It’s a wild world. There are so many issues confronting investors these days it’s difficult to prioritize a single important one. The matter/antimatter relationship between stimulus and COVID-19, the upcoming election, geopolitics, employment, contracting globalization, and others all fight for headlines. Rather than picking one topic to highlight this month, we thought it more appropriate to briefly share our thoughts on several.

Uncertainty

Uncertainty is a hackneyed theme today, but few investors appreciate the past several years has been an unprecedented period of uncertainty. Those high levels of anxiety have likely contributed to companies’ preference for risk-averse capital allocation strategies such as dividends and share repurchase to riskier strategies like expansion of plant and equipment.

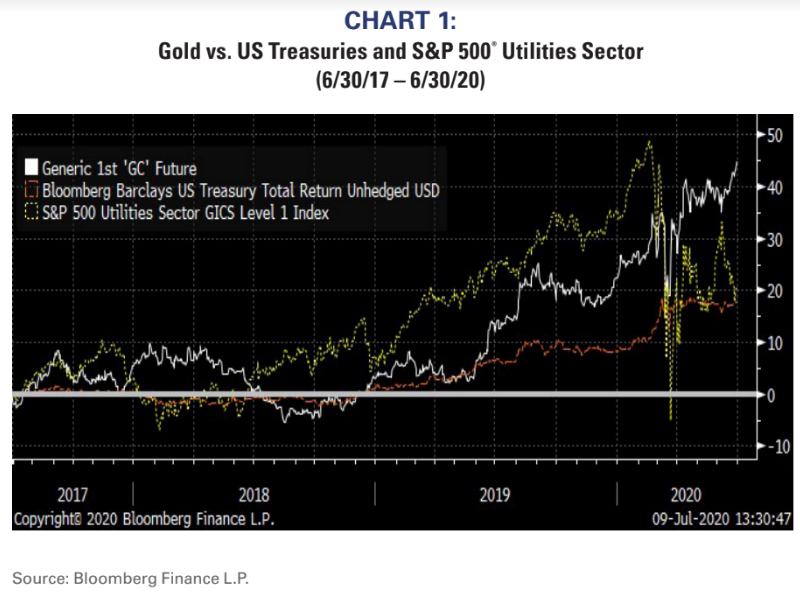

Gold has historically been a viable hedge against uncertainty, and it has indeed been among the best performing asset classes. Over the past 3 years, gold has actually outperformed other traditional safe haven assets like Treasuries and utilities stocks (Chart 1).

Matter vs Antimatter: Stimulus vs. COVID-19

When antimatter touches matter, the universe is destroyed. If COVID-19 offsets historic stimulus, one should make sure their portfolio doesn’t get “destroyed.”

We remain concerned about the push and pull between the positives of historical fiscal and monetary stimulus and the negative of spreading COVID-19. We mentioned in January (before most investors had even heard of coronavirus) the spread of the virus would become a political issue and how important it would be for investors to take their cues from scientists and not politicians. COVID-19 has unfortunately become a main political issue, and investors seem to be ignoring some of the risks the virus still presents.

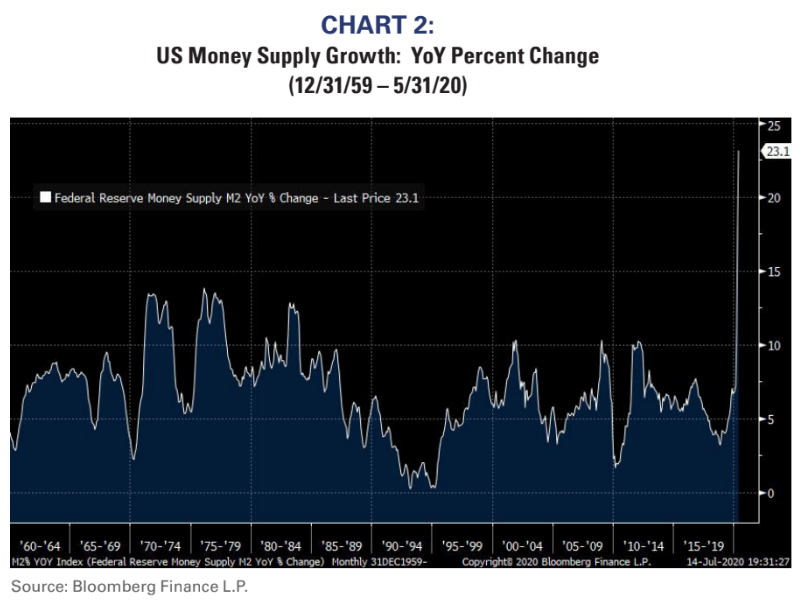

Chart 2 highlights some matter in the matter vs. antimatter showdown. US money growth is the fastest in more than 60 years of history. M2 growth is now roughly 2/3rd faster than that during the inflation-prone 1970s and more than twice as fast as during the early-2010s when investors were concerned that periods’ money growth would lead to significant inflation.

