By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

We have seen a dramatic flattening in the yield curve in response to the U.S. Federal Reserve (Fed) raising short -term rates (exhibit 1). Recently, there has been a slight inversion which would indicate perhaps the Fed has overstepped. Given that Fed policy errors are usually at the root of most recessions and large equity market selloffs, investors should consider what a flattening or inverted yield curve is telling us about the potential risks.

In the current environment, many fixed income investors may see little value in taking on duration risk. One long standing yield curve strategy has been to shorten duration when the curve flattens, which seems logical as a risk averse investor would want to decrease interest rate risk for the same return. However, shortening duration may not make sense for those investors who are using fixed income within a diversified asset allocation strategy. While there may be value in yield curve strategies for certain types of investors, we do not believe shortening duration when the yield curve flattens or inverts is a viable trading strategy for asset allocation portfolios.

The idea of asset allocation is to have a diversified portfolio of low or even non-correlated assets that perform relatively independent of each other. This should protect the portfolio when one asset class may not be performing as well. Thus, the purpose of the fixed income allocation is to help offset poor equity performance during a slowdown in the economy.

An inverted yield curve has historically been a leading indicator of economic slowdown, therefore following a strategy of shortening duration as the yield curve flattens takes away from the interest rate sensitivity of the bond portfolio.

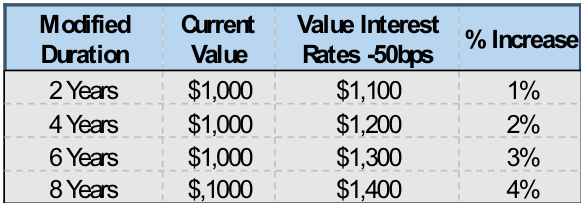

Duration is a measurement of a bond’s price sensitivity to moves in interest rates. The longer the duration, the more sensitive the bond’s price is to interest rates. Given the inverse relationship between a bond’s price and yield, it would not benefit an asset allocation portfolio to shorten duration in this type of environment in our opinion.

As a basic example, assume a portfolio holds a bond with a 6 -year duration. As the yield curve flattens, the investor can swap into a 2-year duration bond and earn the same yield to maturity with less interest rate risk. This trade may make sense for shorter-term investors and traders. However, an investor depending on the fixed income allocation’s protection during a risk off event, such as an equity sell off, may be disappointed with the result. The table below demonstrates the price impact of a 50 basis point parallel decline in interest rates on bonds with different durations.

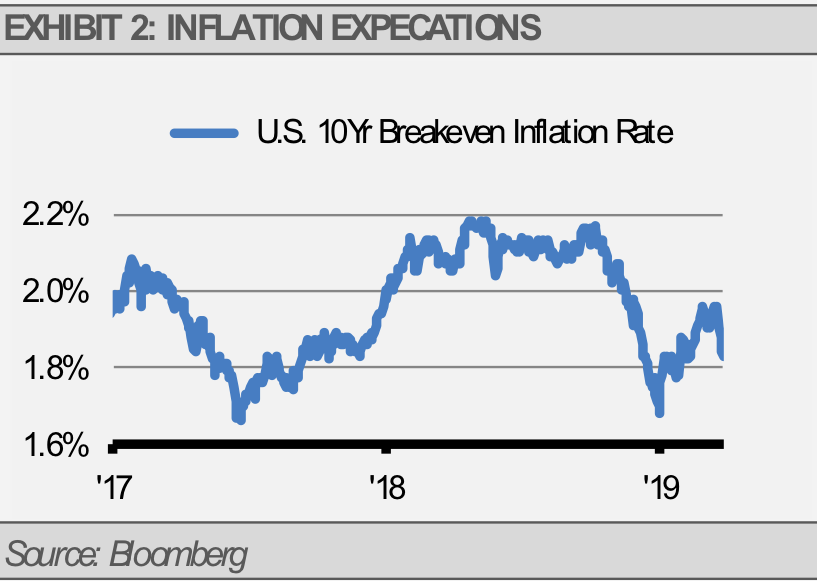

Generally, when there is an economic slowdown, or the expectation of one, a few things can happen that can lead to lower rates and benefit longer duration bonds. First, there is little inflationary pressure during a slower growth period, which leads to lower inflation expectations and inflation risk premiums (exhibit 2). As a result, investors find lower yields and higher bond prices during this environment. Recently, we have seen inflation expectations fall off from their 2018 highs.

Another hallmark of an economic slowdown is that investors become less willing to take on risk. In this environment the risk-off trade occurs where equities are dumped in favor of the perceived safety of bonds. This extra demand works to push yields lower and high-quality bond prices higher.

Lastly, this is usually an environment where the Fed steps in and eases policy to stimulate the economy. The main stimulus tools for the Fed are lowering interest rates and or purchasing bonds, and both generally lead to lower bond yields and higher bond prices.

History can give us some insight into what a flat or inverted yield curve tells us. Almost every recession and large equity market decline has been preceded by an inverted yield curve. Importantly, the curve must flatten before inverting. Bond fundamentals show that the longer the duration of a bond, the more sensitive the price is to changes in interest rates. Therefore, giving up duration means less price increase when rates fall. For investors in asset allocation strategies, the bond portion of the portfolio should support the portfolio value when equities fall. We believe this makes long duration fixed income holdings more attractive for long-term asset allocation investors.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.