Talking Points: The Slow Pace of Fed Tapering from Stringer Asset Management on Vimeo.

On November 3rd, the U.S. Federal Reserve (Fed) announced that it will reduce, or taper, it’s $120 billion in monthly purchases of U.S. Treasuries and agency mortgage-backed securities by $15 billion per month. Additionally, the Fed expects to end those purchases by June of 2022. We estimate that this policy will inject an additional $400 billion into the U.S. financial system on top of the trillions of dollars the Fed has already pushed into the system.

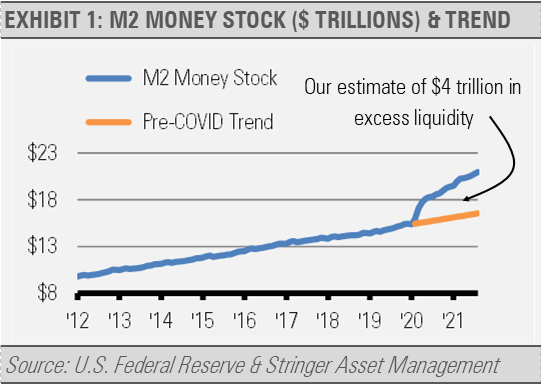

The strengthening employment picture and previous fiscal and monetary stimulus has added roughly $4 trillion in excess cash and cash equivalents to the U.S. economy by our estimate. That amounts to an roughly 20% of the size of the U.S. economy in excess liquidity that the economy would not have received without the pandemic and the resulting government response. The gradual reduction in bond purchases by the Fed will add to the deluge of cash already present in our system. Importantly, a lot of that excess cash will be spent or invested over time as consumer demand and global economic forces find a way to absorb the excess capital.

The economy has already recovered to its pre-pandemic level and is at or near capacity. We think that the latest stimulus measures will prove to be unnecessary and that any continued bond purchases by the Fed will build on the already massive amount of liquidity in the financial system.

The unemployment rate is currently falling at four times the pace of the previous business cycle. Also, a record number of businesses have said that they intend to continue to increase wages even as the Employment Cost Index is increasing at its fastest pace in more than 25 years. Finally, consumer demand for goods of all types has outstripped the economy’s supply, which has contributed to nationwide shortages.

With the economy already operating at capacity, any additional liquidity will likely not add to real inflation-adjusted economic growth in our opinion. While an $400 billion increase on top of the trillions already injected into the financial system may not be overly inflationary, it will not likely ease inflationary pressures either.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.