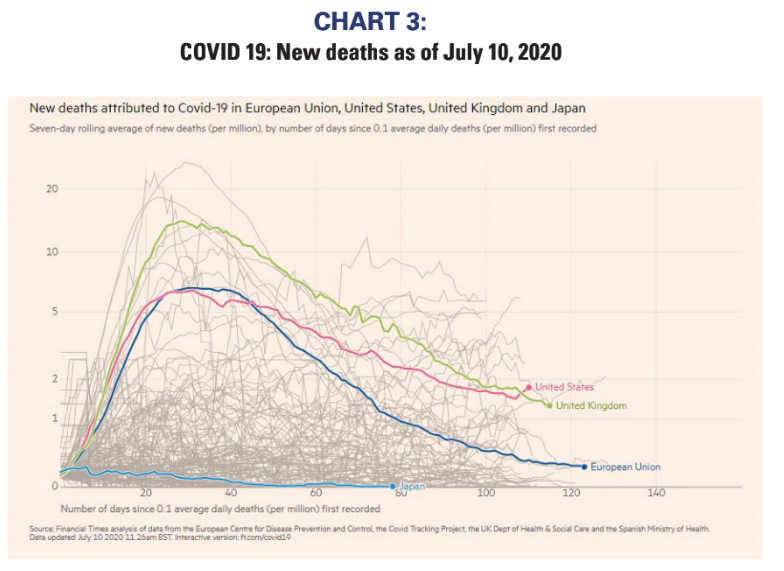

However, the antimatter risk remains significant. The US’s COVID-19 response has been haphazard, and case counts, hospitalizations, and deaths (see Chart 3) remain elevated relative to those in other developed countries. The current acceleration in US COVID-19 data is already having a detrimental effect on corporate profits and employment, and is contributing to market volatility.

Taxes and the 2020 Presidential election

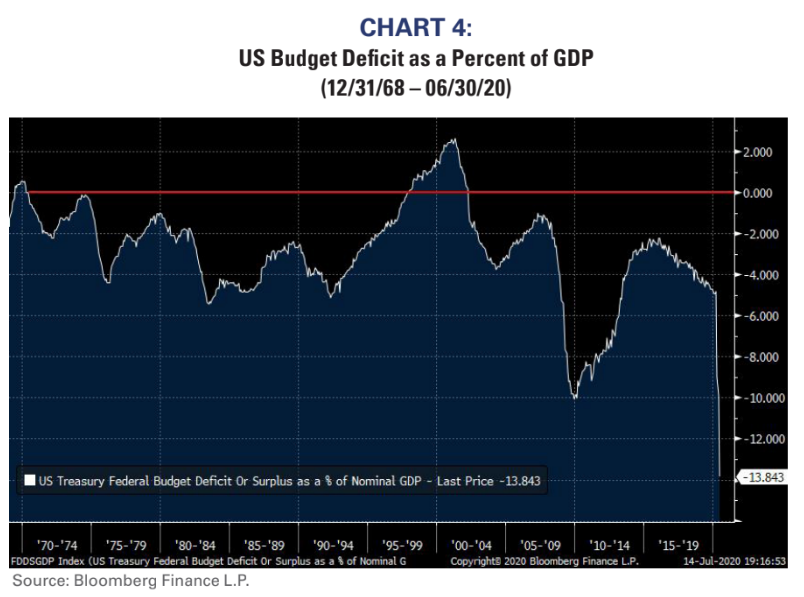

Tax policy will be a highlighted issue during the upcoming Presidential campaigns. Our conclusion is taxes will likely increase regardless of which party wins the White House. Because the US’s finances are in such poor shape and foreign buyers are less willing to purchase US treasuries, the reality is it will be impossible to alleviate the US’s financial problems without raising taxes.

One could argue raising taxes is good or bad policy, but that’s a political discussion and not an investment discussion. It is relatively clear taxes will at least not be lower during the next Presidential term given the chances of a split Congress and the current poor state of the US’s financial position. If the existing tax policies remain in place, then that is simply the status quo with which the markets are familiar.

If investors want to look for opportunities, it seems worthwhile to look objectively and dispassionately at the opportunities increasing taxes might present.

Chart 4 shows the US budget deficit as a percent of GDP. The current deficit now exceeds that associated with the Great Recession. Of course, the program spending associated with the deficit were a necessary cushion for the economy, but such spending has nonetheless left the country in a precarious financial position.

