By Solomon G. Teller, CFA, Chief Investment Strategist, Green Harvest Asset Management

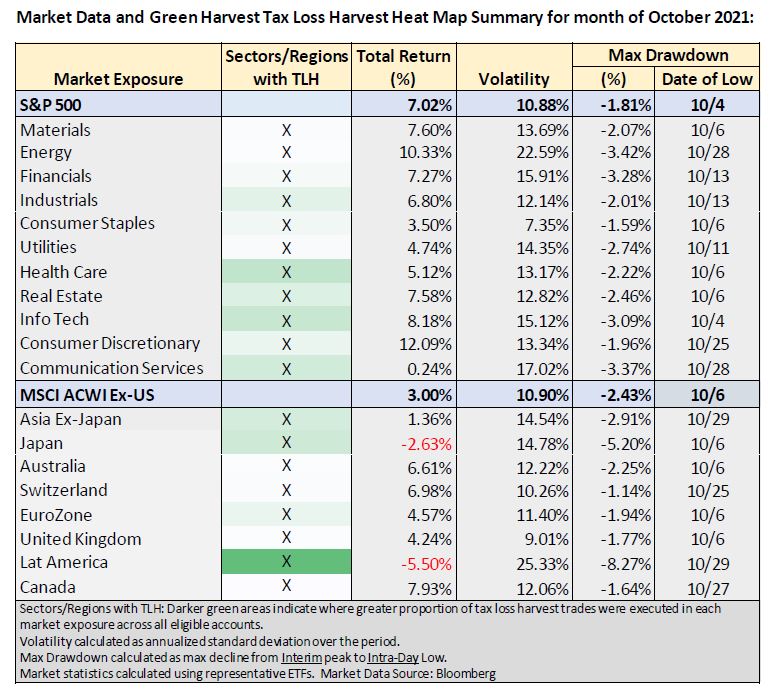

Stocks rocketed in October with the S&P 500 gaining 7.0% to achieve a new all-time high. Despite strong pre-tax returns, there are almost always opportunities to capture or harvest tax benefits to improve after-tax returns, and this month was no exception. Below are harvesting highlights for October with accompanying chart and statistics on page 2:

- We captured the most tax benefits in the Healthcare sector. While its 2.2% intra-month drawdown was just below average, Healthcare stocks found fresh new lows (which, for our clients was a good thing). On three separate occasions early in the month, they briefly bottomed, offering repeated opportunities to harvest. Healthcare is typically one of the least volatile sectors, and true to form, the sector recovered by month-end, returning 5.1% for the month.

- The Energy sector on the other hand, offers an illustrative contrast. Regular readers may recall that Energy was the sole sector to gain in September during the broader market’s pullback. As such, this sector’s October declines didn’t offer many new opportunities to harvest, as many accounts had already experienced the prior month’s gains.

- Outside the U.S., harvesting opportunities were even greater. International stocks have scarcely kept pace with their U.S. counterparts and some areas, such as Latin America, are down for the year. While the S&P 500 is up 24.0% year-to-date, Japan is up just 2.0% and China and Latin America are both down by double digits.

- Having recently peaked in June, Latin American stocks fell for four consecutive months to new 2021 lows in October. More than half of non-US and Global tax benefit capture was in this region.

- After Latin America, Japan and China were the two regions with the greatest number of harvesting opportunities.

Overall, October yielded solid returns for stock investors, particularly in the U.S. At the same time, Green Harvest capitalized on opportunities which captured tax benefits, helping clients further their after-tax investment goals.

Disclaimers:

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when the portfolio is liquidated. Current performance may be higher or lower than that quoted. Performance of an index is not illustrative of any particular investment. It is not possible to invest directly in an index.

GHAM does not provide tax advice and does not employ a Certified Public Accountant on its staff. We work with outside accounting firms and tax counsel that provide guidance and updates on relevant tax law, and we have reviewed the tax treatment of our transaction structures with those professional advisors. Based on those reviews, GHAM is satisfied that our structures support the desired tax results, but we urge clients to consult their own legal and tax advisors regarding the tax treatment of the transactions effected in their GHAM account. Such transactions include ETFs. Federal, state and local tax laws are subject to change. GHAM is not responsible for providing clients updates on any changes in tax laws, rules or statutes. Clients remain fully responsible for their own tax positions. Although GHAM does not provide tax, legal or accounting advice, we stand ready to assist clients and their advisors in reviewing the relevant tax rules.

Reasons to harvest capital losses, sources of capital gains and the suggestion that mutual funds distribute capital gains are for illustrative purposes only. The availability of tax alpha is highly dependent upon the initial date and time of investment as well as market direction and security volatility during the investment period. Tax loss harvesting outcomes may vary greatly for clients who invest on different days, weeks, months and all other time periods. A client’s tax alpha will depend on the client’s individual circumstances, which are outside of GHAM’s knowledge and control. All performance and tax benefit capture figures are derived from data provided from multiple third-party sources. All estimates were created with the benefit of hindsight and may not be achieved in a live account. The data received by GHAM is unaudited and its reliability and accuracy is not guaranteed.

This material is not intended to be relied upon as legal, investment or tax advice in any form or for any specific client. The information provided does not take into account the specific objectives, financial situation or particular needs of any specific person. All investments carry a certain degree of risk, and there is no assurance that an investment will perform as expected over any period of time.

As a convenience to our readers, this document may contain links to information created and maintained by third party sites. Please note that we do not endorse any linked sites or their content, and we are not responsible for the accuracy, timeliness or even the continued availability or existence of this outside information. While we endeavor to provide links only to those sites that are reputable and safe, we cannot be held responsible for the information, products or services obtained from such other sites and will not be liable for any damages arising from your access to such sites.