By Jonathan Bernstein, Vice President, Sales & Marketing Director, Stringer Asset Management

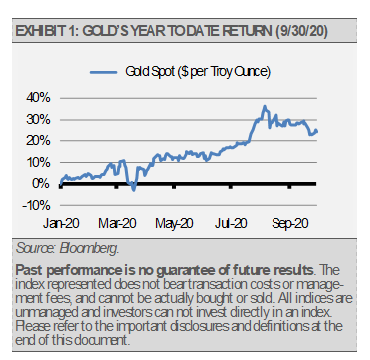

We believe planning should be the baseline for measuring investment success. If you have an investment plan that has you on course, that’s worth its weight in gold. Therefore, investors may want to think twice before abandoning their plan and switching everything to an asset like gold that has appreciated more than 24% this year through September.

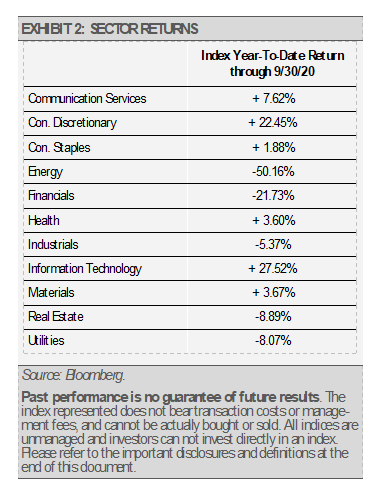

Of course, we are being facetious but the fear of missing out (“FOMO”) and the associated performance chasing is no joking matter. In fact, it’s a behavioral trap that has plagued investors throughout history. This year has been especially treacherous as the market decline and rebound happened so quickly. What is even more interesting is the extremely narrow way some of the broad indices have recovered. So far, growth sectors have far outpaced many of the more defensive areas of the market. This creates an interesting behavioral challenge to overcome but there are steps investors can take as either an advisor working with clients or an individual investor going it alone.

First, don’t chase recent performance, which is akin to selling low and buying high. It’s easy to get distracted by the siren song of outsized returns when looking at index performance. For example, the S&P 500 Index is capitalization weighted, which means that companies with larger market capitalizations make up a larger percentage of the Index. The recent performance of the S&P 500 Index has been led primarily by the technology sector, which has caused the Index to become very top-heavy and perhaps paints a rosier picture of this market recovery, especially for those investors less inclined to roll up their sleeves to take a look under the hood.

This can also be true with active managers that may have narrower mandates that require them to allocate more in areas that have already appreciated and now potentially represent a higher risk. These managers may also be forced to allocate less to areas that represent excellent values due to their constraints.

If you are allocated and diversified properly, it’s likely you will find that you are already positioned to participate in what has done well and to take advantage of those areas that are poised to catch up as the economy recovers.

Additionally, if there is a theme or idea that you are truly passionate about, and your due diligence supports that idea, a tactical portion of the portfolio can give you some flexibility while maintaining the overall allocation.

Secondly, investors should review their plan to ensure that their current situation and goals are still consistent with what they were when the plan was created. Oftentimes, extreme market volatility like we just experienced can distract us from our long-term goals. It never hurts to review your risk tolerance to make sure that your attitudes about risk have not changed significantly.

Thirdly, it’s important to acknowledge that hindsight is often 20/20. Keep in mind that even the most diligent investor cannot be prepared for every eventuality. We have just experienced one of the fastest downturns in market history. The uncertainty around a global pandemic coupled with political and social unrest undulated across the globe and roiled economies and markets. Once the seriousness of the pandemic was reported, it only took about a month to hit the March 23rd bottom. Reviews are important, but make sure you are doing it in the context of your long-term plan and asset allocation and not based on recent market outcomes.

Lastly, we cannot forget about reversion to the mean. There are certainly long-term relationships and dispersions in this market between large cap and small cap stocks, growth and value, domestic and foreign, and even yield spreads. In cases of mean reversion, as the economy normalizes, those relationships tend to as well. Price discrepancies that stray far from the long-term trend should revert to their more normalized levels as those relative correct themselves. This can be a great way to find value when market recoveries mature into broad economic recoveries.

In conclusion, investing can be fraught with behavioral challenges. It is not a natural tendency to be fearful when others are greedy and greedy when others are fearful as Warren Buffett suggests. Doing so can require a remarkable level of discipline with an institutional time horizon as well as the ability to take on higher levels of risk. The average investor saving up for retirement is more focused on portfolio optimization whereby they seek a more predictable level of return for a given level of risk. With this approach, asset allocation forms the foundation for sound portfolio construction and is designed to narrow the range of returns. Regardless of your approach, it’s always beneficial to take a step back and review your plan, your asset allocation, and your risk tolerance. We think it is prudent to be introspective and acknowledge that even the most disciplined investors are susceptible to behavioral errors when their emotions enter into the investment equation. The path to your financial goals becomes clearer and more easily navigated when your investment approach is aligned with your expectations.

Originally published by Stringer Asset Management

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.

Index Definitions:

The Gold Spot is quoted as U.S. dollars per troy ounce and is designed to measure the price of gold. The S&P 500 Index is a capitalization-weighted index of 500 stocks. The Index is designed to measure performance of a broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The S&P 500 Consumer Discretionary Index is capitalization-weighted and is designed to measure the consumer discretionary sector of the S&P 500 Index. The S&P 500 Consumer Staples Index is capitalization-weighted and is designed to measure the consumer staples sector of the S&P 500 Index. The S&P 500 Energy Index is capitalization-weighted and is designed to measure the energy sector of the S&P 500 Index. The S&P 500 Financials Index is capitalization-weighted and is designed to measure the financial sector of the S&P 500 Index. The S&P 500 Health Care Index is capitalization-weighted and is designed to measure the health care sector of the S&P 500 Index. The S&P 500 Industrials Index is capitalization-weighted and is designed to measure the industrial sector of the S&P 500 Index. The S&P 500 Information Technology Index is capitalization-weighted and is designed to measure the information technology sector of the S&P 500 Index. The S&P 500 Materials Index is capitalization-weighted and is designed to measure the materials sector of the S&P 500 Index. The S&P 500 Real Estate Index is capitalization-weighted and is designed to measure the real estate sector of the S&P 500 Index. The S&P 500 Telecommunication Services Index is capitalization-weighted and is designed to measure the telecommunication services sector of the S&P 500 Index. The S&P 500 Utilities Index is capitalization-weighted and is designed to measure the utilities sector of the S&P 500 Index.