How the Ukrainian Invasion Has Changed RiverFront’s Portfolio Positioning

The situation on the ground in Ukraine has taken numerous turns – some shocking, some inspirational – in the scant time since Russia first invaded Ukraine on February 24,2022. We have witnessed Vladimir Putin brazenly target civilian areas and nuclear reactors in Ukraine in his bloodthirsty war to reclaim the territory of the defunct Union of Soviet Socialist Republics (USSR). We have also witnessed inspiring levels of unity and resilience not only from Ukraine itself, but the rest of the democratic Western order. We have seen Germany and other Eurozone countries set aside their regional rivalries and economic self-interest to sanction Russian banks, individual oligarchs and the Russian central bank, not to mention ship weapons and aid directly to Ukraine. Even Switzerland has cast aside nearly four centuries of neutrality to actively aid Ukraine in their existential battle.

Russia related disruptions in energy and agricultural supply chains (Ukraine is a major supplier of agricultural commodities), as well as the economic effect of sanctions, are having significant impacts in global markets. Last week, oil, industrial metals and agricultural commodities all hit multi-year highs (see chart, below) and the Russian Ruble touched all-time lows. Back in November of 2021, as RiverFront was laying out the major market risks we saw in the upcoming year in our 2022 Outlook , the possibility of a war in Europe notably wasn’t among them -though higher than expected inflation certainly was. Thankfully, our portfolio management process is guided by ‘process over prediction’, not on possessing a better ‘crystal ball’ than others. Our process is disciplined and dynamic, designed to assess new information quickly, and unemotionally adjusts as appropriate. To paraphrase the great John Maynard Keynes, “As the facts change, we change. What do you do, sir?”

We do not know when or how the war in Ukraine will be resolved, but we will continue to follow our unemotional, data-driven process to guide us on, if and how to both further reduce portfolio risk – crucially for long-term portfolio performance-and when and how to add stocks back into the portfolios.

HOW OUR PORTFOLIOS HAVE CHANGED IN RESPONSE TO UKRAINE’S INVASION

Our processes have triggered risk reduction trades in our balanced asset allocation portfolios twice since the beginning of 2022. These include a comprehensive set of risk reduction trades we executed on February 25, the day after the invasion, that took us from overweight stocks relative to our policy benchmarks to roughly neutral. The trades further lowered exposure to both domestic and international stocks, raising cash to give us flexibility as we assess the market’s fundamentals and technicals. We believe opportunities to reinvest in equities will eventually emerge, but near term, sorting out inflation and geopolitics will create more headwinds than tailwinds for markets, in our opinion.

In general, RiverFront’s portfolios are now positioned in the following ways due to the risks of not only the war in Ukraine, but also how this dynamic and the labor/supply chain aftershocks of COVID-19 have complicated central bank policy:

- Elevated cash levels: We are currently carrying elevated levels of around 9-12% of cash in our balanced portfolios:

We believe cash can act as a risk ‘shock absorber’ in a market where both stocks and bonds have been highly volatile, cash can also give portfolio managers additional flexibility – ‘dry powder’ to deploy to help capitalize on potential overreactions in stock markets.

- Underweight international assets:

- Underweight Mainland Europe – we believe the concentration in financials and reliance on Russian energy and complex banking relationships will lead to further downside risks in the near term.

- Underweight Emerging Markets – our belief is that the increasing geopolitical risks from Russia and China will create several short-term corporate earnings headwinds in a large number of emerging markets.

- Favor Energy-related securities: RiverFront has been meaningfully increasing energy and commodity-related weightings in portfolios over the last few quarters and now are neutral to overweight US energy stocks; we also prefer cyclical materials and industrials, other sectors helped in general by higher commodity prices in our opinion.

In addition to the US – our preferred region for energy stocks – we also prefer some commodity-linked international regions that are likely winners from both heightened global inflation and political tensions. In our longer-horizon, most risk-tolerant portfolios, we have recently increased holdings in Norway, Canada, and Latin America.

