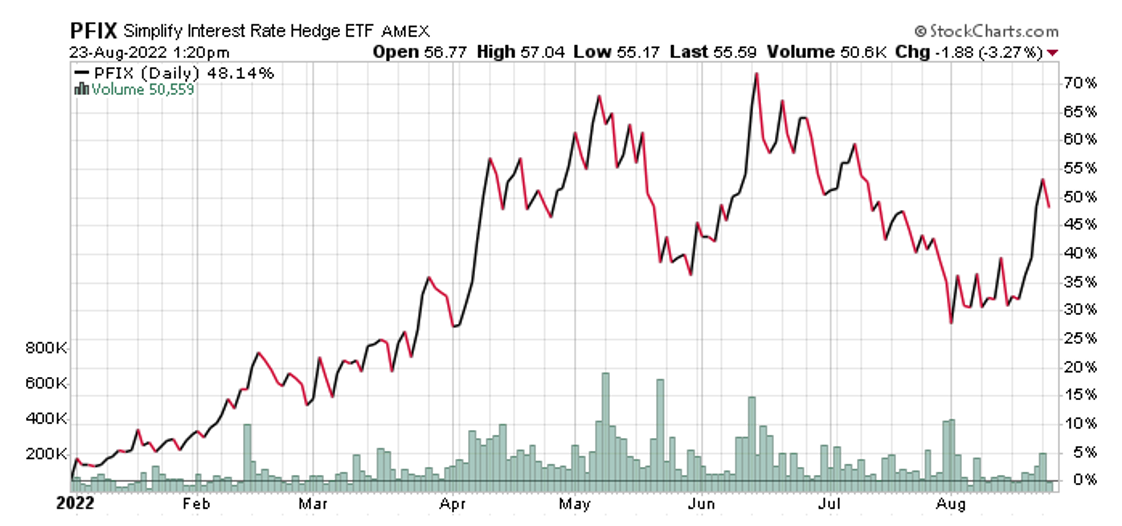

- Simplify Interest Rate Hedge ETF (PFIX) is up 48% year to date.

PFIX is designed to hedge against rising interest rates or sharp interest rate moves.

The fund allocates 50% of the portfolio to OTC interest rate options (benefiting from higher rates and higher rate volatility) and 50% to US Treasuries (generating some income along the way).

As Simplify describes it, PFIX is akin to “owning a position in long-dated put options on 20-year US Treasury bonds.” That functionality means the fund works as a great interest rate hedge for assets sensitive (or negatively correlated) to rates such as fixed income, real estate and growth stocks.

This year, as rates have gone up, bonds have struggled, real estate has felt increasing pressure and growth names are down.

To view Simplify Interest Rate Hedge ETF (PFIX) standardized performance, Click here

- iMGP DBi Managed Futures Strategy ETF (DBMF) is up 23% YTD.

DBMF is a hedge fund replication strategy. The fund is a long/short managed futures portfolio that sets out to replicate – or deliver as close an approximation as possible – to the largest positions of the 20 or so largest hedge funds in the market today (name like AQR, Man, etc).

Hedge fund replication – and managed futures – isn’t a space known for simplicity. But DBMF sets out to do exactly that: simplify access to a complex segment.

By design, managed futures tend to do well in rising rate environments, but this year’s stellar performance comes down to hedge funds getting the inflation call right. DBMF has been largely long crude oil, long dollar (vs. yen), and short Treasuries. This long/short mix has placed the fund among the best performing alternatives ETFs in the market.

If you talk to the portfolio manager Andrew Beer, you are reminded that while strong performance this year has been a boon to asset gathering, the long-term attributes that make this fund a viable portfolio diversifier are twofold. First, DBMF is a multimanager portfolio. Unlike many hedge fund replication strategies – and hedge funds themselves – single manager risk is not an issue here. Secondly, DBMF sets out to capture alpha [1], as in outperformance relative to a direct investment in hedge funds, through its lower fee vs. hedge funds themselves. The fund costs 0.85% in expense ratio, or $85 per $10,000 invested.

