Despite Volatility, Markets Post Gains in Q1

Despite bank failures and uncertainty regarding monetary policy and interest rates, equities posted gains in Q1 as the Nasdaq 100 Index was up nearly 17%, notching its best quarter since the second quarter of 2020. US growth stocks were among the best performers (+9.6%), followed by international developed equities (+8.5%) and US large-caps (+7.5%). Bonds also fared well as investment grade corporates rose 4.7%, 7-10 year US Treasuries increased 3.9%, and high yield credits gained 3.7%. Commodities produced mixed returns as both gold and silver were up (+8.0% and +0.5%, respectively), while broad-based commodities and crude oil fell (-5.9% and -5.2%, respectively).

Banking Crisis and the Fed’s Response

As banks typically lend long and borrow short, they acquired vast amounts of bonds back when interest rates were pegged near zero. Given the Federal Reserve has hiked rates by nearly 500 bps over the past year, these securities have significantly declined in value given their interest rate risk, and the overall banking system is sitting on nearly $620 billion of unrealized losses. Many clients in both Silicon Valley Bank and Signature Bank had deposits well above the $250,000 insured by the FDIC, and vast amounts of customers simultaneously attempted to withdraw their funds. The banks’ investments were then sold to meet these unexpected liquidity needs, ultimately causing the losses to be realized and the banks to fail. Investors feared the same might happen to other banks, and in response, the Fed created the Bank Term Funding Program, which provides additional funds to meet deposit needs. This program allowed the Fed to go through with the 25 bps rate hike at the March FOMC meeting amid heightened inflation data. The Committee feels the “U.S. banking system is sound and resilient,” and that the recent bank failures will result in “tighter credit conditions” that will likely slow the economy.

Services Inflation Continues its Rise

Though headline CPI continued its decline in February, inflation is still elevated at an annualized rate of 6%. When looking at the underlying components, both energy and core goods prices have cooled, but food prices remain stubborn. Moreover, core services prices have accelerated and make up more than half of headline CPI alone.

Will CRE be the Next Shoe to Drop?

Post-pandemic, commercial real estate (CRE) demand has decreased as work from home has gained popularity and property valuations have lowered. Moreover, vast amounts of existing CRE loans were financed when rates were near zero, and $2.5 trillion of these loans are maturing over the next 5 years. These will have to be refinanced in an environment of substantially higher rates and tighter lending standards, potentially leading to defaults and losses to banks. Given approximately 70% of total CRE loan exposure is held by small to mid-sized banks, could potential losses they absorb pose a larger threat to the economy?

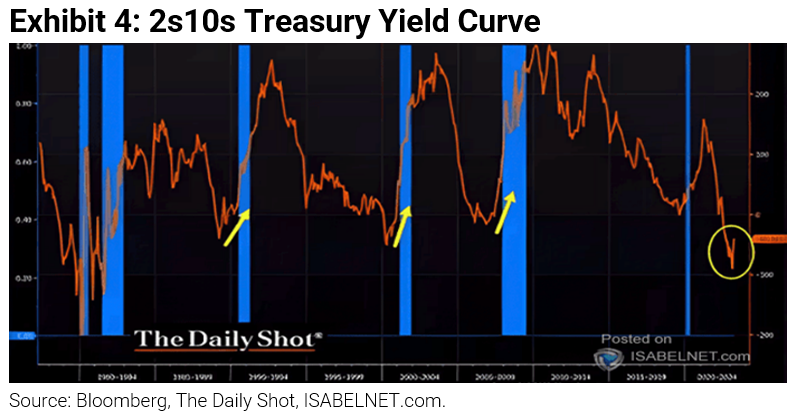

Re-Steepening Signals Recession is Close

Rate volatility has recently hit levels last seen in 2008 and the 2-year US Treasury yield has fallen sharply, causing the 2s10s Treasury yield curve to re-steepen from its trough. Such a move in yields has historically occurred just before economic slowdowns. Does this suggest the US is closer to the pending recession?

Embrace Quality When Earnings Decline

Across the 6 earnings downturns that have occurred since 1985, companies with higher profitability, strong earnings growth, attractive interest coverage ratios, and above-average free cash flows have historically outperformed. As next twelve months earnings estimates for the S&P 500 have turned negative, these metrics and factors suggest now may be an appropriate time to increase exposure to high quality stocks.

Stay Defensive. Bull Markets Don’t Start with the S&P 500 Trading at 18x Earnings

Investors may want to fade this rally. Why? 1) Q1 was more liquidity driven as opposed to fundamental. 2) China’s reopening released trillions of dollars in pent-up demand into the economy. 3) Mean reversion was heavy at play as 2022’s biggest losers were up the most in 2023. 4) Japan’s yield curve control also led to additional liquidity. 5) Market breadth was poor as only a handful of stocks drove the S&P 500’s return in Q1. 6) Given many indicators remain in contractionary territory and forecasts for the upcoming earnings season are weak, it’s hard to get excited about buying the S&P at 18x earnings. We plan to stay defensively positioned. Once the yield curve un-inverts further and leading indicators inflect higher, we’d aim to re-risk towards higher beta/risk factors. We’re still in a bear market, and bull markets don’t start with the S&P trading at such expensive valuations.

For more news, information, and analysis, visit the ETF Strategist Channel.

Warranties & Disclaimers

As of the time of this publication, Astoria Portfolio Advisors held positions in IEMG, IVE, SPMD, SPY, SPSM, IVW, IEFA, MUB, TIP, AGG, IEF, HYG, LQD, BCI, GLD, USO, and SLV on behalf of its clients. There are no warranties implied. Past performance is not indicative of future results. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. The returns in this report are based on data from frequently used indices and ETFs. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data, and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to the accuracy, completeness, or reliability of such information. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements.