By Dan Suzuki, CFA, Richard Bernstein Advisors

RBA is a macro-based investment firm, but we are not event driven. Billions, if not trillions, of dollars are singularly focused on profiting off of whether a vote will go a given way, whether an economic data print will surprise to the upside/downside, or when a geopolitical event is likely to occur.

In recent years, significant amounts of capital have also flowed toward funds competing to be first to the trade. The increased competition around predicting and reacting to macro catalysts has made it harder and harder to eke out consistent alpha in these strategies. Instead of competing with these funds, we invest based on profits, liquidity and sentiment, with our investment horizons measured in months and years, not seconds, days or even weeks.

The latest catalyst that investors seem to be trying to predict is a potential trade deal with China (not to mention the rest of the US’s trading partners). While we do not trade based on event predictions, we think it is likely that the US and China will ultimately reach an agreement. But the risk that the US/China relationship deteriorates has risen since the beginning of the year, and this reinforces our emphasis on quality and stable growth over cyclicality.

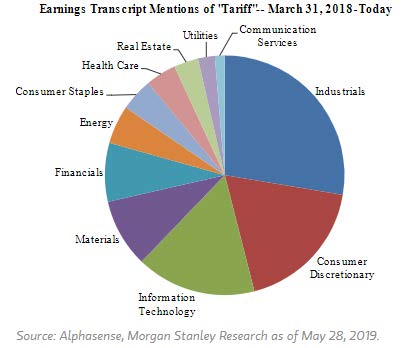

The below chart from Morgan Stanley shows the mentions of the word “tariff” on companies’ quarterly earnings calls. The sectors most concerned about tariffs are the most global and cyclical sectors. Sectors such as Utilities, Health Care and Consumer Staples (our most overweighted sectors) are among the sectors mentioning tariffs the least. So, whether one is focused on the slowing profit cycle as we are or are concerned about trade wars, the appropriate investment positioning seems generally the same.

Mentions of ‘tariff’ on corporate earnings calls: Sector breakdown

Source: Richard Bernstein Advisors LLC, Morgan Stanley

Source: Richard Bernstein Advisors LLC, Morgan Stanley

Dan Suzuki, CFA

Portfolio Strategist

For more information About Dan Suzuki, please click here.

Richard Bernstein Advisors is a participant in the ETF Strategist Channel.