Executive Summary

Global equity markets and related risk assets have experienced a strong rally in recent months. Still, our base-case scenario includes a recession and continued market volatility over the near-term. While we have upgraded our outlook for Europe based on falling energy prices, we think that U.S. Federal Reserve (Fed) policy represents the most acute risk to the global economy and markets.

Looking further out, we think the next business cycle will be longer and on more solid financial footing than the over-stimulated one that is nearing its end. At this point, we are more optimistic about the potential for long-term returns than we have been in some time.

Recent Activity

We recently made changes to our Strategies to potentially help make them more resilient to economic and market turbulence. Economic momentum has continued to fade according to several measures including leading economic indicators.

While these datapoints are showing stronger economic output than during the depths of the last two economic downturns, persistent economic weakness may stress the market for private sector debt, such as asset-backed and mortgage-backed securities, as well as corporate bonds.

As a result, we sold our allocations in these types of securities in favor of additional U.S. Treasury bond exposure, which we think can perform better during times of economic and market stress. Additionally, we swapped a few other securities to further refine our exposures.

Global equity markets and related risk assets have rallied strongly in recent months. In fact, this rally suggests that the worst may be behind us in terms of global economic and geopolitical risks. Still, our base-case scenario includes a recession and continued market volatility over the near-term. While we have upgraded our outlook for Europe based on falling energy prices, we think that U.S. Federal Reserve (Fed) policy represents the most acute risk to the global economy and markets.

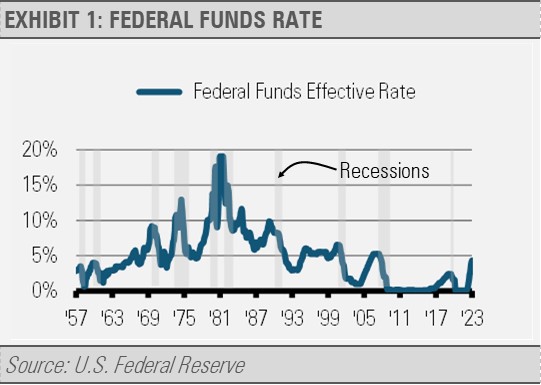

Since 1954, the Fed has achieved four soft landings (1965, 1971, 1984, and 1995) out of 14 interest rate hiking cycles. If the Fed sticks the landing this time, it will mark the fifth out of fifteen. Not great odds, but also definitely possible at this time. In our opinion, the strongest sign the Fed may pull off this challenging feat to avoid a recession is the ongoing strength of the labor market.

However, changes in the Fed’s monetary policy take time to work their way through the economy. We wrote in August 2022 that we thought the Fed should pause its interest rate hikes to see how the tightening already enacted was impacting the economy. With the Fed continuing to raise interest rates, albeit more slowly, the full impact of these rate increases has not yet been fully felt in the economy. With a lot of good news priced into the market, we expect a short and shallow recession ahead accompanied by market volatility as many of our leading indicators are flashing cautionary signals.

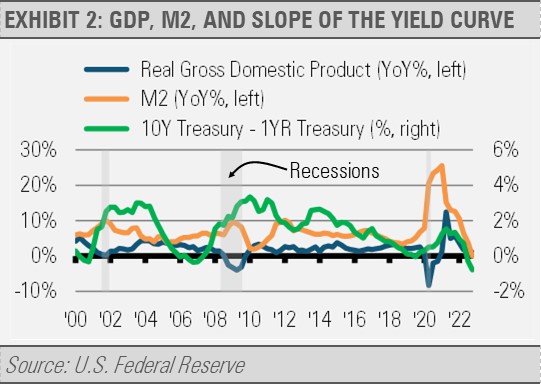

As the following graph illustrates, two of our primary forward-looking indicators of the health of the economy, broad money (M2) growth and the slope of the yield curve, are both flashing cautionary signals (exhibit 2). While no individual or even set of leading indicators are foolproof, the combination of these two signals has been very good at forecasting economic growth and contraction. More money moving through the economy suggests more transactions and economic growth ahead, while the opposite case also holds. Similarly, a steeper yield curve is indicative of stronger nominal economic growth ahead, not adjusting for inflation. Here too, the opposite case also holds. At this point, broad money growth and the slope of the yield curve suggest signs of some economic weakness ahead.