To view iMGP DBi Managed Futures Strategy ETF (DBMF) standardized performance, Click here

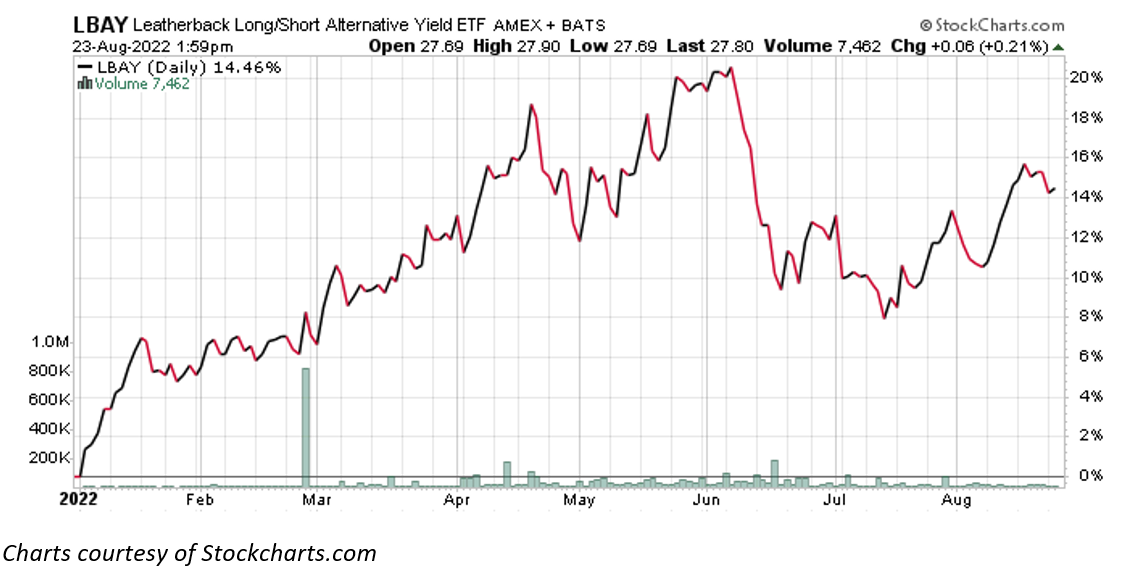

- Leatherback Long/Short Alternative Yield ETF (LBAY) is up 15% YTD.

LBAY is for all practical purposes a hedge fund. The strategy is a long/short portfolio in an ETF wrapper that’s managed by a very hands-on short seller veteran, Michael Winters.

LBAY is a mix of 30 to 40 long positions, and 20 short positions. The long book tilts towards value and quality names looking for stocks that deliver shareholder yield/dividends, while the short allocation is idiosyncratic, relying on forensic accounting to spot the names most likely to fall.

This year, the dividend-payer and factor tilts of the long sleeve has worked well, but it’s the short bets that have delivered the real punch.

LBAY, which steers clear of stocks with high short interest – anything above 20% short or in meme stock territory, found strong returns by shorting stocks that have dropped anywhere from 60 to 90% this year, including names like Carvana and Netflix.

As Winters describes it, LBAY is “the epitome of active management” and in this case, active that’s not afraid to double down on a bet. As a strategy, LBAY is slow to take profits on a position, instead reloading a short as it goes down.

In a market environment like the one we’ve seen this year, LBAY has found success in its appetite for risk, and benefited from a higher rate environment that’s friendly to lower beta names – and spot on security selection.

To view Leatherback Long/Short Alternative Yield ETF (LBAY) standardized performance, Click here

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090.

Finding Alternatives ETFs For Your Goals

There are many alternatives ETFs in the market today. As our sampling demonstrates, there are no two alike in this eclectic segment.

At the ETF Think Tank, we actually avoid using the ‘alternatives’ label in our ETF classification efforts because we find it too broad and non-descriptive enough. Instead, we like to go a step further to segment alternatives into more granular categories that include allocation and managed futures, among others. The idea is to go directly into what drives a portfolio’s performance.

If you are searching for alternatives ETFs in our database, you’ll need to search by asset category specifically under ‘Toroso Category” at www.etfthinktank.com. As always, if we can help you with your research, just holler!

[1] “Alpha” A measure of performance on a risk-adjusted basis. Alpha takes the volatility (price risk) of a fund and compares its risk-adjusted performance to a benchmark index. The excess return of the fund relative to the return of the benchmark is a fund’s alpha.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by visiting leatherbackam.com. Please read the prospectus carefully before you invest.

References to other securities is not an offer to buy or sell

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short. Since the Fund is actively-managed, it does not seek to replicate the performance of a specified index. The Fund therefore may have higher portfolio turnover and trading costs than index based funds. The Fund may invest in other funds, and in so doing will incur the expenses and risks of those funds. The Fund uses short sales and derivatives (forwards, futures, swaps, and options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets (BDCs) which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

The Fund is distributed by Foreside Fund Services, LLC