By: BCM Investment Team

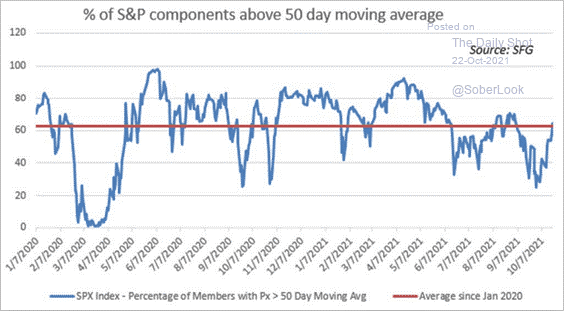

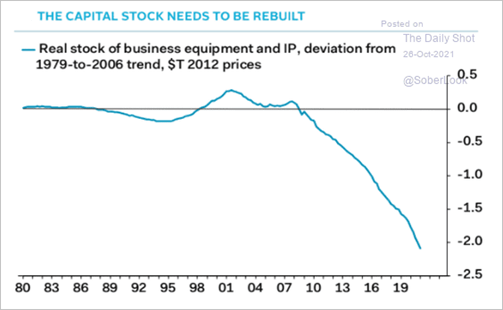

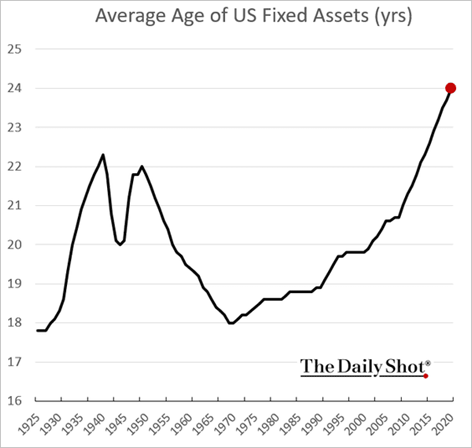

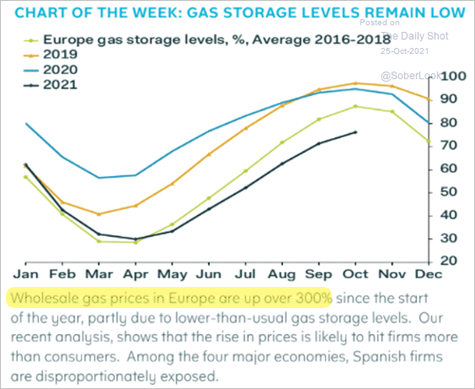

The Markit Manufacturing PMI came in slightly below expectations in October at 59.2, easing a bit from September’s high but still demonstrating robust growth. Price pressures, both input and output, remain near extremes as supply bottlenecks persist, and prices are climbing in the Services sector as well. Despite this creeping economic threat, equities climbed to record highs ahead of a lynchpin earnings week that’ll see 30% of all S&P 500 companies—including headline names like Amazon, Alphabet, and Apple—report. Is that record strength really just another demonstration of the mega-cap’s influence though when barely more than half the index was above their 50-day moving average? And what effect will rapidly aging fixed assets and the recent lack of capital expenditures have on future spending plans—not to mention returns and buybacks? And as the U.S. deficit climbs to $2.77 trillion, the second-highest level on record, and more than 50% has a maturity of under five years, what effect will an unwind have on the economy? Will new Covid variants and accelerating case counts have something to say on the matter?

1. The Markit manufacturing PMI confirmed the NY and Philly Fed’s surveys results—a return to slower growth. Meanwhile, inflation continues to work its way into what we buy—a trend that’s taking hold in Europe as well:

2. Inflation takes time, as do the reactions to it. Does bias prevent earlier recognition?

3. Just how healthy is the market? It hit a record high last week, yet ~300 of the 500 were below their 50-day moving averages:

4. Has the age of massive stock buybacks come at an unintended (or intended) cost? What will the ramifications be for the future if the trend continues?

5. Will corporations need to start spending on replacing their capital assets?

6. 2021 suffered the second-highest federal deficit on record following last year’s record. With a 5.9% CPI increase to government outlays in 2022, along with the higher interest rates bloating our interest expenses, the amount of new debt to be financed will be staggering. This is before the ~$3 trillion in the spending bills that are being contemplated by Congress. The Fed is going to start tapering soon. Sorry to ask again, but who will be buying all this bond supply? And at what rates?

