- Investors’ love affair with past winners is insatiable. The ‘conventional wisdom’ on Wall Street is that IPOs, Private Equity, SPACs, and Large-Cap Growth stocks will continue to be the ‘big winners’ in the post pandemic environment. Unfortunately, yesterday’s darlings almost never outperform in the future with the same risk-adjusted returns per unit of liquidity risk (this is important) as they did in the past. Paradigm shifts typically happen slowly and quietly with most investors realizing after the fact.

- Many firms put out their 2021 outlook reports but very few of them are actionable. We wish they would attach a link to their prior year forecasts so we can judge how well they did. The goal of this piece is to not only provide unique thought leadership, but to provide investors with actionable investment ideas. Here is our 10 ETFs for 2020 (click here) so you can evaluate our calls.

Exhibit 1. Astoria’s 10 ETF Themes for 2021

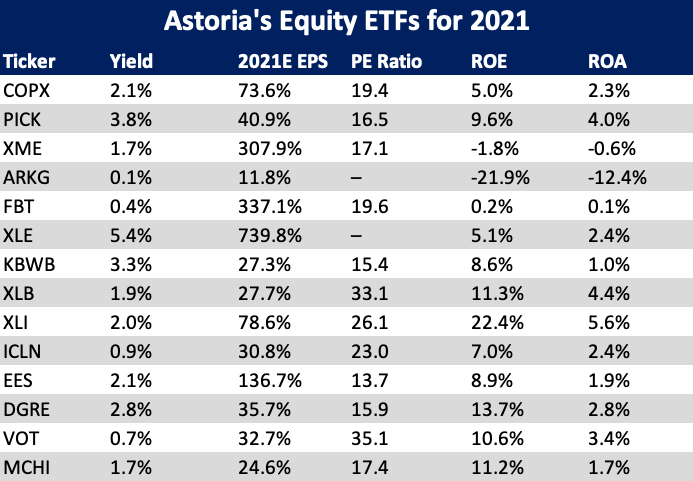

Source for 10 ETF Themes for 2021 is Astoria Portfolio Advisors. Segment data retrieved from ETFAction.com on December 14, 2020.

- We have had gold and gold miners in our Core ETF Portfolios in the prior 2 years which worked well. We still hold both forms of gold but acknowledge that on a return per unit of risk basis, they are not as attractive as commodity equities. In the early 2000’s, commodities were all the rage. At one point, Petrobras and Exxon Mobil were amongst the top stocks in the MSCI indices. Nowadays, it feels like nobody wants to hold commodity equites within reach of a 10-foot pole. Based on our experience, that is usually when you want to buy an asset. We are using commodity equities in our newly developed Inflation Sensitive Thematic Portfolio.

#2. HealthCare: FBT (First Trust NYSE Arca Biotechnology Index Fund) and ARKG (ARK Genomic Revolution ETF)

- We are in the middle of the worst healthcare crisis in the past 100 years. There is a huge bull market in the healthcare industry which is hard to ignore. A successful vaccine is likely the only way that life normalizes. Per ETFAction.com, FBT trades with a 19 PE ratio and its 2021 earnings growth estimate is 337%. 36% of the ETF is geared towards Mid-Cap stocks which fits our preference to move down the market cap range in 2021. ARKG is focused on genomic sequencing, stem cell research, agricultural biology, and molecular diagnostics. We view ARKG as a complete lotto ticket with very idiosyncratic risks. Hence, we have sized it accordingly in our Disruptive Growth Thematic Portfolio.

#3. Cyclical Growth: XLE (Energy Select Sector SPDR Fund), KBWB (Invesco KBW Bank ETF), XLB (Materials Select Sector SPDR Fund), and XLI (Industrial Select Sector SPDR Fund)

- Right now, the retail traders are out with vengeance cobbling up disruptive growth ETFs. We own some of those ETFs in our Disruptive Growth Thematic Portfolio in which we are mandated to have these exposures. However, in the portfolios where we have flexibility, we believe Cyclical Growth is the sweet spot. If you think that the entire global economy is going to suddenly drive electric cars, use PayPal and Venmo, think again. The energy and banking system represent too much of the global economy. Be careful what you wish for. Meanwhile, there is a lot of historical data showing that Cyclicals have done relatively well coming out of a recession when the economy hits full stride. This is not necessarily a long-term trade, but an attractive tactical opportunity over the next 12-18 months. We like XLE, KBWB, XLB, and XLI to play a cyclical upswing in the US economy.

#4. Clean Energy: ICLN (iShares Global Clean Energy ETF)

- Every new US President has a few of their ‘wish list’ polices implemented. Is a divided Congress going to block a Clean Energy deal? Who knows, but we do think there is enough of a margin of safety in this area? ICLN trades with a 23 PE ratio versus 26 for SPY. The 2021 earnings growth estimate for ICLN is 31% versus 22% for SPY.

