The latest market news has centered around rising bond yields. So, what does that mean? Well in short, it means that it has been a bad time to own bonds. In the traditional sense, most investors tend to fall somewhere in the category of “conservative” to “moderately conservative” risk levels. Conventional wisdom would say that these investors should hold a relatively even balance between stocks and bonds. The belief is a stock market decline would be offset by a flight to quality and a rise in the bond market.

Well, the general stock market has certainly been volatile this year. As of the time of this writing, the S&P 500 is down almost -8% on the year, after being down as much as -13%. The Nasdaq index is down -15% on the year and has been down as much as -20%.

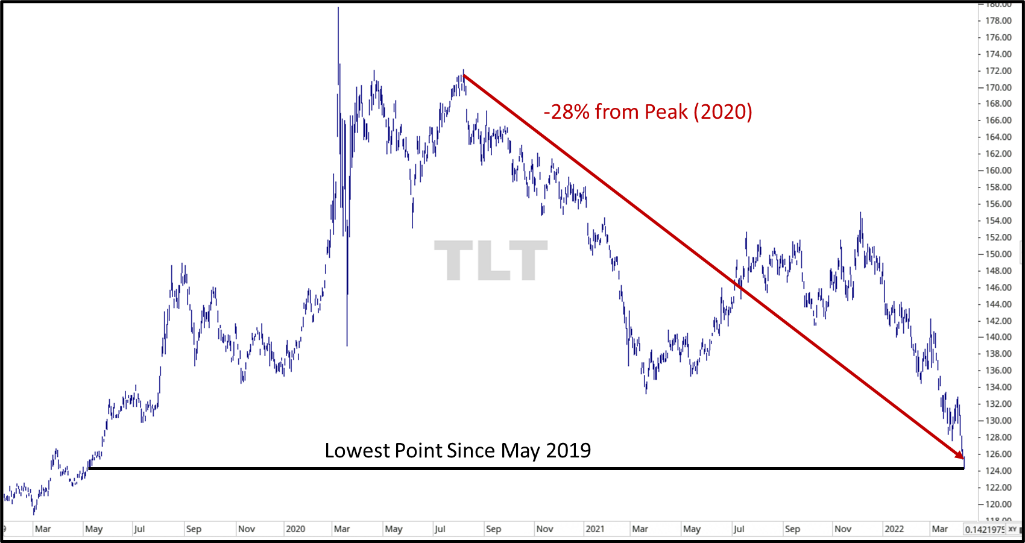

For those holding a “balanced” portfolio of stocks and bonds, instead of reducing volatility, bonds have contributed to it. Twenty-year treasury bonds (ETF: TLT) are down more than -17% year-to-date. Ten-year treasury bonds (ETF: IEF) are down almost -10% year-to-date. This is the lowest point for bonds since 2019. Since its peak in August of 2020, twenty-year treasuries are down more than -28%.

Bond Yields

The question now becomes “how much and how fast can bond yields rise, and how much can bond prices fall?” While I don’t have a direct answer to that question, from a technical perspective, yields are at a critical point. Noted market technician, Carter Worth, shared an interesting chart on bond yields. Looking at a logarithmic scale chart of 10-year bond yields dating back to the 1960s, yields have been on a steady decline. Each subsequent rise in yields has been met by a declining resistance point. We are now at that resistance point once again. The question is “will yields once again bounce off and fuel a rise in bond prices? Or will yields break through resistance and continue the decline in bond values?”

Market Leadership

We wrote last week that Nasdaq was leading the markets over two weeks and that the markets were 99% overbought. There is no indication for how long that would stay in place. Since the market has sold off a bit, it is no longer overbought, and the Nasdaq is no longer leading in the short run. Value stocks have taken back the reigns. According to Canterbury’s risk-adjusted rankings, the top ranked sectors are Utilities, Energy, Health Care, and Consumer Staples. The trend of defensive stocks leading continues to hold up.

Bottom Line

Conservative investors are looking at their traditional “risk tolerance” portfolio and scratching their heads. They are learning the hard way that bonds are not always “conservative.” Rather than limiting a conservative portfolio’s volatility, they have made it more volatile.

Now that we are in the midst of a bear market in both bonds and growth stocks, it is more important than ever to adapt to a less volatile and more efficient portfolio of securities. There are many unique Exchange Traded Funds (ETFs) that are actually benefitting from the downturn in bonds and most stocks. This is the kind of market environment where having the ability to adapt is critical.

For more market trends, visit ETF Trends.