- Using covered call strategies to help offset volatility:

RiverFront considers covered call writing an alternative strategy to owning stocks. We have been adding the strategy in recent quarters to help generate portfolio yield and potentially offset some equity volatility (See definition of covered calls in Footnotes).

WHAT WE ARE WATCHING GOING FORWARD

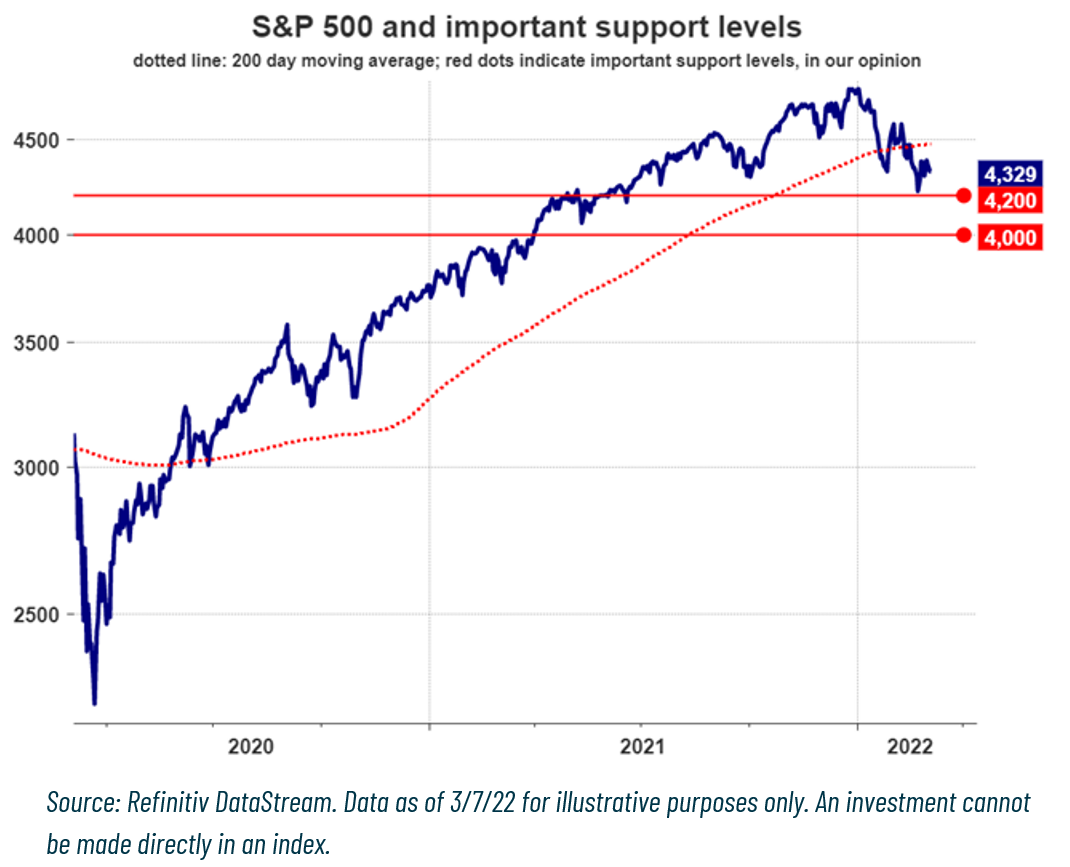

While we believe corrections can be healthy, the gravity of the Russia/Ukraine situation may lead us on a different path. The conflict is unlikely to end quickly, and consequences and costs will be large – creating the need for continual reassessment. One of our tactical rules is ‘Don’t Fight the Fed’. Our recent Weekly View: The Fed Outlook is Changing laid out just how the war in Ukraine has made the Federal Reserve’s (Fed) job more difficult, as the Fed weighs the potential need to offset economic issues caused by Russia with the concerning level of inflation in commodities and goods. We believe this underscores the need to remain flexible and be able to adjust tactically where appropriate. In terms of the message of markets themselves (‘Don’t fight the Trend’), we are impressed that the S&P 500 has been able to hold above thus far what we view as important technical support at ~4200 (the 38% retracement of the Oct ’20 thru Jan ‘22 rally) since the start of the Ukrainian war on February 24. On that day, it had broken decisively below 4200 intraday before bouncing more than +4% to end the day higher.