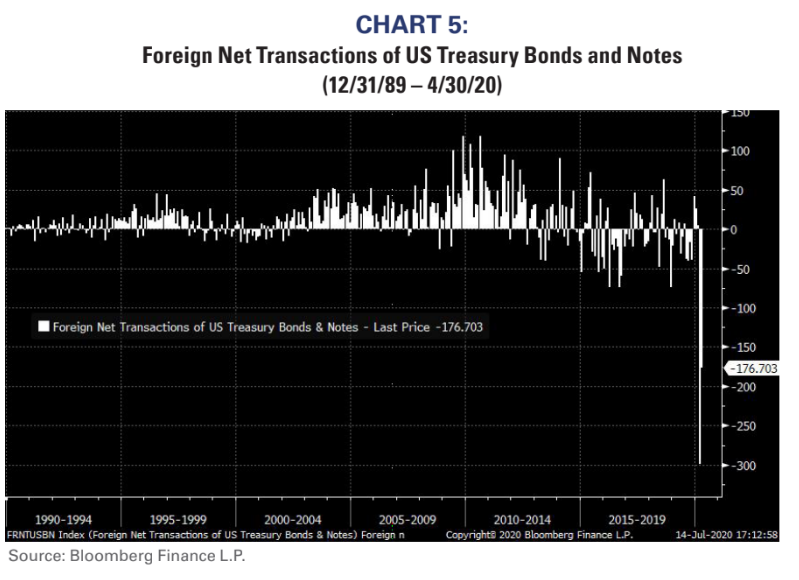

One meaningful difference between 2009’s deficit and today’s is non-US investors were willing to finance US spending. That is increasingly untrue today. Chart 5 shows the total net foreign purchases of US Treasury Notes

and Bonds. In 2009, net flows were positive. Today they are negative suggesting other countries are less willing to finance US deficits. The change in net flows carries important implications for tax policy. Because Medicare, Medicaid, Social Security, interest on existing debt, and defense are the major spending categories, it is highly unlikely that government spending will be meaningfully cut. So, the US is left with a simple choice: raise taxes or have the Fed monetize the debt like a 3rd world country. It’s our guess both will happen, but one way or the other taxes are likely to increase. Few investors seem prepared for increasing taxes.

Monetary policy fueling speculation rather than real growth Recent stock performance suggests the transmission mechanism between monetary policy and the real economy has broken down. The Fed used to lower interest rates with the intent to spur bank lending to high multiplier sectors like housing and autos. Today, it appears as though lower rates simply spur financial speculation and the stated intent of the Fed’s actions is to quell financial market volatility.

Chart 6 shows the stocks of US exchanges and firms that support trading have outperformed traditional commercial banks during 2020. Real economy lending seems to be taking a backseat to financial transactions.

It’s a Wild World

Investors can be certain about only one issue. Namely, there will be continued uncertainty. The breadth of issues currently confronting investors is astounding. Black swans are no longer single events. Rather, a full flock of

black swans are swimming freely. The word “unprecedented” is being used with unprecedented frequency!

Our portfolios have continued since April to be incrementally, yet prudently, more cyclical. The sheer magnitude of fiscal and monetary stimulus is so far winning the matter/antimatter battle. However, investors who ignore

COVID-19 do so with considerable risk. The US’s response continues to be subpar relative to other developed nations’ efforts.

We simply can’t get rid of our ear worm: “Ooh Baby, Baby it’s a wild world…”.

To learn more about RBA’s disciplined approach to macro investing, please contact your local RBA representative.

Nothing contained herein constitutes tax, legal, insurance or investment advice, or the recommendation of or an

offer to sell, or the solicitation of an offer to buy or invest in any investment product, vehicle, service or

instrument. Such an offer or solicitation may only be made by delivery to a prospective investor of formal offering materials, including subscription or account documents or forms, which include detailed discussions of the terms of the respective product, vehicle, service or instrument, including the principal risk factors that might impact such a purchase or investment, and which should be reviewed carefully by any such investor before making the decision to invest. RBA information may include statements concerning financial market trends and/or individual stocks, and are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially, and should not be relied upon as such. The investment strategy and broad themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information contained in the material has been obtained from sources believed to be reliable, but not guaranteed. You should note that the materials are provided “as is” without any express or implied warranties. Past performance is not a guarantee of future results. All investments involve a degree of risk, including the risk of loss. No part of RBA’s materials may be reproduced in any form, or referred to in any other publication, without express written permission from RBA.

Links to appearances and articles by Richard Bernstein, whether in the press, on television or otherwise, are

provided for informational purposes only and in no way should be considered a recommendation of any

particular investment product, vehicle, service or instrument or the rendering of investment advice, which must always be evaluated by a prospective investor in consultation with his or her own financial adviser and in light of his or her own circumstances,

including the investor’s investment horizon, appetite for risk, and ability to withstand a potential loss of some or all of an investment’s value. Investing is subject to market risks. Investors acknowledge and accept the potential loss of some or all of an investment’s value. Views represented are subject to change at the sole discretion of Richard Bernstein Advisors LLC. Richard Bernstein Advisors LLC does not undertake to advise you of any changes in the views expressed herein.

© Copyright 2020 Richard Bernstein Advisors LLC. All rights reserved. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS