By KEVIN NICHOLSON

THE RIVERFRONT WRITING TEAM

REBECCA FELTON

Senior Market Strategist

ADAM GROSSMAN, CFA

Global Equity CIO |

Co-Head of Investment Committee

CHRIS KONSTANTINOS, CFA

Director of Investments |

Chief Investment Strategist

KEVIN NICHOLSON, CFA

Global Fixed Income CIO |

Co-Head of Investment Committee

DOUG SANDLER, CFA

Head of Global Strategy

ROD SMYTH

Chairman of the Board of Directors

SUMMARY

- We believe that price depreciation will no longer dominate income generation at current yields.

- We are focusing on maturities 5 years and shorter due to lower income cushion in longer maturities.

- From a credit perspective, we are particularly attracted to short term high yield and bank loans.

The Fed Plan Raises Fixed Income Breakeven Levels

Going into 2022, we focused on the Four I’s: Inflation, Interest rates, Innovation, and Intrinsic value. However, it is the first two I’s that are garnering the attention of financial markets after headline inflation rose to 8.5% in March. Rising inflation has caused the Federal Reserve (Fed) to raise interest rates quicker than previously anticipated to get inflation under control. Inflation and interest rates are highly correlated, and if the Fed can tame the former, the latter will stabilize. Of course, taming inflation is easier said than done. The Fed is using all the tools at its disposal to lower inflation while trying to avoid a recession…a soft landing. While we cannot predict whether the Fed will be successful, we can say that its inflation-fighting efforts have led to higher bond yields. The higher bond yields provide more income to offset potential losses from a further decline in bond prices and thus higher ‘breakeven’ levels for bonds, i.e. the level where price depreciation equals annual income generation.

The Fed’s Plan: Cooling The Demand Side Of The Economy To Fight Inflation

The Fed raised its interest rate target range to between 0.75% and 1% at its May 4th meeting even though it struck a more dovish tone than expected, as it attempted to normalize the Fed Funds rate and navigate a soft landing. The Fed appears to be set to finally fight inflation at all costs, which arguably could put additional pressure on both the economy and financial markets. As it pertains to the economy, the hope is that rising interest rates will prompt consumers to dial back their consumption to help mitigate some of the pricing pressures that are stoking inflation. A consumer pullback combined with a rising Fed Funds rate, and Quantitative Tightening (QT) should help to slow demand as the Fed unwinds its nearly $9 trillion balance sheet, in our view. The Fed is starting QT on June 1st, initially reducing the balance sheet by $47.5 billion per month. By September, it will be selling $95 billion per month according to recent guidance.

However, Fed policy does not have any influence over the supply of goods and services. The supply side is driven by the ability of the global economy to fully recover from the pandemic. This means that bottlenecks experienced in parts of the supply-chain will have to be fixed and companies must no longer experience labor shortages. In our opinion, we do not believe that all countries have thrown away the playbook of shutting down their economies when virus outbreaks arise, as we are currently seeing in China. Therefore, the supply side will probably not improve as rapidly as most economists would like, but we do believe that there will be major improvement once China reopens.

Impact On The Balanced Portfolio: Asset Allocation Not ‘Dying’; Bonds Starting To Generate Attractive Income Again

Thus far we have focused on the economic consequences of Fed policy; now we will explore the financial market fallout from the Fed’s inflation fighting agenda. We will start with the ‘million-dollar question’ of, what will happen to the classic balanced stock and bond portfolios that have come under pressure given the rocky start to the year by financial markets? While investors were preparing for slower earnings growth, equity market returns in the low to mid-single digits, and miniscule fixed income returns, few were prepared for the Fed to make an abrupt transition from very loose monetary policy to a very strict policy overnight. The abrupt about-face has uncharacteristically caused fixed income to experience price depreciation at the same time as equities are falling, thus compounding balanced portfolio losses, generally speaking. Historically, fixed income has been utilized in balanced portfolios to generate income and to act as a counterbalance to riskier equities. However, 2022 has seen bond prices fall more than the income that the bonds generate on an annual basis. This has led to many believing that the benefits of a diversified balanced portfolio is ‘dying’. We believe higher bond yields will allow bonds to have better returns, and thus the balanced portfolio to behave more normally again.

Fixed Income Breakeven Levels: Bonds Are Now An Attractive Investment Alternative, In Our Opinion

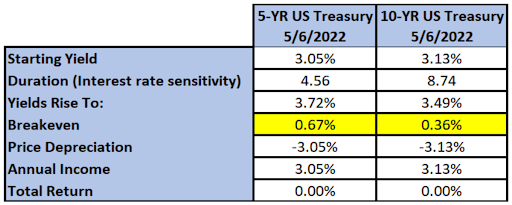

The purchase yield of a bond is its return if held to maturity. At current yields, bonds are once again generating income that can better withstand price depreciation, as we demonstrate below. The Bloomberg Aggregate Bond Index yielded 1.75% at the end of 2021, and as of May 6th, the index now yields 3.62%, more than double where it ended last year. This dramatic increase in bond yields has led to the index falling 10.51% year-to-date; at the same time the S&P 500 is down 13.07%, over that same period. However, we believe that balanced portfolios will receive some relief going forward as the price depreciation should no longer dominate the income generation if investors buy fixed income at current yields. 10-year Treasuries fall twice as much as 5-year Treasuries when interest rates rise. Thus a 5-year Treasury will reach ‘breakeven’ if yields rise another 0.67%, whereas a 10-year Treasury will start losing money much faster with a breakeven of just 0.36%, highlighted in the table below.

As the illustration shows, we believe that the worst may be behind the fixed income market. We do not believe that bond yields will rise significantly from current levels unless the Fed becomes even more aggressive than their most recent guidance. We would argue against bond yields having a lot more to rise because that would indicate that the Fed will have to tighten monetary policy a lot more than financial markets are pricing in, and thus would likely throw the economy into recession. Under a recession scenario, we would expect bond yields to fall and thus prices to rise.

Therefore, we believe that fixed income has once again become a valuable investment alternative at current levels and higher.

In conclusion, the Fed’s crusade to fight inflation has reset the fixed income market, but it is important to remember that not all maturities are created equal. In an effort to increase the opportunity to generate income from bonds that will be higher than potential price depreciation, our portfolios will focus on maturities that are five years or shorter. Recently, we have been adding short-term high yield and bank loans to RiverFront portfolios to generate income in addition to other alternative income investments.

For more news, information, and strategy, visit the ETF Strategist Channel.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

All charts shown for illustrative purposes only. Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Index Definitions:

Standard & Poor’s (S&P) 500 Index TR USD (Large Cap) measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

NASDAQ 100 Index includes 100 of the largest domestic and international non-financial securities listed on the Nasdaq Stock Market based on market capitalization.

Definitions:

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Principal Risks:

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Current yield is a bond’s annual return based on its annual coupon payments and current price (as opposed to its original price or face). The formula for current yield is a bond’s annual coupons divided by its current price.

In a rising interest rate environment, the value of fixed-income securities generally declines.

High-yield securities (including junk bonds) are subject to greater risk of loss of principal and interest, including default risk, than higher-rated securities.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2192349