According to Mr. Market, the “growth” company Apple reported “spectacular” results last Friday; the stock rallied to $157 from about $151. YTD in 2023, Apple stock is up 18.9% vs the S&P 500 at 7.8% and QQQs at 14.8%. Are investors and traders confused, or was this a relief rally, or possibly even a “bear” market rally? How can growth investors be excited about a 5.5% year-over-year decline and a miss on both revenues and earnings per share (EPS)? According to CNBC and Refinitive, revenues were expected to be $121.1 billion, but came in at $117.15 billion. EPS, as reported, reflected similar headwinds at $1.88 vs estimates of $1.94. See details from CNBC, and First Quarter 2023 Press Release from Apple.

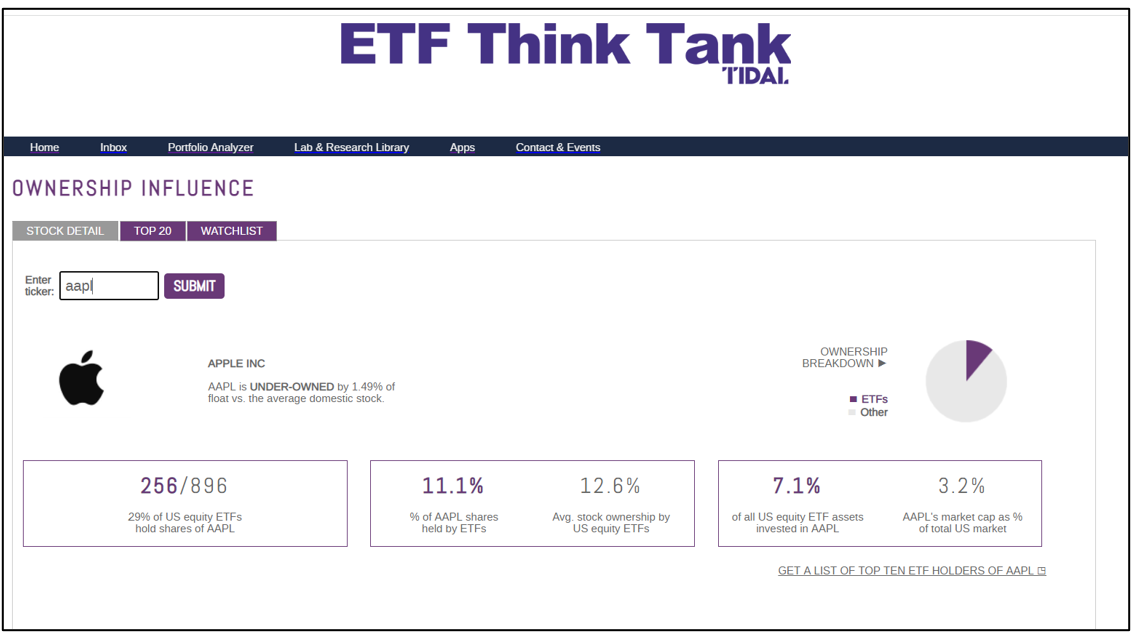

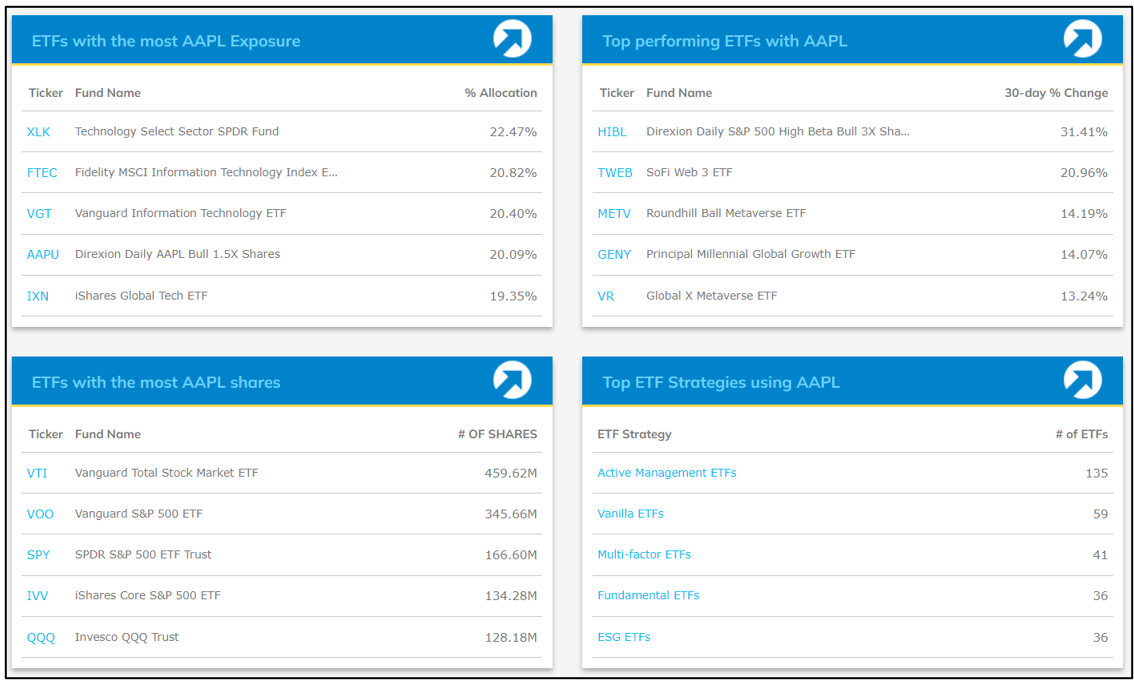

We are neither bulls nor bears in relation to Apple stock, but have recommended for years to isolate Apple stock as an individual asset category in portfolios. After all, Apple as an investment directly impacts so many theme ETFs, industry ETFs, and factors ETFs and, therefore, tends to be over-owned by investors. There are 407 ETFs that own Apple stock, according to ETF.com [1]. Classifying Apple has its challenges. According to Warren Buffet, through Berkshire Hathaway, it is even considered a consumer discretionary and moat-like business. MSCI seems to disagree with Mr. Buffett, categorizing the stock as a technology company. The Technology Select Sector SPDR (XLK) holds over a 20% weighting in the stock[1]. It is overweighted in many value ETFs, most growth ETFs, and across so many thematic ETFs – even those focused on Catholicism (CATH and PRAY). Therefore, it is no surprise that market conditions found a relief from the reported results on Friday. What is good for Apple stock is good for the overall market.

Ultimately, with a certain level of irony, every investor and portfolio manager with large-cap exposure must have a view on Apple stock. At its peak, Apple’s market cap was $3 trillion, so the decision to overweight or underweight matters arguably even more than the decision to weight energy. However, three questions remain: First, what is an investors appropriate exposure to Apple stock? Next, where does it fit in index constructions (growth vs. value)? Finally, what is an active portfolio manager expected to do when it is the largest holding in the S&P 500, at 6%?

Equity Portfolios Need a Minimum of 5% in Apple Stock to be Market Cap Weighted.

