We think the recent strength in the economy and labor market, coupled with persistent inflation, will push the U.S. Federal Reserve (Fed) to end its bond purchases and begin to hike short-term interest rates sooner than previously expected.

In a positive sign for labor shortages, the labor force grew by a huge 594,000 workers in November. The average increase in the labor force over the last 12 months was 126,000 workers per month and 186,000 workers per month over the last six months. Despite the jump in the size of the labor force, the unemployment rate declined 0.4% to 4.2% in November. This drop is the result of the large increase in the labor force being offset by the 1.1 million new jobs reflected in the November household survey.

As exhibit 1 illustrates, the unemployment rate has fallen at a significantly faster pace than during the previous business cycle. If the current pace of decline in the unemployment rate continues, we will likely be below the previous cycle low of 3.5% in February or March of 2022.

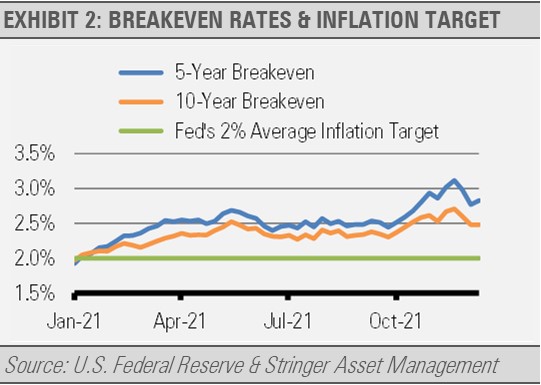

Our work also suggests that while the rate of inflation will ease, it will likely remain above the Fed’s average inflation target of 2% for years to come. Due to a combination of COVID related price declines, such as in energy, as well as the Fed’s renewed focus on inflation, market-based inflation expectations have declined to still elevated levels of 2.84% on average over the coming 5 years and 2.47% on average over the next 10 years. Again, these levels are well above the Fed’s 2% target and higher than rates experienced during the previous business cycle (exhibit 2).

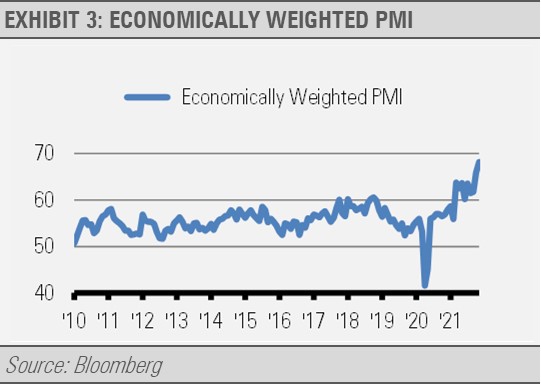

With a strong labor market and persistently high inflation, the Fed should be motivated to curtail its bond purchases and raise interest rates faster than expected. Still, we think the current economic momentum is strong enough to absorb these changes in stride. For example, the Institute for Supply Management (ISM) Manufacturing and Service Sector Purchasing Manager Indices (PMIs) remain elevated (exhibit 3). In fact, the November Service Sector PMI made a new all-time high by rising above the October level, which was already a record as demand for services remains strong.

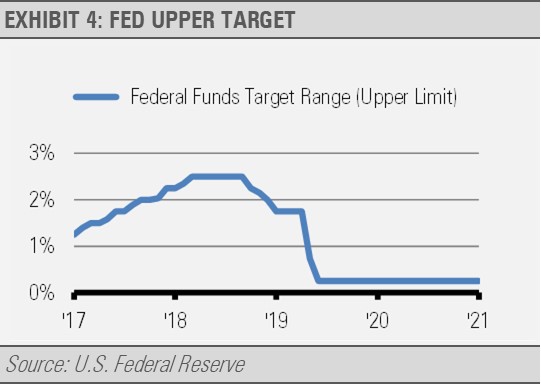

We expect the 10-year rate to increase by roughly 1% from here due to persistent inflation and continued economic growth. Meanwhile, short-term interest rates will likely rise to more than 2% over a series of interest rate moves as the Fed shifts from a focus on supporting economic growth and jobs creation to taming inflation over the coming two or three years.

Similar to the pattern we saw in the previous business cycle (exhibit 4), we expect the Fed to incrementally raise short-term interest rates over a number of meetings. One key difference with the pending rate increase cycle is the stronger inflationary pressure this time around. This inflation may cause the Fed to move at a somewhat faster pace than the previous cycle.

While we think that economic momentum is strong enough to absorb a change in Fed policy, some areas of the market will likely be more vulnerable than others. For example, equity markets tend to shutter with an initial Fed rate hike.

Though the volatility may pass quickly, tighter monetary policy poses a threat to areas of the market with stretched valuations or that are more economically sensitive. This is where active and tactical management can help navigate such a changing environment. To manage these risks, we favor specific sectors, such as financials, health care, and information technology.

Higher short-term interest rates would hurt prices of fixed coupon short-duration bonds. Long-duration bonds may also come under pressure as inflation and economic growth persist. As a result, we favor floating rate alternative fixed income holdings as well as high quality intermediate duration bonds.

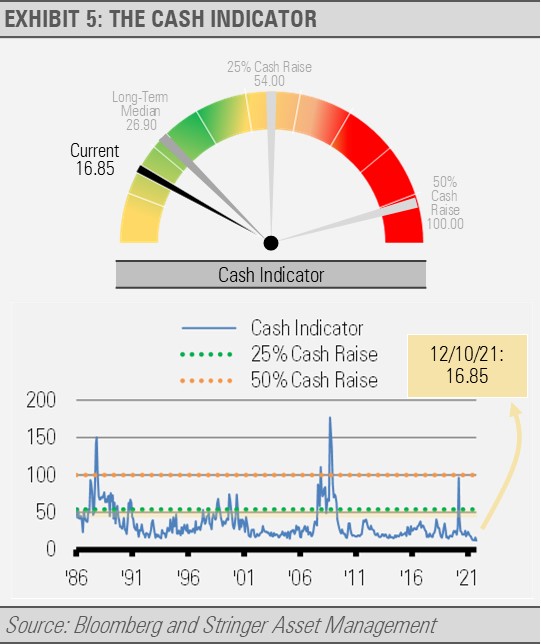

THE CASH INDICATOR

Recent volatility has shifted the Cash Indicator (CI) around the low end of its normal range. The recent low levels have suggested some complacency in markets which tends to lead to increased volatility. As expected, the forces of reversion to the mean kicked in and volatility began to increase but only into a more normalized range. Overall, we remain fully invested and we are seeing tactical opportunities to both manage risk and take advantage of potential for gains.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.