7. The FED will not be alone in its taper as the world’s central banks are all expected to taper at the same time. Trillions more in bond supply will hit the market. If demand stays constant, and supply roughly triples, what does Economics 101 say will happen to price?

8. Only ~20% of the current U.S. debt has the interest rates locked up for 10 years or more. Over half has a maturity of 5 years or less, all subject to “transitory” inflation, a massive supply imbalance, and higher rates:

9. If anyone is looking for an inflationary energy shock, it is all around us!

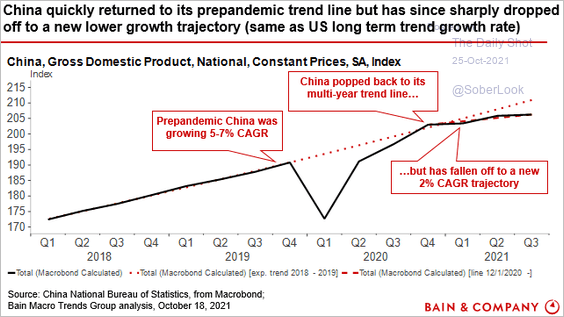

10. Is the world’s second-largest economy now stuck in a 2% growth mode?

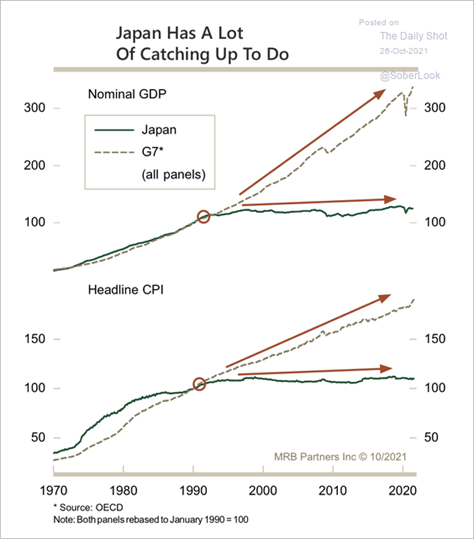

11. The world’s third-largest economy has been in a low growth, low inflation mode for 30 years. They have never recovered from their real estate bubble in the late eighties:

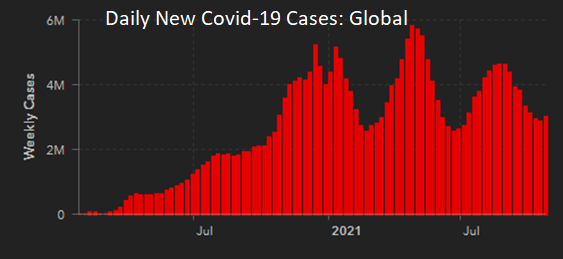

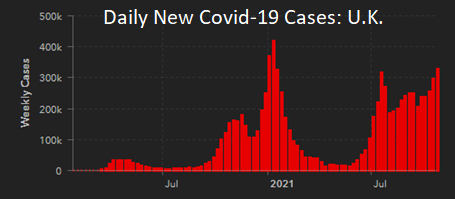

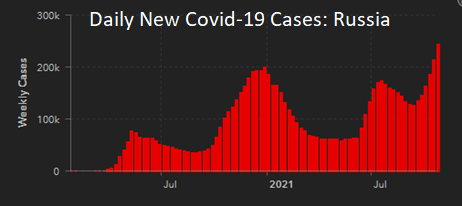

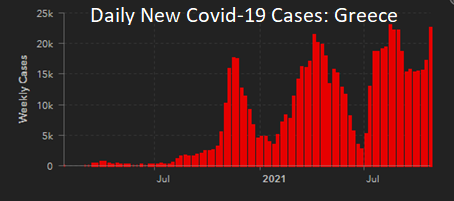

12. Does the Delta variant’s new mutation need to cause concern? Global Covid cases are rising again, and many parts of Europe are getting hit hard:

World:

The U.K.:

Russia:

Greece:

This article was contributed by Beaumont Capital Management, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.