At Nottingham Advisors, we are particularly excited about Responsible Investing, and the opportunity to do well in our investment strategies, while doing good in the world around us. This paper is the first installment in a series which will make the case for integrating Environmental, Social, and Governance (ESG) data into the investment process. Our view is supported by a consistent flow of studies [1], [2], [3] confirming that a company’s ESG data is material information that should be considered. The materiality of this data (defined as information that is sufficiently important to have a large impact on a company’s stock price [4]) presents an opportunity to investment professionals and investors who are early adopters of this worldview.

By integrating ESG data into their investment process, investors have the opportunity to harness benefits to investment portfolios over the long run. This performance can come from multiple areas. In general, we expect that ESG integration will lead to portfolios having exposure to higher performing companies, with more consistent profitability, a durable advantage due to being ahead of the regulatory curve, lesser drawdowns in market corrections, and more. The tradeoff to receive these significant benefits is nothing more than incorporating ESG concerns into the due diligence process.

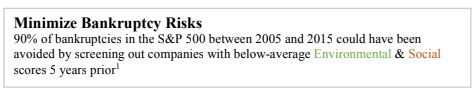

This additional analysis results in owning companies that are more likely to display the risk & return profile that we are looking for, while avoiding exposure to the companies whose less attractive ESG data predisposes them to negative earnings trends, regulatory violations/fines, having to play catch up and work through significant expenses that had been put off, getting caught up in scandals, etc.

While Responsible Investing has been around for a long time, it appears that it is now ready to enter the mainstream. In 2019, coverage of ESG topics by the financial and traditional press was prolific. Many news outlets began distributing newsletters dedicated to the topic. Investment flows increased dramatically. Responsible Investing conferences saw increased attendance, and new venues for discussion were launched. Google searches for the term ESG hit all-time highs in 2019, both in the U.S. and Globally [6].

While Responsible Investing has been around for a long time, it appears that it is now ready to enter the mainstream. In 2019, coverage of ESG topics by the financial and traditional press was prolific. Many news outlets began distributing newsletters dedicated to the topic. Investment flows increased dramatically. Responsible Investing conferences saw increased attendance, and new venues for discussion were launched. Google searches for the term ESG hit all-time highs in 2019, both in the U.S. and Globally [6].

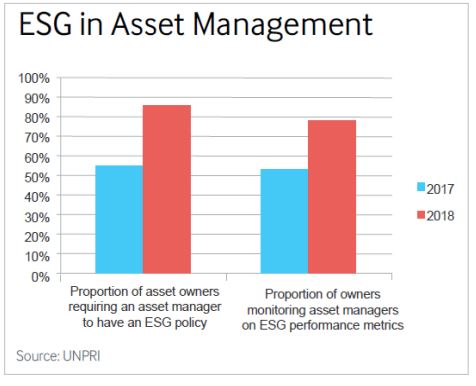

The Governance & Accountability Institute’s most recent data showed that 86% of the companies in the S&P 500 Index® published sustainability or corporate responsibility reports. This is a dramatic increase from 2011, when only 20% of the companies provided this data. ESG interest was so great that it became a common topic of discussion at mainstream conferences. As investor understanding of ESG integration benefits grows, so does the number of Asset Owners requiring their investment manager to incorporate ESG data.

ESG interest was so great that it became a common topic of discussion at mainstream conferences. As investor understanding of ESG integration benefits grows, so does the number of Asset Owners requiring their investment manager to incorporate ESG data.

BlackRock, the world’s largest investor with $7 Trillion in assets under management, proclaims that long-term sustainability must be at the center of its investment approach, and will make sustainability integral to portfolio construction and risk management. “Awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance,” says Larry Fink, the founder and chief executive of BlackRock.

The Business Roundtable, America’s most influential group of corporate leaders, put out a statement encouraging companies to consider communities and stakeholders instead of single-mindedly pursuing

shareholder returns [7].

