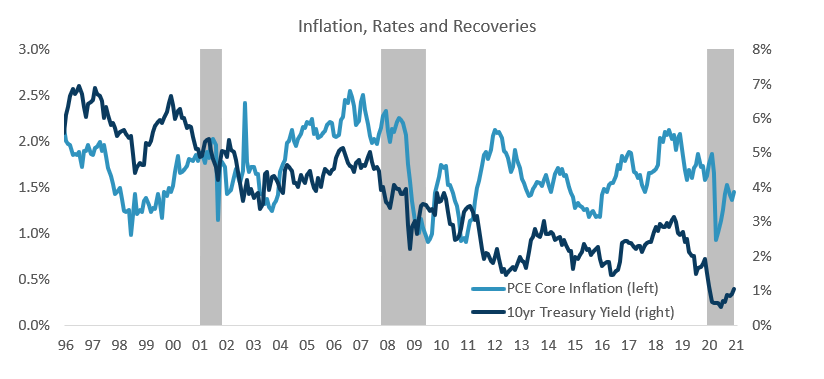

Inflation is a bond investor’s worst enemy. Higher costs erode the purchasing power of a bond’s future cash flows, which pushes bond yields higher as investors demand more yield to compensate for inflation risk. The following chart illustrates how inflation growth and bond yields move together. Inflation typically declines during recessions (shaded in grey).

Where is inflation now? Inflation naturally trends higher coming out of a recession, which is where we are now, as the demand for goods and services recovers and confidence builds. First comes inflation expectations, but actual inflation is slower to follow. As shown in the chart below, Treasury-inflation protected securities (TIPS) are Treasury bonds where the principal value is tied to inflation movement, so TIPS valuations are an excellent proxy of where investors see inflation going.

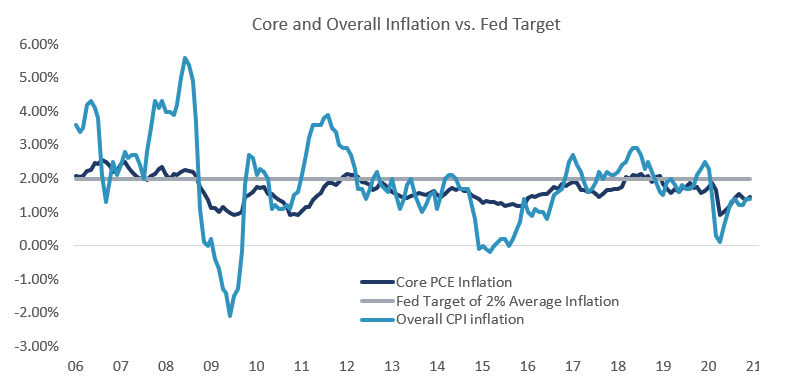

There are multiple ways to measure inflation, but core inflation is what the Federal Reserve watches closely. Core inflation excludes the food and energy sectors, which tend to be volatile. Recently the Fed shifted its inflation target to an average inflation target of 2%, meaning they will allow inflation to run above 2% to make up for periods where inflation is below 2%.

The good news for bond investors is that while both rates and inflation are likely to move higher as the economy recovers, it will take time. In fact, if inflation were at 2.5% every month going forward, it would take until March 2022 for average inflation to reach 2.0%.

All this suggests investors should position for rising inflation but not runaway inflation or an aggressive response from the Fed. This includes staying modestly short duration, underweight Treasuries, and an overweight to spread sectors (e.g., MBS and credit) and assets that do well in a rising inflation environment, such as TIPS.

Originally published by Sage Advisory, 2/23/21

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.