By Doug Sandler, CFA

Summary

- The economic re-opening has led to supply constraints which threaten growth.

- Historically, a combination of technological gains, human ingenuity, and labor and mix shifts have alleviated supply constraints.

- We view supply constraints as more of a speedbump and less of a roadblock.

Supply constraints more likely a speedbump than a roadblock

Undoubtedly, we believe better economic times are coming as a result of pent-up demand and high consumer savings rates. However, for the first time in a while, our view is that the biggest threat to future growth may not be a lack of demand but rather constraints on supply.

Last week, we highlighted some of these supply-related challenges facing the economy including labor supply and manufacturing and services capacity. This week our focus is on the potential fixes to these supply shortages and challenges to our thesis.

Potential Fixes:

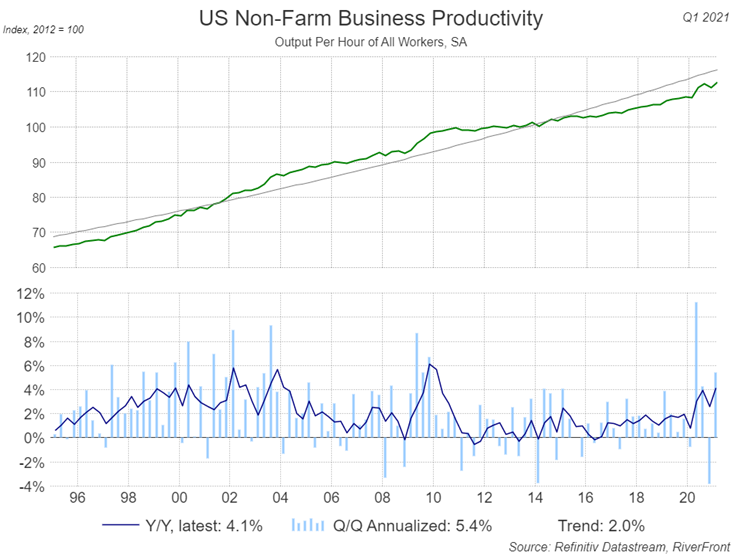

- Technology: From the steam-engine to artificial intelligence, technology has always played a pivotal role in narrowing the divide between demand and supply. In our view, the rapid adoption of technology by many companies to operate effectively during the COVID-19 pandemic, will turbo-charge productivity gains in coming years. As can be seen in the chart below, productivity growth has picked up since COVID-19 registering 4.1% year-over-year and 5.4% quarter-over-quarter increases. This rate of growth is significantly higher than the 2% growth trend that has existed since the mid-1990s.

In effect, we believe almost all companies are tech companies whether they supply it or use it. Technology will continue to transform companies’ ability to tackle change.

Productivity Starting to Rise

- Human ingenuity: Using history as a guide, supply shortages typically get rectified. Higher prices bring more competitors, workers, and capacity to an industry. Eventually, we believe this will get figured out. After all, we developed a vaccine for COVID-19, a never-before-seen disease, in less than one year…. building a new sawmill or auto plant should be child’s play in comparison.

- Onshoring: ‘Onshoring’ occurs when a job that was ‘offshored’ to a lower wage country comes back to the US. This trend toward onshoring started as the cost/productivity advantages of offshoring started to decline. President Donald Trump’s trade war and more vehement public opposition to outsourcing accelerated the trend. Today, any additional disruptions to the global supply chain, like COVID-19 or shipping challenges, will only accelerate the trend further, in our view.

- Mix Shifts: The pandemic was all about goods as the service part of the economy was shut down. However, reopening could reduce demand for goods, as consumers reallocate spending more towards services underutilized during the pandemic, such as entertainment and travel. We believe this could also potentially alleviate some of the inflation pressures that have arisen as a result of constraints on supply. Recently the prices of a number of commodities (lumber, copper, agricultural products, etc.) appear to have started to cool off slightly, as an example.

- Service fees: Service wages need to increase, in our view. The government’s enhanced unemployment benefits are partly to blame but other factors also contribute. For many service workers that depend on tips, the economics of working at a restaurant or hair salon running at half capacity with limited hours is not tenable. Long-term factors like a lack of benefits and disruptions to public transportation may also be contributing factors. One solution would be to raise service worker wages and benefits funded through a mandatory service charge in lieu of tips. Such models are commonplace throughout Europe and may be ready for prime time in the US, especially as COVID-19 has highlighted the value of these professions.

Challenges to our thesis:

- Significantly higher rates and/or significantly lower US dollar: As the public worries about higher prices and inflation, the bond and currency markets have been signaling that long-term inflation is not yet a concern. A spike in long-term interest rates, currently below 3%, would be cause for concern, as would a significant and sustained drop in the value of the US dollar.

- Absence of productivity gains: The best antidote to supply-side inflation is productivity gains. Productivity gains represent the economy’s ability to produce more for the same cost. If productivity gains begin to subside, some of the ‘transitory inflation’ now being experienced may prove to be ‘structural’ and cause for additional concern.

- Poor management decision making: ‘Transitory or structural’ is the question many business executives are grappling with. If the supply shortage is viewed as transitory, brought on by pent-up demand and stimulus, then massive changes to supply chains are unnecessary. However, if the shortages are viewed as structural, i.e., a function of de-globalization and the millennials reaching their ‘prime spending’ years, then further action is required. The consequences to answering this question incorrectly could be significant. The boom-and-bust cycles of the 50s, 60s, 70s, and 80s were brought on by business leaders misinterpreting demand surges. Back then it was common for businesses to produce extra inventory, aggressively hire workers and expand their manufacturing capacity; often financed through massive amounts of debt. Inevitably, the economy would hit an obstacle deeming their demand forecasts too rosy and much of their efforts would have to be reversed: fire-selling inventory, laying off workers, and closing factories. Since much of the expansion was funded with debt, the economic consequences of misjudging demand were often total (bankruptcy). If companies were raising the risk profiles of their businesses by overspending, we believe it would be first reflected in their credit ratings. A material decline in overall credit ratings would be something that would worry us.

Conclusion:

We believe that a combination of American ingenuity and a lowering of investor expectations will prevail, and the bull market will remain intact. To get there it may take a quarter or two of lower-than-average equity returns. Our portfolios remain slightly overweight stocks relative to bonds, consistent with our positive long-term outlook.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1669154