The Fed lowered the Fed Funds rate for the first time since 2008. This move has confused some investors because the Fed’s dual mandate seems in order: unemployment is at a roughly 50-year low and inflation remains below the Fed’s self-defined 2% inflation target.

Here are some thoughts on today’s announcement:

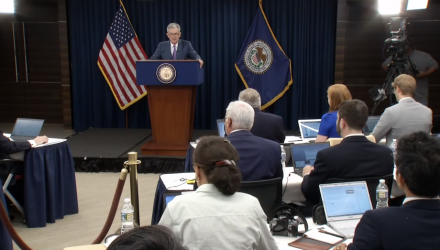

1. Fed Chair Powell mentioned that he considers this cut to be a “mid-cycle adjustment”. He clarified that rates could actually increase in the future if necessary, and that one shouldn’t necessarily view today’s cut as the beginning of a full-blown easing cycle. Market implied probabilities suggested the investors previously viewed today’s cut as the beginning of a full-blown easing cycle.

2. The Fed has a dual mandate of low unemployment and stable inflation. Powell’s comments repeatedly mentioned “uncertainty around trade policy” as a 3rd concern. Stable trade conditions is not one of the Fed’s mandates, so monitoring trade will likely raise questions about the Fed’s previous strategy of being “data dependent” and about the Fed’s independence given the existing low unemployment and stable prices.

3. The Fed Chair went out of his way today to say he was not criticizing trade policy, but some may say he implicitly did criticize trade policy by lowering rates, i.e., why lower rates if trade policy will be successful.

4. What ever happened to “don’t fight the Fed”? Assuming #2 and #3 are political poppycock and the Fed is indeed adhering to the dual mandate of low unemployment and stable prices, then the implication is the rate cut is meant to spur higher inflation. Bond investors should take note because duration risk might be seriously underpriced if the Fed is successful and inflation does increase.

If you have any additional questions on our thinking, please reach out to your regional RBA Portfolio Specialist.