However, the S&P is not out of the woods yet: it is still trending lower, based on this year’s pattern of lower highs and lower lows, it is 9.7% below the January 3 record high (as of 3/7/22). The S&P 500’s primary trend (the red line in the chart to the right) is still positive but flattening, now at a +6% annualized run rate down from approximately 26% at the beginning of the year (see chart, right). Unfortunately, international stocks’ primary trend is now negative, falling at a -4% annualized rate.

IN A DARK TIME… SOME COUNTERPOINTS TO CONSIDER

Even in such a dark time, there are reasons to believe that the US market, in particular, can eventually shake off this recent volatility. Another important tactical rule we follow – ‘Beware the Crowd at Extremes ‘– is increasingly on investors’ side, as investor sentiment is now extremely bearish, based on NDR’s weekly and daily crowd sentiment polls – a contrarian plus in our view. Our proprietary ‘heatmap’ analysis of crowd sentiment combined with the primary trend’s current run rate suggests to us that, based on history, the S&P has well above average odds of being up over the next three months.

We would also note that the global economy is entering this geopolitical crisis in strong economic shape according to survey-based economic data, with Germany, Eurozone, US and UK manufacturing Purchasing Manager Indexes (PMIs) all above 57 right now.

Additionally, historical precedent over the past century warns against emotional ‘overreaction’ in investment decision making because of geopolitical events as S&P 500 is typically higher 6-12 months after the event. We show a table from Ned Davis Research[1]. We have taken this table and highlighted three potentially relevant historical cases, as we believe they all share similar characteristics to the current situation in Ukraine…in all three instances, markets were higher six and twelve months after the incident.

- ‘Cuban Missile Crisis’, 1962: Dow Jones Industrial Average (DJIA) higher by 24% 6 months later, and 30% 12 months later

- Iraq Invasion of Kuwait, 1990: DJIA higher by 16% 6 months later, 22% 12 months later

- Russian invasion of Crimea, 2014: DJIA higher by 6% 6 months later, and 11% 12 months later

[1] Davis, Ned, ND, (2022) Sentiment – short-term hopeful, but long-term cautious (Issue: HOT202202231) Ned Davis Research. NDR.com

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

Covered Call – An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy (call) or sell (put) a stock at an agreed upon price within a certain period or on a specific date. A covered call option involves holding a long position in a particular asset, in this case US common equities, and writing a call option on that same asset with the goal of realizing additional income from the option premium. Certain ETFs use a covered call strategy. By selling covered call options, the fund limits its opportunity to profit from an increase in the price of the underlying index above the exercise price but continues to bear the risk of a decline in the index. A liquid market may not exist for options held by the fund. While the fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price.

Buying commodities allows for a source of diversification for those sophisticated persons who wish to add this asset class to their portfolios and who are prepared to assume the risks inherent in the commodities market. Any commodity purchase represents a transaction in a non-income-producing asset and is highly speculative. Therefore, commodities should not represent a significant portion of an individual’s portfolio.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero).

Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio. Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Standard & Poor’s (S&P) 500 Index TR USD (Large Cap) measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.RiverFrontig.com or contact your Financial Advisor.

Don’t Fight the Fed – ‘Supportive’ means the Fed’s monetary policy regarding inflation and employment is in what we believe based on our analysis to be the investors’ best interest; ‘Against’ means the Fed’s monetary policy, in our view, is going against the investors’ best interest; ‘Neutral’ means the Fed’s monetary policy is neither supportive nor against the investors’ best interest in our view. Don’t Fight the Trend – Terms correlate to the 200-day moving average as it relates to the equity indexes: ‘Positive’ means that the trend is rising, ‘Flat’ means the trend is flat, ‘Negative’ means the trend is falling. Beware the Crowd at Extremes – Terms correlate to the NDR Crowd Sentiment Poll and its measurement of Extreme Optimism (Bearish), Neutral, or Extreme Pessimism (Bullish).

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.RiverFrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2015890