By Rob Williams, Director of Research, Sage Advisory

Earlier this year many investors panicked and fled to cash when news of Covid-19 caused a sharp downturn in the first quarter. While market downturns are common, there was no playbook for a global pandemic. However, due to the historic monetary policy and fiscal stimulus response, the correction proved to be short-lived. It was more like an intra-cycle correction that happens fast but rebounds just as quickly. In the end, like in other corrections, those investors who stayed invested in the market were better served than those who fled to cash.

During the most recent four market corrections, on average roughly two-thirds of an investor’s downside was recovered in two weeks.

Put another way, for the 2020 correction, an investor who lost $10,000 by going to cash when the market hit bottom, would miss out on recouping ~$6,200 if s/he were still invested in cash two weeks later.

| Year of Correction | % of downside recovered in first week |

% of downside recovered in first two weeks |

| 2015 | 48% | 64% |

| 2016 | 43% | 78% |

| 2018 | 43% | 52% |

| 2020 | 27% | 62% |

| Average | 40% | 64% |

Market Timing vs. Time in the Market

Market timing is a strategy that relies on predicting market movements – and it is nearly impossible to accomplish even by the most skilled portfolio managers. Ideally, investors want to buy stocks when prices are low and sell them when prices hit highs. However, this rarely occurs. Instead what often happens when markets dip down is investors 1) panic and sell their stocks to hold cash, and 2) don’t reinvest their cash back into the market fast enough to ride the market back up.

Time in the market refers to a “buy-and-hold” approach, whereby investors invest when they can as often as they can, and they stay invested through market cycles. Over the long-term, investors’ returns are likely to be higher than they would have been if they had tried and failed at timing the market (which is almost always the case!).

Keeping Clients Invested

At Sage, we prefer time in the market. And as tactical managers, we take this a step further by 1) creating the smoothest ride possible so that financial advisors have an easier time keeping clients invested, and 2) holding fast to our belief that there is always a better market segment to be in than cash. Our tactical approach to investing client portfolios includes moving in and out of stocks, bonds, etc., as the market changes. Instead of going to cash and exiting the market entirely, we prefer to focus on rotating into market segments that are likely to perform better than others given the current market environment.

Instead of deciding when to exit the market and reenter, which is extremely difficult to time, we ask what segments of the market are likely to outperform? What is causing the correction? And, what asset classes are likely to have the most upside as the markets recover?

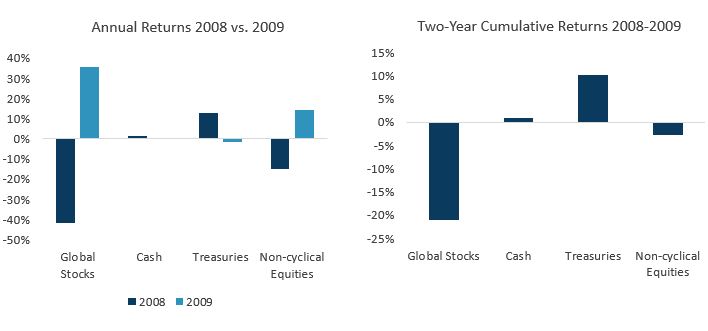

Even during large, longer-lasting corrections, cash is often not the best defense over time. For tactical strategies, especially balanced ones, the 2008-2009 period provides a perfect example. The strategy of increasing Treasuries in the bond allocation, while using defensive stocks instead of cash on the equity side, provided investors with a smoother ride (less swings up/down) and similar downside protection than cash without the risks that result from trying to time when to get out and back into the market.

Given the political and macro uncertainties facing equity investors and the challenging yield environment facing income investors, it has never been more important to apply an active approach to investing. It is also important to stay invested in the market and not be driven by fear and market timing. As we’ve learned from previous market downturns, cash is often not the best defense.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.