Talking Points: Fixed Income Positioning from Stringer Asset Management on Vimeo.

Managing fixed income strategies in a low interest rate environment has been a challenge for years. Recently, the shifting U.S. Federal Reserve (Fed) policy, changing economic circumstances, and inflationary dynamics stemming from the pandemic have exacerbated the challenge for many passive fixed income investors. Just as 2021 offered excellent tactical opportunities for active managers to outperform passive strategies, we think changes over the year ahead offer new challenges and opportunities.

Inflationary concerns have been at the forefront as pent-up demand and excess liquidity met supply side constraints and input cost pressures. The Fed has held firm on the dot plot, which called for accommodative monetary policy into 2023. Having debated the transitory nature of post Covid-19 inflation for more than a year, the Fed has finally decided that some of the inflationary pressures are stickier and likely to linger longer than expected. Whether they waited too long or not is still unknown. In the current environment, we expect to see an expeditious shift away from previous accommodative policies, which may necessitate a closer look at fixed income positioning moving into 2022.

In addition to holding its target rate close to zero, the Fed continued a healthy expansion of the balance sheet to support bond prices across the yield curve. During this period, a barbell strategy using Treasury Inflation Protected Securities (TIPS) out further on the yield curve and nominal bonds on the short end fared well. With the expectation of the impending taper in bond purchases and faster rate hikes as indicated by the Fed recently, bond positioning for 2022 will be more of a challenge for passive investors.

To get a clearer picture of the impact of a Fed taper, we can look at the spread between the nominal 10-year Treasury yield and the Consumer Price Index (CPI). Though bond investors are not getting paid what they used to for inflation risk, the current nominal 10-year Treasury to CPI spread stands out. In November, the U.S. Consumer Price Index (CPI) hit a near 40-year high while the yield on the 10-year Treasury remains well below 3%. This should be a concern for bond investors if inflationary pressures persist longer and higher than TIPS breakeven spreads currently suggest.

A tapering of asset purchases by the Fed could prove to be a double edge sword for the bond market in 2022. On one hand, any pullback in bond purchases should impact the demand supporting prices. On the other hand, there is the lingering question of the efficacy of the Fed’s plans regarding the pace of tapering. As it stands, we believe a slow pace of the taper will do little to combat inflation. Additionally, some inflationary pressures, such as wage rates and rents, tend to be persistent.

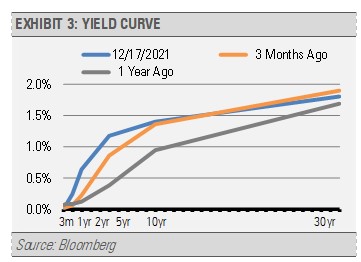

If inflation persists as expected, the Fed will speed up the pace of rate hikes baring any additional downside surprises to the economic landscape. This would send a message to the long end of the curve while increasing short-term rates and eventually flattening the yield curve. We are already seeing a glimpse of yield curve flattening just from market anticipation.

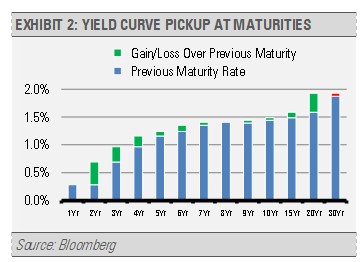

We think there is little value in taking on duration out past 10-years, as the 10-year to 30-year area of the yield curve flattens and perhaps even inverts. The shorter end of the bond market gets more difficult as we move into 2022 with potential Fed rate hikes accelerating rising short-term rates that impact bonds in this area of the yield curve.

While it may seem fairly intuitive to own TIPS in an inflationary environment, we have to also understand that the bond market is a forward-looking mechanism that is already discounting a change in inflation dynamics and Fed policy. Long duration TIPS, which worked well over the past year, should become less attractive as the Fed gets serious about combatting inflation. While there is still some benefit from further CPI adjustments, the market tends to price these changes in well before they become a reality by weakening demand. Currently, we are not seeing a lot of value in the various spread sectors, which creates a conundrum as the yield advantage over U.S. Treasuries helps mitigate some of the downside from rising rates.

In this environment, lower duration than the broad fixed income market makes sense. The most value in the yield curve currently lies in the 3- to 5-year area with 3-year maturities offering the most value when considering risk as measured by duration in our opinion. With a potential shift in policy, we think keeping the overall duration within the 5-year range is the most attractive with an allocation to floating rate bonds on the short end. We still favor TIPS at this point; however, we have reduced exposure and shortened the duration of our TIPS position. As for sector allocations, there is not a lot of value when considering where option adjusted spreads lie relative to their historical averages. High yield bonds are the clear standout here with spreads way below their 5-year averages as we head into an environment that is vulnerable to Fed policy mistakes. Under this scenario, we favor bond sectors that have better relative value, such as investment grade securitized bonds and senior loans, which are higher up in the capital structure than high yield and have floating rate coupons.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.