Recent shortages are not only due to COVID-19 related lockdowns restricting supplies. In many cases, demand is also running far stronger than it did during the previous business cycle. As the following chart illustrates, retail sales spiked as the U.S. economy reopened and demand has remained elevated. At the end of August, retails sales were $67 billion or 12% higher than they would have been without the pandemic based on the previous cycle trend.

Changes in consumer preferences are further exacerbating supply chain issues. With the shift to more home schooling and working from home, spending on goods, such as laptop computers, has increased at a much faster rate than spending on services, such as dining out. In short, U.S. consumer balance sheets are so strong today that spending on goods has created demand that far outstrips the global supply chain’s capacity.

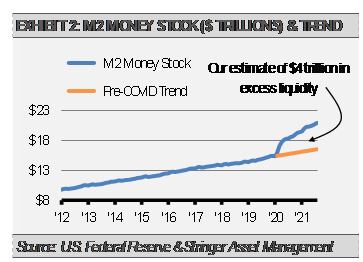

This increase in demand makes sense given how much cash and liquidity has been pushed into the economy through stimulus checks, enhanced unemployment benefits, and the child tax credit, among other things.

As we showed recently, the U.S. financial system is sitting on approximately $4 trillion in excess liquidity in the form of cash and cash equivalents due to the pandemic. That $4 trillion in excess liquidity amounts to approximately 17% of the size of the entire U.S. economy. As COVID cases subside and the economy reopens, we expect much of the excess to be invested and spent. In fact, we are already starting to see the effects of massive consumer spending.

We expect this massive amount of demand to continue into the new year. The growth rate of retail sales is stabilizing and may remain flat for some months going forward. Over the coming 6-12 months, we expect that supply chain issues should ease as business will adapt to the changing environment and consumer preferences for spending on services compared to goods returns to pre-pandemic norms.

However, we expect liquidity growth and retail sales to remain above their trend lines from the previous cycle for months to come. Combined, these factors can support both continued economic growth and persistent inflation. The results should be increased jobs creation, higher corporate revenues, and higher long-term bond yields.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.