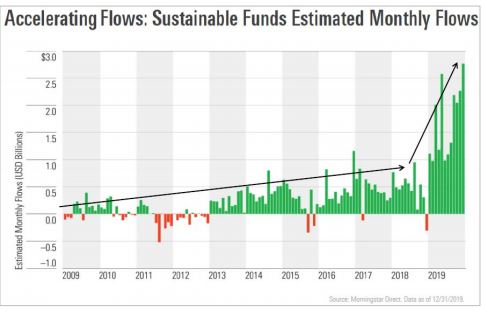

Perhaps unsurprising with such a supportive backdrop, 2019 was a fantastic year for Responsible Investing funds. Morningstar funds in the ESG Fund group experienced an annual inflow of $20.6 Billion, which is almost four times the prior annual inflow record set in 2018. Monthly inflows are displaying significant momentum, particularly during the third and fourth quarter of 2019. Recently released Morningstar data shows that Q1 2020 was another record breaker for sustainable funds.

Perhaps unsurprising with such a supportive backdrop, 2019 was a fantastic year for Responsible Investing funds. Morningstar funds in the ESG Fund group experienced an annual inflow of $20.6 Billion, which is almost four times the prior annual inflow record set in 2018. Monthly inflows are displaying significant momentum, particularly during the third and fourth quarter of 2019. Recently released Morningstar data shows that Q1 2020 was another record breaker for sustainable funds.

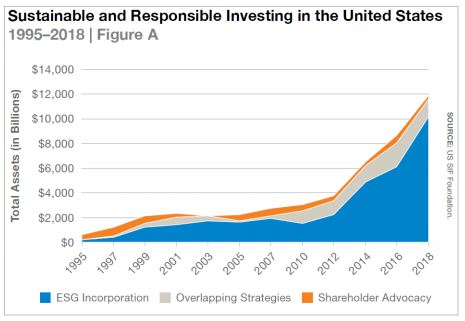

The Forum for Sustainable and Responsible Investment (US SIF) data shows the strong growth of assets that are invested using some level of ESG integration. After having plateaued for a time, more recent growth has been significant. When the 2020 update is released later this year, we are confident the trend will show continued strength. This expectation is supported by the Morningstar data on funds flows, and the likelihood of increased interest driven by rising social consciousness and strong relative performance.

We believe that there are many tailwinds which will support strong interest in Responsible Investing going forward, and will provide future updates focused on individual subjects.

A few of the most notable are:

Outcomes – Study after study1,2,3 continue to show that incorporating the consideration of ESG data into the investment process results in beneficial outcomes for investors. This can mean higher investment returns, educed drawdown risk, lower rates of default, increased profitability, and more.

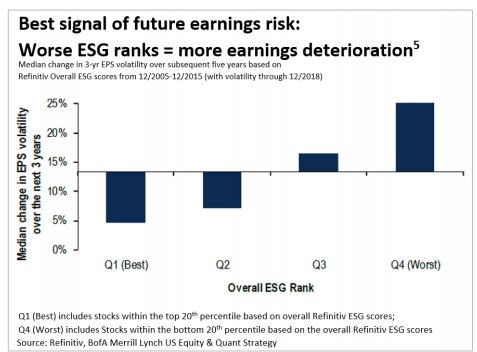

Risk Mitigation – Many studies have supported the expectation that ESG integration (considering additional risk factors) would result in fewer negative outcomes. A Bank of America/Merrill Lynch report found that ESG scores were the most reliable factor for predicting earnings risk, superior to leverage or other risk and quality factors [5]. A Wharton School study found “clear evidence that higher-performing companies on ESG criteria experienced subsequent lower incidence of adverse material events.” [8]

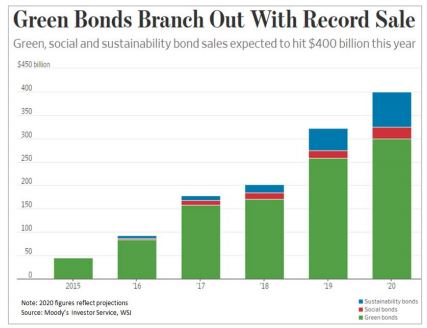

Fixed Income – The growth of the Green/Sustainable bond market confirms the ESG interests of sophisticated asset owners. Many well-known companies have issued qualifying bonds, such as Apple, Bank of America, Pepsi, and Starbucks. Growing interest in these bonds could allow for a price premium to develop in an issuer’s Green bond offering vs. traditional bonds outstanding.