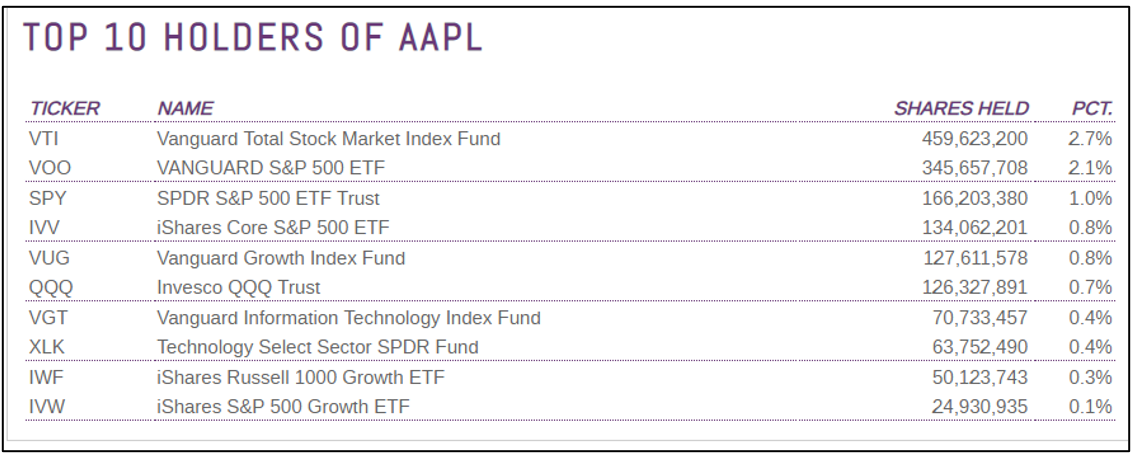

The Vanguard Total Stock Market ETF (VTI) is 5.17% weighted to Apple stock[1]. This ETF owns about $60 billion in stock or 459 million shares. Broadly speaking, ETF investors own 11.1% of Apple stock (avg stock ownership across ETFs is 12.6%), which includes the ownership by the S&P 500 which has a 6% weighting in Apple stock. Apple remains the most valuable company by market cap. It is now worth $2.45 trillion, down from a peak of about $3 trillion, and is owned by about 1/3 of all ETFs[1]. The great news is that through today’s tools, investors can drill deep, isolate their Apple exposure, and target more using different sector ETFs or even singular holding leveraged ETFs. For example, when technology ETFs like XLK and VGT are added to a portfolio, these holdings bring about a 20% weighting in Apple. Getting this trade right recently would have added short term alpha to a portfolio. Make no mistake about it – hedging Apple exposure vs taking a capital gain last year when it declined from a high of $200 per share down to $135 could have also added value. Remember, depending upon whether you have 3%-4% ,4-6% or 6-8% weighting in Apple stock, you are either underweight or overweight the stock.

Apple Stock: Growth or Value Weighting?

