Housing costs make up approximately one-third of the Consumer Price Index (CPI) and are undoubtedly a major expense for most households each month. One measure within the CPI housing component is Owners’ Equivalent Rent (OER), which attempts to capture the cost of owning a home. This approach to quantifying homeownership is questionable not only because it results in limited and stale data points, but also because of the subjective nature of the process. Recently, as home values have soared and mortgage rates have risen, we have also seen a sharp uptick in this component of CPI indicating a growing burden on homeowner’s budgets.

With nearly two-thirds of U.S. consumers owning their own home, this sharp increase in the cost of home ownership would appear to have negative implications for the economy as household finances may appear strained. However, this may not tell the whole story. There are a few things to consider on this front with respect to both higher home values and higher mortgage rates.

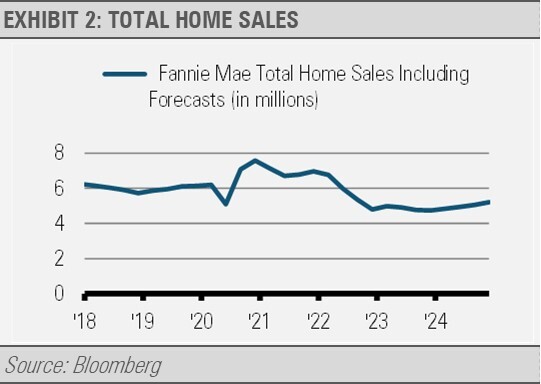

First, mortgage debt service has been on the decline for years. Despite higher home values and the recent spike in financing rates, many homeowners purchased their homes prior to the spike in home values so only those homeowners that have purchased homes over the past two years are potentially impacted. The chart below demonstrates the level of home sales and how this has declined over the past two years while values have risen.

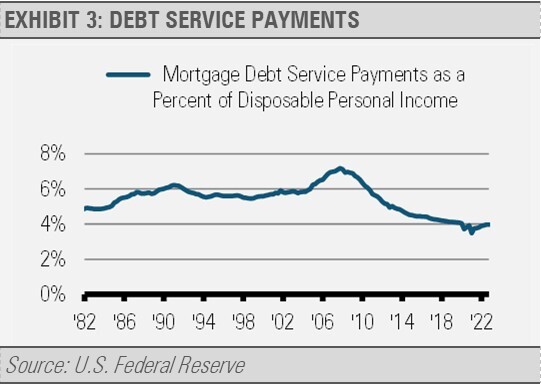

As it stands, the average outstanding home mortgage rate was 3.8% as of September 2022. This is well below the May 18th, 2023, average of 6.39% for a new 30-year fixed rate mortgage according to the U.S. Federal Reserve. The impact on more recent buyers has likely been offset by lending standards that are designed to guide new homeowners into mortgages within an appropriate percentage range of monthly income. This means that the majority of households owning their own homes have benefited from lower home values and mortgage rates relative to their income over the years as the following chart indicates.

With historically low mortgage debt service, U.S. consumers likely have more flexibility to weather inflationary pressures and are in better condition than they were during previous economic cycles. Additionally, many of these households are in much better equity positions as well. While home values have pulled back recently, they have been very resilient to rising mortgage rates.

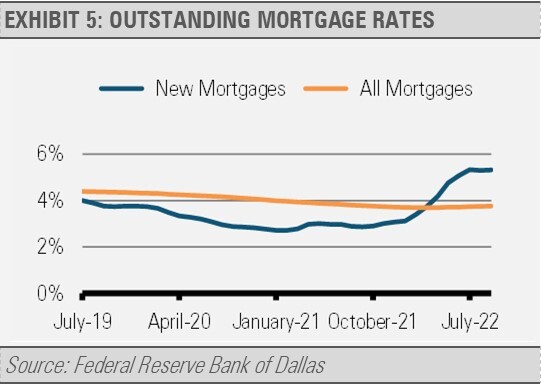

Another important consideration is the make-up of the mortgage loans outstanding. With 96% of mortgage loans outstanding being fixed rate, the average interest rate across all mortgages is less than 4%. As interest rates decline, it is more attractive to borrow at a fixed rate, which can reduce the risk that interest rates would rise, and the mortgage rate would adjust upward. This lock in at a low fixed rate is positive for most homeowners who have purchased homes and refinanced before rates increased.

Finally, history suggests that as interest rates move higher fewer low interest rate mortgages turnover. This is because very few refinancing opportunities make sense, and homeowners are less likely to voluntarily move as they are not incentivized to pre-pay their mortgages. This leaves cases where households are transferred for work, which has become less likely with remote work environments, or move irrespective of affordability. The Constant Prepay Rate (CPR) is a good proxy for how fast mortgages are turning over. It measures the level of principal prepayments coming from sales, defaults, scheduled and unscheduled monthly principal payments, and refinancing activities. The CPR levels for a generic mortgage pool with a weighted average mortgage rate of approximately 3.77% have declined substantially as mortgage rates have increased over the past year. The chart also displays the spike in prepayments when mortgage rates hit lows after the pandemic. This historic spike demonstrates the amount of refinancing activity that occurred at record low mortgage rate levels.

To summarize, while we believe that the current high inflationary environment has created challenges for consumers, we do not believe that higher mortgage rates have had as negative of an impact on the consumer and discretionary income as might be expected. The higher cost of homeownership reflected within the Consumer Price Index is not actually representative of what real homeowners are experiencing. While we believe that over time higher mortgage rates will weigh on home values and affordability, they are not currently creating a burden on the majority of consumers owning their own homes.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.