Fixed Income – The growth of the Green/Sustainable bond market confirms the ESG interests of sophisticated asset owners. Many well-known companies have issued qualifying bonds, such as Apple, Bank of America, Pepsi, and Starbucks. Growing interest in these bonds could allow for a price premium to develop in an issuer’s Green bond offering vs. traditional bonds outstanding.

Materiality – As the consistent drip of research reinforces the value of ESG data when making investment decisions, it is being recognized by influential bodies within the industry as “material” to the investment process. The CFA Institute (CFA), The Chartered Alternative Investment Analyst Association (CAIA), and The Investments & Wealth Institute (CIMA), have all added ESG content to study materials that must be mastered to earn their respective designations. This will increase practitioners’ knowledge of the importance of ESG data, and drive investor adoption.

Engagement – To drive change, some investors have chosen engagement as the path forward. When companies are open to working with their investors and stakeholders, it opens the door to a continued and ideally productive dialogue, which can result in improvements to the business and shareholder outcomes. Less open companies may end up with agitated shareholders who take another route to have their concerns heard, by filing shareholder resolutions to be voted on at the annual meeting. If the company continues to stonewall the concerned shareholders, they can take the path of divestment, and liquidate their position in the company. The growing interest in stakeholder concerns and company engagement clearly illustrates the tide change in the investor psyche.

Flows – Morningstar data on flows into ESG focused funds, as well as US SIF’s Trends report, illustrate the growing interest and wave of capital entering the responsible investing space. Bank of America/Merrell Lynch goes so far as to predict that there will be, “over $20 trillion of asset growth in ESG funds over the next two decades [5].” This significant migration of investor capital into higher ESG scoring companies should be supportive of share prices, regardless of general market direction.

Negative Externalities – The way society allows companies to operate has been changing gradually, and then suddenly. Negative externalities were once socialized with little or no impact on the offending organization. Eventually, companies were held to task on occasion for the damage their actions inflicted upon society. And more recently, there has been significant public concern and close monitoring of offending companies, their employees, and how the issue is addressed. With so many people carrying a video recording device in their pocket, with the ability to transmit the data captured, and connected to billions of other people via social media, the court of public opinion (where socialized negative externalities end up) has become much more powerful, and provides extra-regulatory punishment for offending low ESG scoring companies, and opens them up to further controversy or regulatory scrutiny. Integration – In time, ESG data will be universally used in investment analysis. Even parties who claim not to believe in its value will be using it at least tangentially, because it is material. At the SRI30 Conference, Jon Hale, head of sustainability research for Morningstar, commented on the rising number of mutual fund families that are adding ESG data consideration to their prospectuses, across the entire family of offerings. As research on the benefits of incorporating ESG data becomes more widely recognized, this trend will be reinforced. By integrating ESG data sooner rather than later, early-adopter investors will have an informational advantage that has been shown to be beneficial to outcomes.

Integration – In time, ESG data will be universally used in investment analysis. Even parties who claim not to believe in its value will be using it at least tangentially, because it is material. At the SRI30 Conference, Jon Hale, head of sustainability research for Morningstar, commented on the rising number of mutual fund families that are adding ESG data consideration to their prospectuses, across the entire family of offerings. As research on the benefits of incorporating ESG data becomes more widely recognized, this trend will be reinforced. By integrating ESG data sooner rather than later, early-adopter investors will have an informational advantage that has been shown to be beneficial to outcomes.

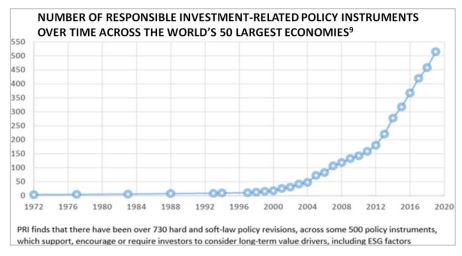

Convergence/Regulations – Companies that are ahead of the curve, being run sustainably or transitioning towards that goal, will have an advantage and are likely to relatively outperform the laggards who must make significant and costly changes (in management, operation, and culture) all at once, as they become required by market participants, investors, or regulatory bodies.