#5. Higher Quality US Small-Caps: EES (WisdomTree U.S. Small-Cap Fund)

- We added EES to our Core ETF Portfolios in July. We went on CNBC in June and argued there was a cyclical upswing to the US economy and investors should rotate into Value, Cyclicals, and US Small-Caps (click here). At first, we wanted to dip our toes into EES which has a quality filter and then weights the companies in the index by their earnings. Perhaps we need to be more aggressive with our Small-Cap position.

#6. Higher Quality EM Equities: DGRE (WisdomTree Emerging Markets Quality Dividend Growth Fund)

- A weaker dollar + a Fed that is on hold + investors starving for yield + a valuation that provides a margin of safety = a nice backdrop for Emerging Markets stocks. We remain overweight Emerging Market equities via DGRE in our Core ETF Portfolios and are using MCHI as a satellite overweight. DGRE trades 3 valuation turns cheaper than EEM. Moreover, it has 200bps more exposure to Technology and 500bps less exposure to Financials compared to EEM (both of which fit our preference). Lastly, DGRE has a higher ROE and ROA (by design) than EEM. We do love quality at Astoria Portfolio Advisors.

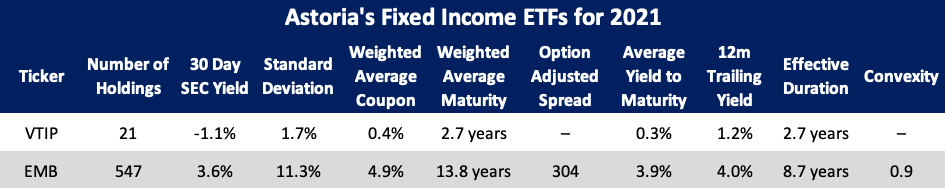

#7. Treasury Inflation Protected Securities: VTIP (Vanguard Short-Term Inflation-Protected Securities ETF)

- The amount of M1 money is skyrocketing and we believe there could be a moderate surge in inflation (3% to 3.5%) in 2021. We added VTIP to hedge potential inflation risks back in April. We remain underweight Fixed Income across our Core ETF

#8. Mid-Cap Growth: VOT (Vanguard Mid-Cap Growth ETF)

- We added VOT to our Core ETF Portfolios earlier this year as we were underweight Growth but did not want to pay up for Large-Cap Growth stocks. The largest stock weights in VOT are approximately 1.5%, so we felt that the risks were balanced relative to their current multiples. Eventually many of these Mid-Cap Growth stocks become Large-Cap Growth stocks.

#9. China: MCHI (iShares MSCI China ETF)

- China remains one of our strategic overweights in our Core ETF Portfolios. This year was a perfect example of the value of having China in a portfolio. We are in the middle of one of the worst recessions in history and China operated as though it had not missed a beat. As of Friday, Dec 11th, MCHI outperformed SPY by nearly 10%. China can stimulate their economy like no other country in the world. They have their own monetary and fiscal systems and are not as reliant on the Western economy as they used to be.

#10. Emerging Market Debt: EMB (iShares JP Morgan USD Emerging Markets Bond ETF)

- The world’s demand for yield is not going to go away anytime soon. While we only own EMB in our Enhanced Income Portfolio where we are mandated to go out the duration curve and take more credit risk, we still think EMB is worthy to be on our list. EMB tracks an index of US-dollar-denominated sovereign debt issued by Emerging Market countries with more than $1B outstanding and at least two years remaining in maturity. EMB yields 4% has a correlation of 41 to the AGG ETF. If our view that Emerging Markets will benefit from an attractive macro backdrop, EMB should benefit.

Exhibit 2. Valuation Data for Astoria’s Equity ETFs for 2021

Exhibit 3. Characteristics for Astoria’s Fixed Income ETFs for 2021

Table Source: Astoria Portfolio Advisors. Data for VTIP retrieved from Vanguard.com on December 14, 2020. Data for EMB retrieved from iShares.com on December 14, 2020.