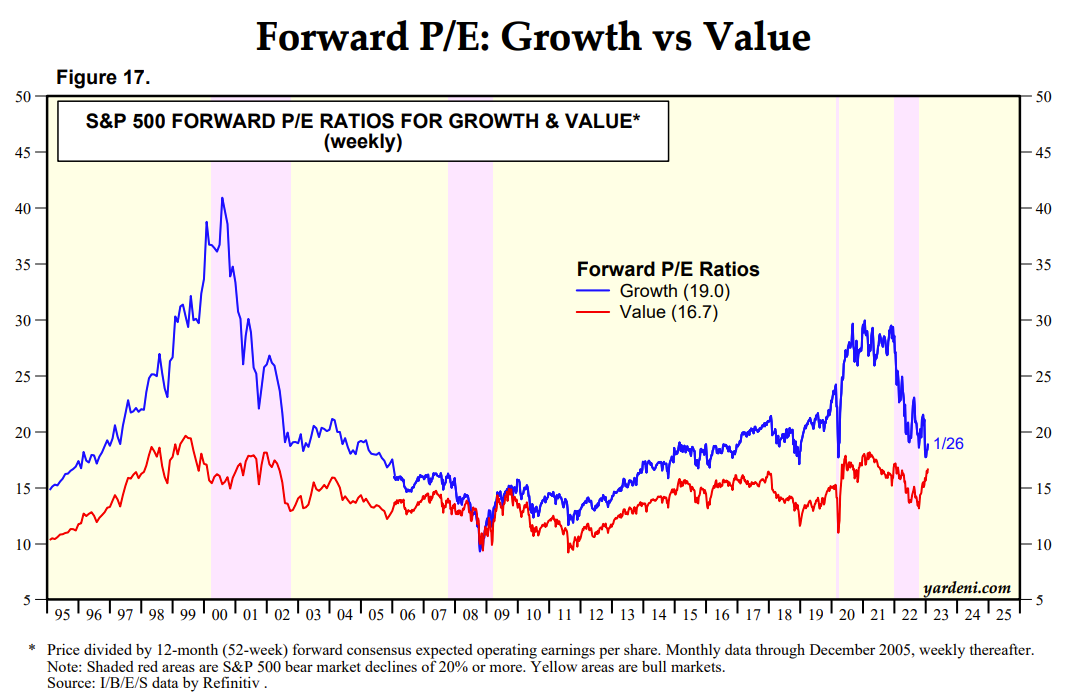

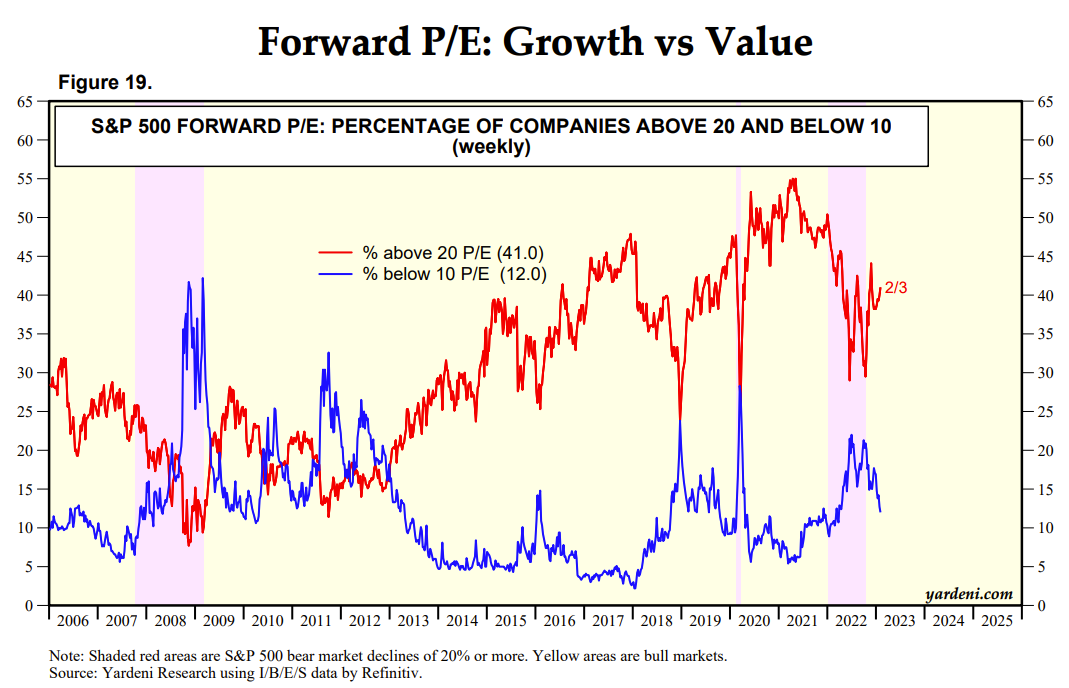

There is some debate on whether AAPL is a growth or value stock. After all, if revenues in the recent two quarters in a row went down over the previous comparable year, how does the company fit the growth factor? Portfolio managers of active strategies, of course, must make such an assessment. Passive large cap funds like VUG, IVW, IWF and SCHG hold substantial overweighted positions in Apple stock (+/- 12%), so this performance is what active portfolio managers are measured against. Of course, value investors also have reasons to love Apple stock, like a beautiful balance sheet that rivals the U.S Treasury, shrinking share count and a waterfall of free cash flow (see Apple’s form 10Q for details). Ironically, all this plays to the debate of whether value will outperform growth in 2023.

Historically, it has been wonderful when a manager or index has overweighted Apple stock, but how this exposure is managed by the investor or financial advisor is important. Apple is overweighted by large cap growth and probably underweighted by large cap value. Which, given its recent financial history, makes little sense, and its transfer to the value category may not be neat. Are there enough value managers and assets to absorb the reclassification of Apple stock from growth to value if it reports slowing growth again in April? Most large cap value ETFs are overweight energy and underweight technology, so their capacity to absorb a big slug of Apple stock simply won’t compute.