While the majority of the policy mandates supporting ESG requirements have been overseas to this point, the U.S. does have governmental agencies looking into the issue. Support for these requirements is building domestically, among the largest investment managers and asset owners. It is only a matter of time before disclosures become formalized, by governmental decree or self-regulation. This will further reinforce the significant inflows that funds incorporating ESG data have been experiencing.

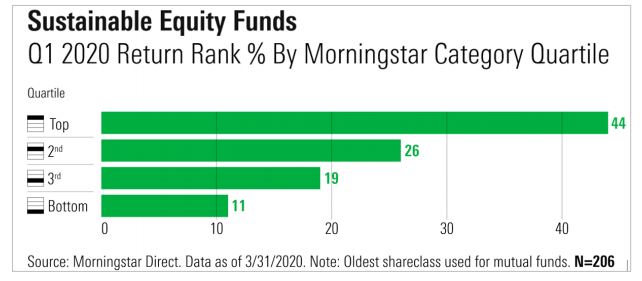

Jon Hale of Morningstar continues to put out thoughtful research which supports our theses. In a piece from April 3rd, he noted that sustainable funds broadly outperformed traditional funds through the Q1 2020 drawdown. In the U.S. large-blend category, 10 0f 12 sustainable funds outperformed the low-cost passive alternative of S&P 500 ETF – IVV. More broadly, 7 of 10 sustainable funds outperformed their comparable benchmark.[10]

With such a strong list of tailwinds supporting increased ESG interest, we see it as an area of significant opportunity for investors. Our experienced managers and long track record as a global asset-allocation specialist gives Nottingham Advisors Asset Management a unique vantage point from which to view the ESG landscape. We build sustainably focused portfolios using best in class active management, paired with low-cost passive ESG holdings. This allows us to avoid unduly restricting our investable universe, and to search out the exposures that we expect to offer the best return characteristics for our clients.

References

1 Arabesque Partners (2015). From the Stockholder to the Stakeholder: How Sustainability Can Drive Financial Outperformance: https://arabesque.com/research/From_the_stockholder_to_the_stakeholder_web.pdf

2 Gunnar Friede, Timo Busch & Alexander Bassen (2015) ESG and financial performance: aggregated evidence from more than 2000 empirical studies, Journal of Sustainable Finance & Investment, 5:4, 210-233, DOI: 10.1080/20430795.2015.1118917

3 Guido Giese, Linda-Eling Lee, Dimitris Melas, Zoltan Nagy, and Laura Nishikawa. “Foundations of ESG Investing: How ESG Affects Equity Valuation, Risk, and Performance.” IPR Journal, Vol. 45, No. 5, 2019

4 Barron’s Dictionary of Finance and Investment Terms

5 Bank of America Merrill Lynch (2019). 10 Reasons You Should Care About ESG: https://www.bofaml.com/content/dam/boamlimages/documents/articles/ID19_1119/esg_matters.pdf

6 https://trends.google.com/trends/explore?date=all&geo=US&q=esg

7 Business Roundtable Redefines the Purpose of a Corporation to Promote ‘An Economy That Serves All Americans’. https://www.businessroundtable.org/business-roundtable-redefines-the-purpose-of-a-corporation-to-promote-an-economy-that-serves-all-americans

8 Henisz, Witold and McGlinch, James, “ESG, Material Credit Events, and Credit Risk,” Journal of Applied Corporate Finance, Volume 31, Number 2, Spring 2019

9 Principles for Responsible Investing (PRI), “Taking stock: Sustainable finance policy engagement and policy influence,” https://d8g8t13e9vf2o.cloudfront.net/Uploads/c/j/u/pripolicywhitepapertakingstockfinal_335442.pdf

10 Jon Hale, Ph.D., CFA, Head of Sustainability Research for Morningstar. “Sustainable Funds Weather the First Quarter Better Than Conventional Funds,” https://www.morningstar.com/articles/976361/sustainable-funds-endure-the-first-quarter-better-than-conventional-funds

Nottingham Advisors, LLC (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent, direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in your account will correspond directly to any benchmark index. A description of each index is available from us upon request. Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.