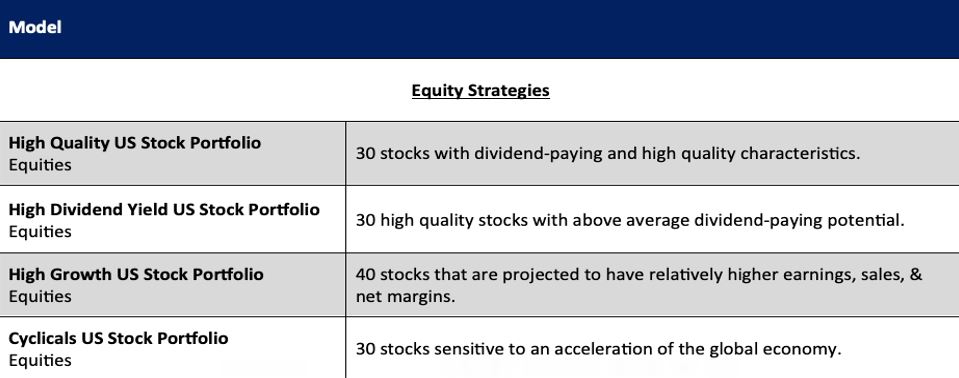

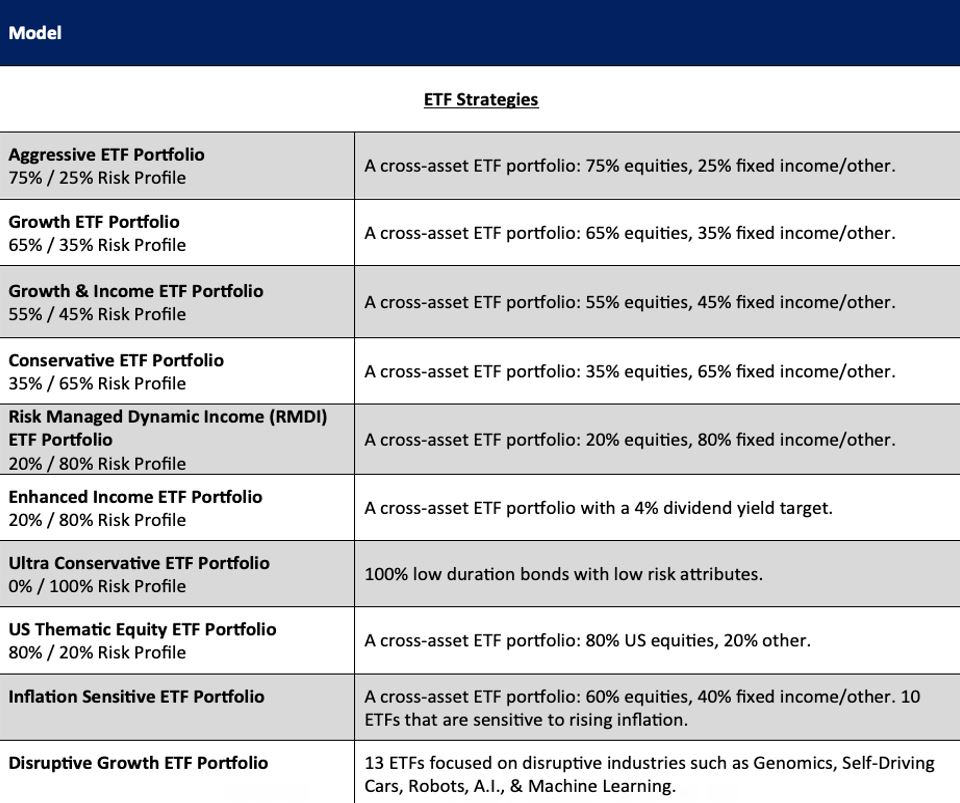

Below is a list of the ETF and Thematic Stock Portfolios that Astoria offers.

Table Source: Astoria Portfolio Advisors. Note that Astoria offers ESG equivalents of our Core ETF Portfolios.

Best,

Astoria Portfolio Advisors

- Background information: Astoria’s CIO has been producing a dedicated Year Ahead ETF outlook for close to a decade. We like that our peers are starting to throw their hat into the ring. We try not to repeat our ETFs from one year to the next as our goal is to communicate unique and actionable thematic ideas for the investment community. If VTI, IEFA, and SPAB were on our top 10 list every year, then it wouldn’t be an interesting report to read, right? Also, we own each of these ETFs in this report in one shape or form. Why would we highlight an ETF in our report that we thought offered value and did not own for our investors?

- Disclaimer: Astoria runs various ETF managed portfolios with different risk tolerance bands and with different holdings. The commentary in this report is generally centered around our Dynamic ETF Portfolios. Our Strategic ETF Portfolios will vary from the holdings noted in this report.

- The ETFs highlighted in this report are solutions that Astoria finds attractive on a per unit of risk basis. However, this list is not meant to be an asset allocation strategy, a trading idea, or an ETF managed portfolio. As such, this list does not constitute a recommendation of any ETF. There are other ETFs that Astoria currently owns which are not highlighted in this report. Contact us for a list of all of Astoria’s ETF holdings.

- Any ETF holdings discussed are for illustrative purposes only and are subject to change at any time. Readers are welcomed to follow Astoria’s research, blogs, and social media updates to see how our portfolios may shift throughout the year. Refer to astoriaadvisors.com or @AstoriaAdvisors on Twitter.

- Past performance is not indicative of future results. Investors should understand that Astoria’s 10 ETF Themes for 2021 is not indicative of how Astoria manages money or risk for its investors. Note that Astoria shifts portfolios depending on market conditions, risk tolerance bands, and risk budgeting. As of the time this article was written, Astoria held positions in each of the ETFs in our 2021 outlook report.

For full disclosure, please refer to our website: https://www.astoriaadvisors.com/disclaimer