By Roman Chuyan, CFA

- Our fundamentals-based process helped protect against the entire market correction so far.

- Our equity model’s outlook for the S&P 500 remains negative; we maintain defensive positioning.

- The correction made stocks somewhat cheaper, but valuation remains negative.

What a difference a week makes! Stock markets plunged in the worst week since 2008 on fears about the coronavirus. All major US indexes entered correction territory, down around 11% in the week. The S&P 500 index plunged 12.7% from its February 19th peak and is now down 8.3% year-to-date. It erased all of its gain since the fourth quarter of 2019, now at its level from 9/30/2019. Non-US equities did better during this plunge but continue to underperform over longer periods, -9.8% YTD and reversing their entire 12-month gain. The technology-heavy NASDAQ-100 is outperforming, down only 3.2% YTD.

The coronavirus epidemic was the driver behind market moves once again – but this time, complacency turned into concern. Stock investors felt an urgent need to sell, resulting in several -3% market days and culminating in a 4.4% loss on Thursday. For the week, all major US indexes lost around 11%. As usual, a catalyst was required to prick the bubble – it turned out to be the coronavirus. A selloff begins when there are no more buyers, and has to run its course. In my view, we’re in the initial, “concern” phase of it.

“Fear indicators” spiked to levels of previous market corrections. Implied volatility – the VIX – jumped to 40, and the Put/Call ratio rose to 1.27 – high, but not quite as high as its peak of 1.8 in December-2018 or even 1.54 in March of 2018:

I wrote the following in my previous, mid-February report:

We think that investors are underestimating the damaging effects of the outbreak… The disruption might be just the pin that pricks the bubble.

This is beginning to happen. Investors are witnessing the negative effect of the epidemic on travel and supply chains. Some institutions adjusted their global GDP growth projections slightly down for this quarter – but the consensus still looks for a V-shaped recovery later in the year. Investors are also becoming concerned about corporate earnings. In February, 129 companies in the S&P 500 discussed “coronavirus” in their analyst calls, up from 60 in January, the Wall Street Journal reports. However, executives are saying that it is too soon to tell how serious the problem it will be. It’s still too early – we will know more in late March when companies provide earnings guidance for the first quarter.

The market is bipolar, although it’s not easy to outperform based on its bipolar tendencies. One must have reasonably accurate models and use them in a disciplined process that eliminates emotion. We at Model Capital have/do both, which helped us to protect clients against this entire correction. Our 6-month equity model last turned negative in mid-November, and our short-term risk model gave a Sell signal on December 23rd. I’m especially pleased with the short-term model’s recent record – it was very timely, as the market has so far dropped by 8.4% since its Sell signal. The 6-month model was somewhat early in retrospect, but still a good signal considering market performance since then. In addition, the models duplicate each other, providing two lines of defense against significant downside risk.

Our 6-month equity model continues to give a negative outlook for the S&P 500. The 8.2% market drop in February certainly made the S&P 500 index cheaper. The valuation component of the model changed from -7.1% in January to -2.9% (it’s not one-for-one with the market performance because the model recalculates factor weights in each run). So, the market is now closer to fair value, but still not quite there. In addition, some other factors changes were negative in February.

As I have written, the problem is not the coronavirus itself, but that it’s happening amid fragile macro environment. Global growth was already weakening, and US corporate earnings stalled last year. Financial assets were priced for perfection, and leverage was extreme everywhere. For years, a zero-rate environment pushed investors to take more risk in reach for return, so they are now overinvested in risky assets. Total US corporate debt reached 74% of GDP, in part due to companies buying back shares financed by debt.

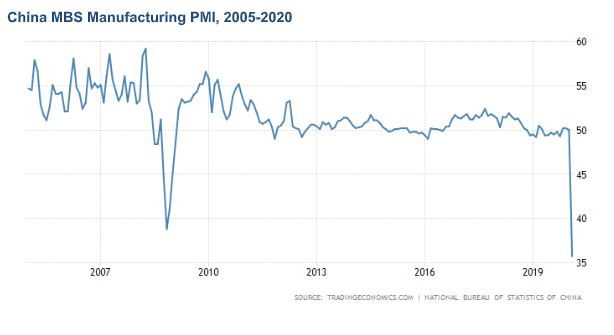

We just got the first glimpse of the epidemic’s effect on China’s economy. The Official NBS Manufacturing PMI in China plunged to 35.7 in February, far worse than consensus expectations of 46. This is the lowest PMI level since its record began in 2005, lower than it was during the 2008 crisis (see chart). China contributes a significant portion of overall global GDP growth. When China sneezes, the world catches a cold, they say – and now China’s getting really sick.

About Model Capital Management LLC

Model Capital Management LLC (“MCM”) is an independent SEC-registered investment advisor, and is based in Wellesley, Massachusetts. Utilizing its fundamental, forward-looking approach to asset allocation, MCM provides asset management services that help other advisors implement its dynamic investment strategies designed to reduce significant downside risk. MCM is available to advisors on AssetMark, Envestnet, and other SMA/UMA platforms, but is not affiliated with those firms.

Notices and Disclosures

- This research document and all of the information contained in it (“MCM Research”) is the property of MCM. The Information set out in this communication is subject to copyright and may not be reproduced or disseminated, in whole or in part, without the express written permission of MCM. The trademarks and service marks contained in this document are the property of their respective owners. Third-party data providers make no warranties or representations relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages relating to such data.

- MCM does not provide individually tailored investment advice. MCM Research has been prepared without regard to the circumstances and objectives of those who receive it. MCM recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of an investment adviser. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. The securities, instruments, or strategies discussed in MCM Research may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them. The value of and income from your investments may vary because of changes in securities/instruments prices, market indexes, or other factors. Past performance is not a guarantee of future performance, and not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized.

- MCM Research is not an offer to buy or sell or the solicitation of an offer to buy or sell any security/instrument or to participate in any particular trading strategy. MCM does not analyze, follow, research or recommend individual companies or their securities. Employees of MCM may have investments in securities/instruments or derivatives of securities/instruments based on broad market indices included in MCM Research.

- MCM is not acting as a municipal advisor and the opinions or views contained in MCM Research are not intended to be, and do not constitute, advice within the meaning of Section 975 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

- MCM Research is based on public information. MCM makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to tell you when opinions or information in MCM Research change.

- MCM DOES NOT MAKE ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THIS MCM RESEARCH (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, MCM HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND/OR FITNESS FOR A PARTICULAR PURPOSE).

- “Model Return Forecast” for 6-month S&P 500 return is MCM’s measure of attractiveness of the U.S. equity market obtained by applying MCM’s proprietary statistical algorithm and historical data, but is not promissory, and, by itself, does not constitute an investment recommendation. Model Return Forecasts were calculated and applied by MCM to its research and investment process in real time beginning from 2012. For periods prior to Jan 2012, the results are “back-tested,” i.e., obtained by retroactively applying MCM’s algorithm and historical data available in Jan 2012 or thereafter. Source for the S&P 500 actual returns: S&P Dow Jones.

- Index returns referenced in MCM Research, if any, are gross of any advisory fees, fund management fees, and trading expenses. Fund or ETF returns referenced, if any, are gross of advisory fees and trading expenses. Returns will be reduced by fees and expenses incurred.