Written by: Matthew J. Krajna, CFA

The state of the housing market nationwide can be best described as nothing short of robust. Demand remains intense, and supply remains, well, in short supply. According to the National Association of Homebuilders (NAHB), homebuilder sentiment hit 83 in May, remaining elevated at above-average levels. Each of the past nine months has shown readings above 80, after hitting a record high of 90 back in November. Traffic also remains robust, with the Traffic sub-index hitting 73, also remaining elevated, with eight of the past nine months posting readings above 70. Readings above 50 signal builders view conditions as favorable. Average monthly inventory stands at 2.4 months’ worth of supply according to the National Association of Realtors, not far off of the record low of 1.9 months hit in December, down from 4.2 months in March 2020. These dynamics have led to higher prices, with existing home sales rising +19.1% year over year in April, with an average selling price of $341,600. Homes are selling at a break-neck pace, with the typical home sold last month spending barely 17 days on the market.

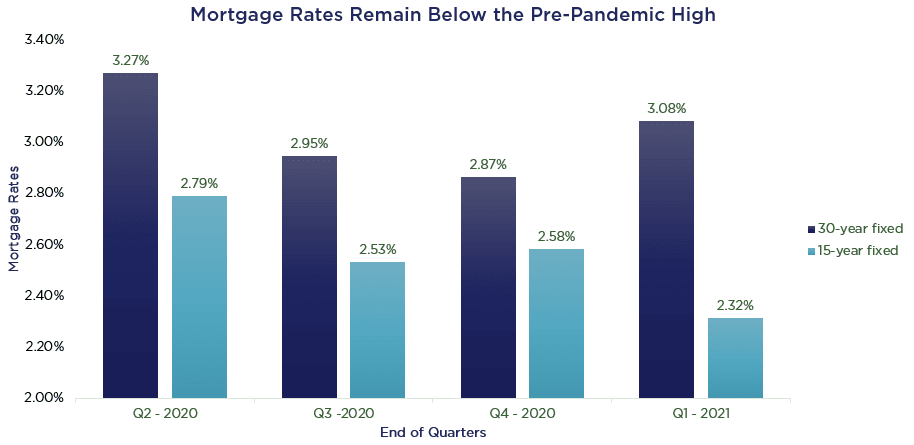

Stimulus checks and pent-up savings continue to bode well for the entire housing-related supply chain as homeowners continue to reinvest in their homes, both with added savings and stimulus, as well as for prospects of higher home values. Positive dynamics stem from more than just supply and demand imbalances. Low-interest rates should continue to persist for some time, even if they creep up slightly. According to Freddie Mac, the latest 30-year fixed-rate mortgage rate of 3.0% remained below the pre-pandemic high of 3.72% on January 2, 2020. Even if rates were to rise 0.75%, they would be just getting back to their pre-COVID highs.

Source: Nerdwallet, https://www.nerdwallet.com/blog/mortgages/current-interest-rates/; Data shown from 06/2020 to 03/2021

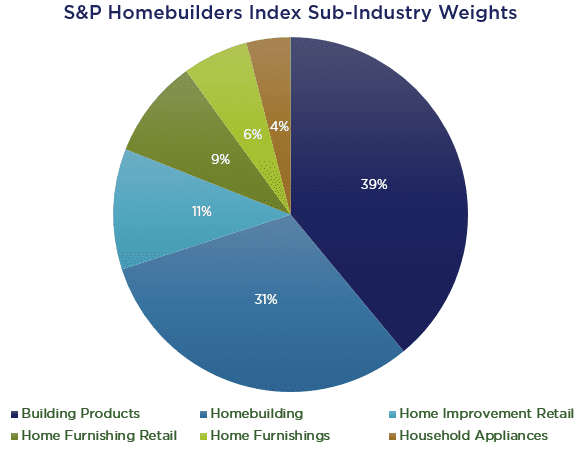

A broad measure of housing, the S&P Homebuilders Select Industry Index has been a strong performer year to date, handily outpacing the S&P 500. As of May 19. 2021, the S&P Homebuilders Select Industry Index ETF had returned +26.22% versus +10.25% for the S&P 500 ETF. Strength in the Homebuilder Index has been broad-based, coming from all sub-industry groups.

Source: SSGA, Nottingham Advisors, May 19, 2021

With quarterly earnings season nearing a close, we’ve effectively heard from the entire supply chain within the Homebuilding ecosystem. Demand remains robust for inputs (i.e. home furnishings, appliances, materials, etc.) and outputs (i.e. new homes). Inflationary pressures are generally being passed along to consumers, through higher prices and smaller square footage of new homes. Many companies are expecting margin expansion this year due to strong demand, lesser COVID related costs, and operating leverage. As such, we’ve seen a significant amount of index constituents increase their revenue and earnings per share (EPS) guidance for 2021, which continues to bode well for the entire homebuilding related category. Couple this with relatively attractive valuations and strong secular tailwinds, and homebuilding remains a favorable tactical exposure in client portfolios, not to mention a potential inflation hedge moving forward.

Source: Nottingham Advisors, Bloomberg, SSGA. S&P 500 ETF (ticker: SPY) and Homebuilders Select Industry ETF (ticker: XHB).

This information is included for informational purposes only and does not reflect past recommendations by Nottingham or actual trading in any individual clients’ accounts. Nottingham makes no representation as to whether investment in any security or strategy mentioned herein was profitable or would have been profitable for any person in the past.

This blog does not constitute current recommendations by Nottingham for any individual client or prospective client to buy or sell any security or engage in a particular investment strategy and Nottingham makes no representation as to whether investment in any security or strategy mentioned herein will prove profitable in the future.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Nothing in this piece should be interpreted as personalized investment advice.