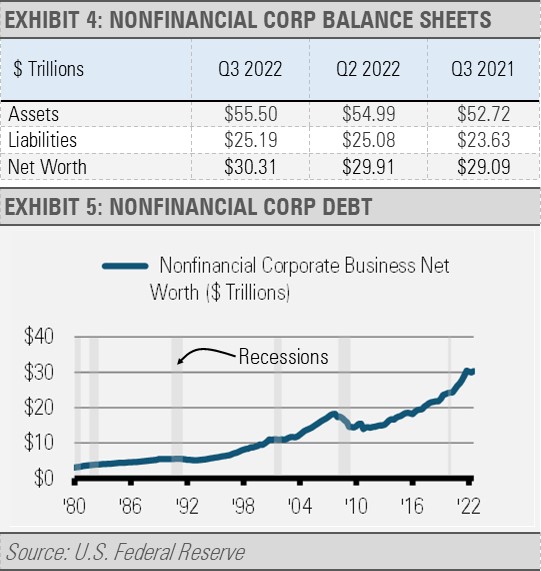

Looking further out, the next business cycle should be longer and on more solid financial footing than the over-stimulated one we think is nearing its end. We have mentioned previously the impressive strength of U.S. household balance sheets in aggregate. It is also important to note the strength of corporate finances. As the graph below shows, nonfinancial corporate net worth is at an all-time high.

Though nonfinancial corporate liabilities have risen in recent years, asset levels have increased faster. This is what one would expect to see in a healthy and growing economy. In fact, debt as percentage of nonfinancial corporate net worth is about the same as it has been since 2009 and less than it was going into the 1990s, which was a great time for the U.S. economy.

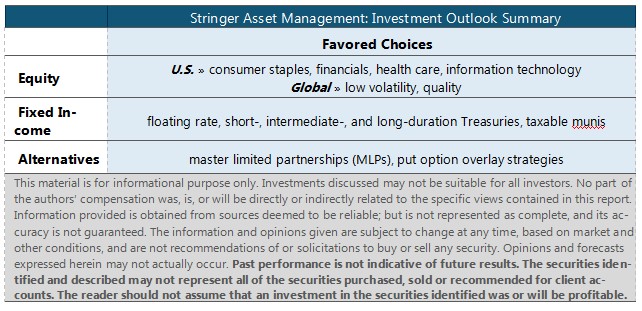

Investment Implications

In short, though we expect market volatility and economic challenges in the near-term, on the other side of these near-term challenges lies a strong business cycle driven by a growing private sector that is more fundamentally sound by recent historical comparisons.

Over the longer-term, we think that both the equity market and especially the investment grade core fixed income market are very attractively valued based on strong fundamentals and appealing interest rates. At this point, we are more optimistic about the potential for long-term returns than we have been in some time.

The Cash Indicator

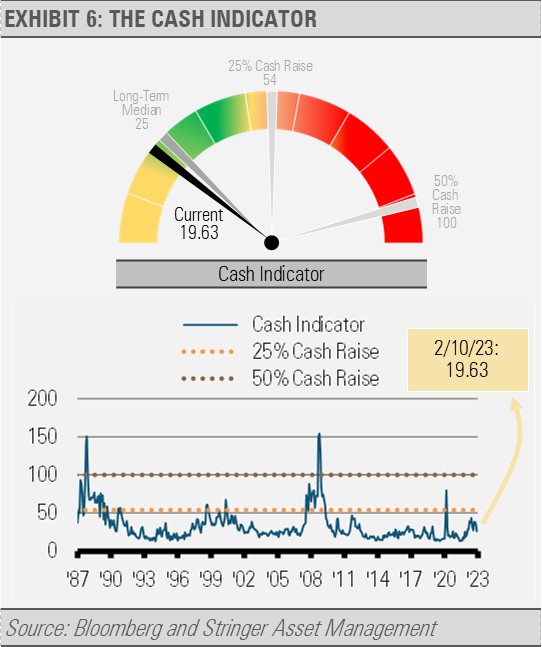

The Cash Indicator (CI) has fallen below its long-term median. At this level, the CI suggests that the markets may be overly complacent. This, combined with our cautious fundamental view, leads us to expect near-term market volatility. Still, the markets appear to be a great deal away from anything resembling a crisis.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.