WALL STREET AND MAIN STREET ARE OUT OF SYNC…THIS IS NOT UNUSUAL

One of the most confusing but useful lessons that investors learn over time is that Main Street (the economy) and Wall Street (the stock market) are not always synchronized. There are times when Main Street looks optimistic and stocks drop and times when Main Street looks pessimistic, but stocks rise. Q2 2020 was a great example of the latter.

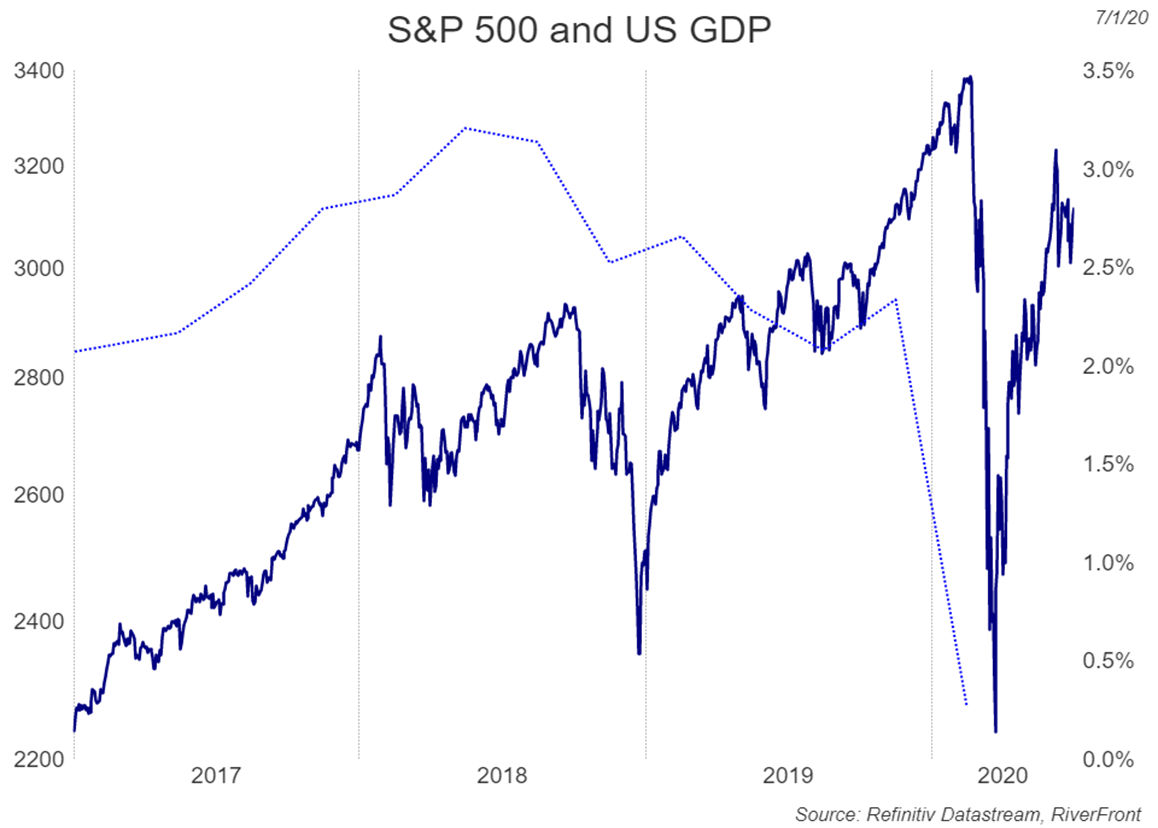

Equity markets around the world showed resilience with US market posting the highest returns in a quarter since 1998 with the S&P 500 rising over 20% (Chart, Bold Line); while the economy is expected to contract by nearly 10% y/y (based on GDP), the largest decline post World War II era (Chart, Dotted Line). The reason for that discrepancy is that Wall Street and Main Street reflect two different perspectives: stocks look forward, while the economy looks backward, in our view. In our view, during periods of transition and volatility, like the last four months, the two will often be out of sync for a period of time.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

We have often found the market prescient and that a rising stock market signals better times ahead. Therefore, as global stock markets began their abrupt rebound in the second quarter, we paid attention. The market’s unusual strength, combined with discounted valuations and our positive long-term outlook, led our portfolio managers to add equities throughout the quarter. As of June 30, 2020; the Advantage balanced portfolios are roughly 2-4% overweight stock relative to their respective benchmarks. This is a significant increase from their 5-9% underweight to equities on March 31st.

Going forward, we believe that human ingenuity will beat COVID-19 and policymakers will be able to re-start their stalled economies through unprecedented levels of stimulus. However, it is important to acknowledge that visibility is unusually low as to the length and magnitude of the current economic downturn, as there is no historical ‘playbook’ for navigating the COVID-19 crisis. A second wave of infections that leads to further lockdowns could change our outlook and thus we need to resist the urge to become too obstinate in our views. In times like this, we strive to stay humble and flexible, relying on our mantra of ‘process over prediction’. For us, this means that a disciplined process for managing risks and opportunities is more effective than anchoring on any one forecast, in our view.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

The value of securities may decline as a result of various catastrophic events, such as pandemics, natural disasters, and terrorism. Losses resulting from these catastrophic events can be substantial and could have a material adverse effect on RiverFront’s business and client portfolios.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor. Portfolio allocations discussed above are as of the date of this publication and subject to change.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

You cannot invest directly in an index

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2020 RiverFront Investment Group. All Rights Reserved. ID 1234137