By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

Our work suggests that U.S. economic growth is set to resume. This growth should create a self-sustaining cycle of increasing demand which can support more jobs creation. We continue to expect quarter over quarter GDP readings to look like a V-shaped recovery in the beginning, but that is more a result of how the math works as the economy recovers from such a sharp drop. It may take years for the U.S. economy to fully recover from COVID-19 with total employment likely being one of the last indicators to return to pre-crisis levels. Additionally, with continued COVID-19 challenges globally, we expect a sluggish economic recovery ahead. Still, this spring’s downturn should mark the shortest recession in U.S. history.

Business surveys, such as the ISM Manufacturing and Services Purchasing Manager Index (PMI) reports, continue to show improvement.

New orders, which is an important leading indicator, continues to be a bright spot and suggests more business improvements in the months ahead. As exhibit 1 shows, our economically weighted PMI measure fell quickly earlier in the year but is now recovering to reflect a return to economic growth.

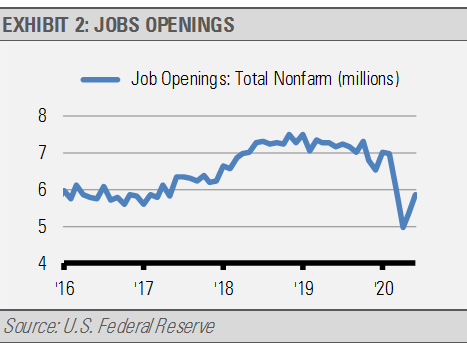

We expect to see more improvement on the jobs front as well. While the headline unemployment rate should remain elevated, we are seeing signs of progress in other areas. For example, both weekly initial and continuing jobless claims, which are also important leading indicators, have advanced recently. In addition, the number of job openings may have bottomed and started to increase after falling for several months (exhibit 2).

Despite these positive shifts, we are not suggesting smooth sailing. Looking ahead, we expect market volatility around the upcoming elections. However, slow economic growth should propel corporate revenues and earnings higher. Expectations of higher sales revenues and earnings can push the stock market 10% higher in the coming year.

We expect interest rates to remain low by historical standards with global influences keeping long-term interest rates down. Furthermore, the U.S. Federal Reserve is unlikely to increase short-term interest rates any time soon. Still, we expect that the confluence of improving economic growth and increasing inflationary pressure resulting from trillions of dollars of monetary and fiscal stimulus will exert some upward pressure on long-term interest rates.

Investing in the recovery has been choppy with some areas of the market recovering more quickly than others. We have also seen some of the major indices’ returns be dominated by a handful of technology stocks which has created top heavy indices and large gaps between leading and lagging sectors. In this environment, we think that investors should use any significant stock market declines to buy on weakness and focus on areas of sustainable business growth as well as areas where this disjointed market environment has created attractive valuations. These areas include health care, technology, transportation, and global natural resource companies.

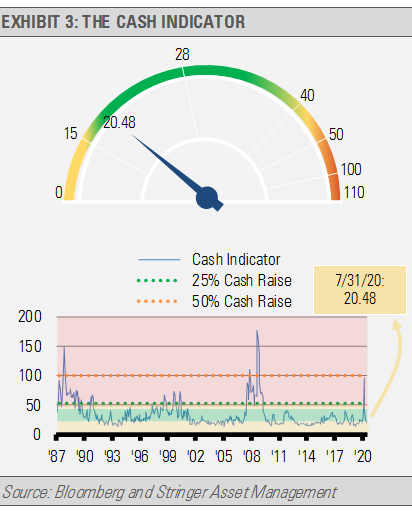

THE CASH INDICATOR

The Cash Indicator (CI) has continued to decline to more normal levels following this spring’s turmoil. At these levels, the CI suggests markets are functioning properly.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.