By Doug Sandler, CFA, Head of Global Strategy

SUMMARY

- US dollar strength remains a headwind for global markets.

- Corporate earnings can be resilient in inflationary environments.

- In our opinion, investors are more likely to see ‘value’ in financial markets if earnings hold up.

We are excited to release our October 2022 Chart Pack – our visual quarterly designed to walk investors through our views on:

- What’s happening and why,

- Predictions about what may come next,

- Positioning in our RiverFront portfolios.

In today’s Weekly View, we created a concise synopsis of three selected visuals from the Chart Pack that encapsulate a few key takeaways.

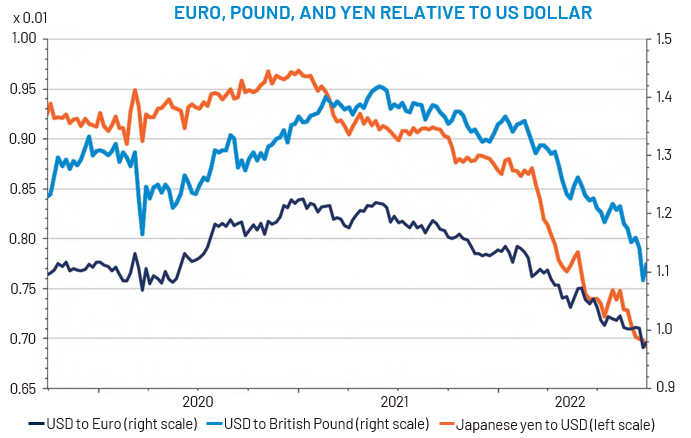

Dollar Strength: A Headwind for Overseas Economies

Source: Refinitiv Datastream, RiverFront; data daily, as of 09.30.2022. Shown for illustrative purposes only. *US safe haven status – The size of the US economy enables the country to sustain a large absolute amount of liquid debt, which is why investors coordinate around Treasury debt as the world’s safe asset.

We think the dollar’s recent strength underscores the attractiveness of US bond yields and the US‘ safe haven* status. However, it can also be a headwind for US corporate earnings…something we are watching closely.

Since global energy commodities are generally priced in dollars, foreign currency weakness (see chart, right) is effectively ‘importing’ inflation overseas, making Europe’s already difficult inflation situation worse.

We continue to favor US assets over international.

History Suggests that US Earnings Can Survive Inflation

Source: Refinitiv Datastream. RiverFront; data as of Q1 2022. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past. Shown for illustrative purposes only.

We think the most compelling bullish argument is that corporate earnings in the US have so far remained resilient.

The inflation recessions of the 1970s and early 1980s (see red circles on chart, left) saw relatively mild earnings downturns, compared to the much starker drops in earnings in the 2000 and 2008 recessions. If past inflationary periods are a good analog for today, earnings may prove robust.

Market Valuations: Reasonable… if Earnings Can Hold Up

Source: Refinitiv Datastream; data weekly, as of 09.30.2022. Chart shown for illustrative purposes only. See Definitions & Disclosures section for index definitions.

The S&P 500’s valuation is roughly 15.3 x 12-month forward earnings estimates…about 6-7 points cheaper than at the start of the year.

The more attractive valuation may be a mirage if earnings subsequently collapse. However, earnings forecasts have remained robust at around $234 per share, a meaningful increase from last year.

Conclusion:

The lingering inflationary impact of the global shutdown, government stimulus and supply chain disruptions have forced central banks to be more restrictive. The knock-on effects of more restrictive policy have also caused significant currency stresses across non-US markets. The net effects have been reduced growth forecasts and negative performance across all major asset classes in 2022. Going forward, Chairman Powell’s recent commentary, which suggests a faster pace of interest rate hikes and a higher terminal rate than previously thought, should continue to place pressure on the economy as well as stock and bond prices, in our opinion.

We are cautious on equities across all balanced portfolios versus our benchmarks. As a result, in our shorter-horizon portfolios, we are close to our COVID-19-level lows in equities, and our fixed income strategy still favors corporate bonds with shorter maturities. Our longer-horizon portfolios are also below the equity weighting in their benchmarks, but less so. In these portfolios, we have sought out high yield bonds and other alternative yield-oriented securities in an effort to increase expected yields across the portfolio, as well as favoring energy-related and technology companies versus cyclical consumer themes.

The reason we are not at historically high levels of cash is that stocks and bonds have already fallen significantly, making them both attractive to us on a longer-term basis. Given this, we think there is a case for longer-term optimism even as the shorter-term tactical outlook remains fraught with uncertainty.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

Earnings per share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. The resulting number serves as an indicator of a company’s profitability.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Buying commodities allows for a source of diversification for those sophisticated persons who wish to add this asset class to their portfolios and who are prepared to assume the risks inherent in the commodities market. Any commodity purchase represents a transaction in a non-income-producing asset and is highly speculative. Therefore, commodities should not represent a significant portion of an individual’s portfolio.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit riverfrontig.com or contact your Financial Advisor.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2516748