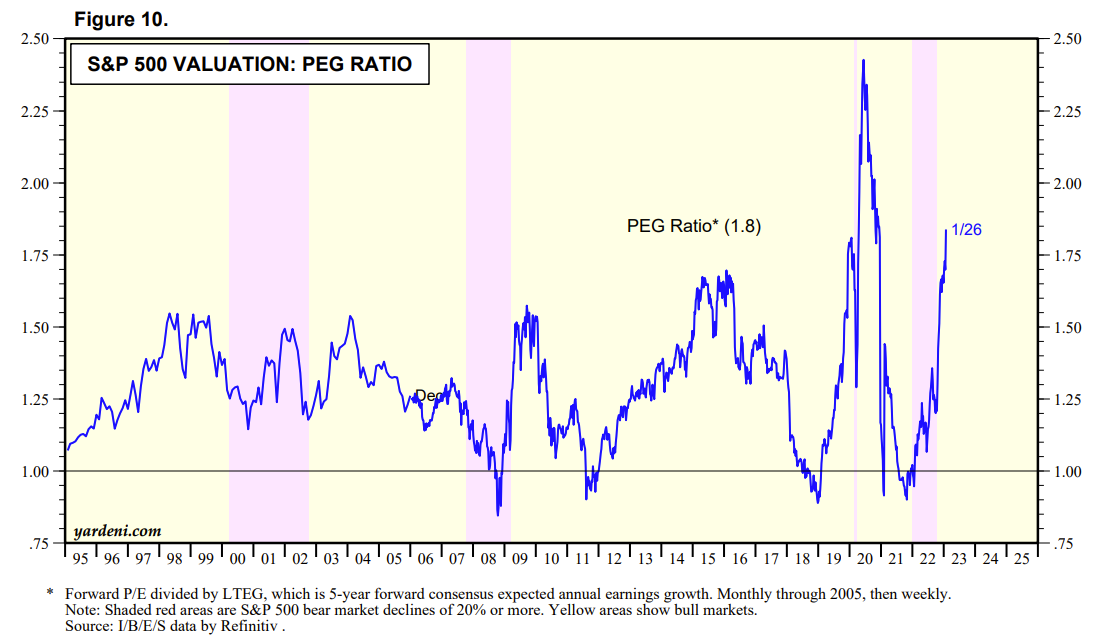

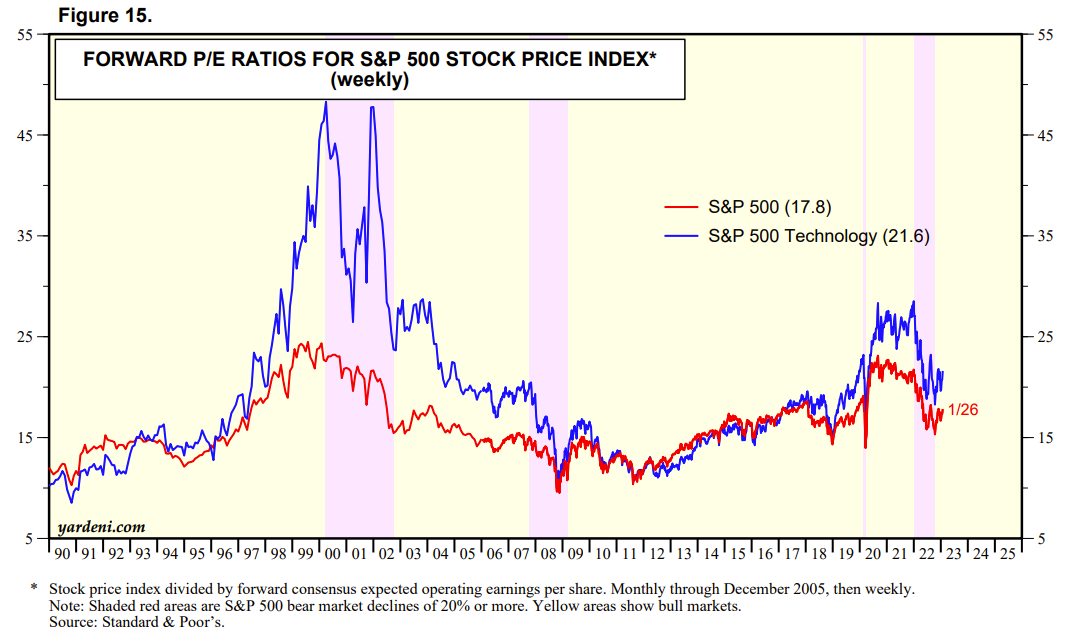

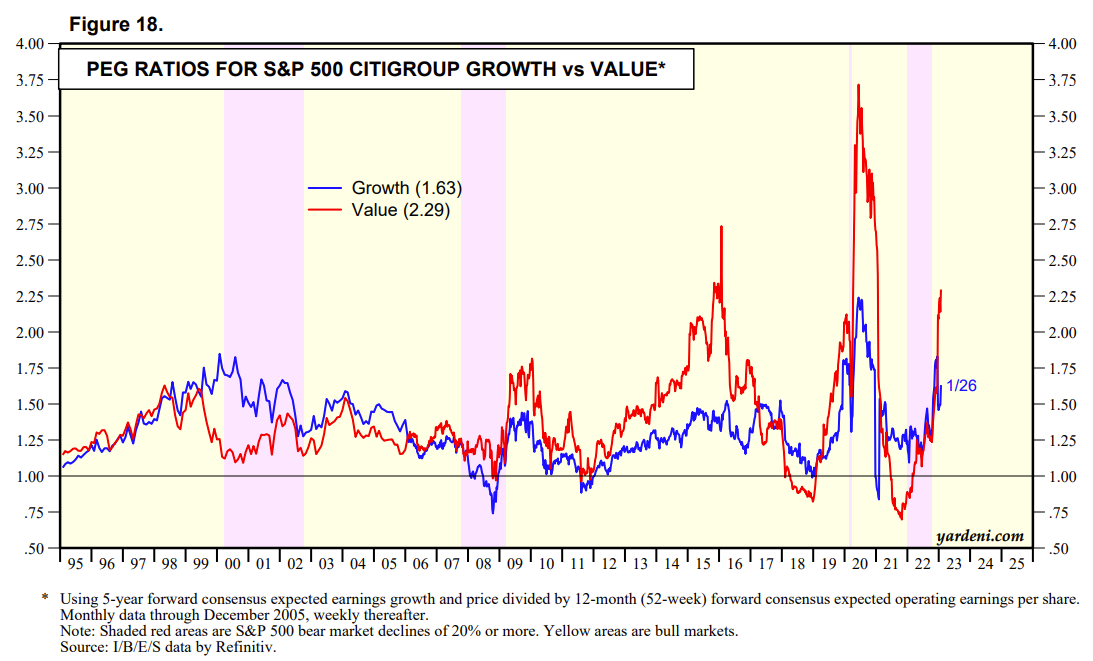

Apple is expecting to grow earnings by about 9% in 2023. Its PE multiple at 24x is a premium PEG ratio over most growth stocks and higher than that of the S&P 500. Yardeni Research provides some wonderful charts that illustrate the comparison between large cap PEG ratio, value stocks, and growth stocks (See Yardeni Research for details). These charts do not target Apple specifically, but it is clear that Apple’s categorization as a technology company and growth company would skew the data. Investors, buyers, and owners are giving Apple a pass as a growth company, but will this be the case indefinitely? Law of large numbers and the need for globalization makes for a stock that could mess a lot of investors up if they are not properly allocated towards the risk of a mischaracterization of this investment opportunity. What’s your position on Apple?

[1] As February 6, 2023

For more news, information, and analysis, visit the ETF Strategist Channel.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).