By Nicholas Porter

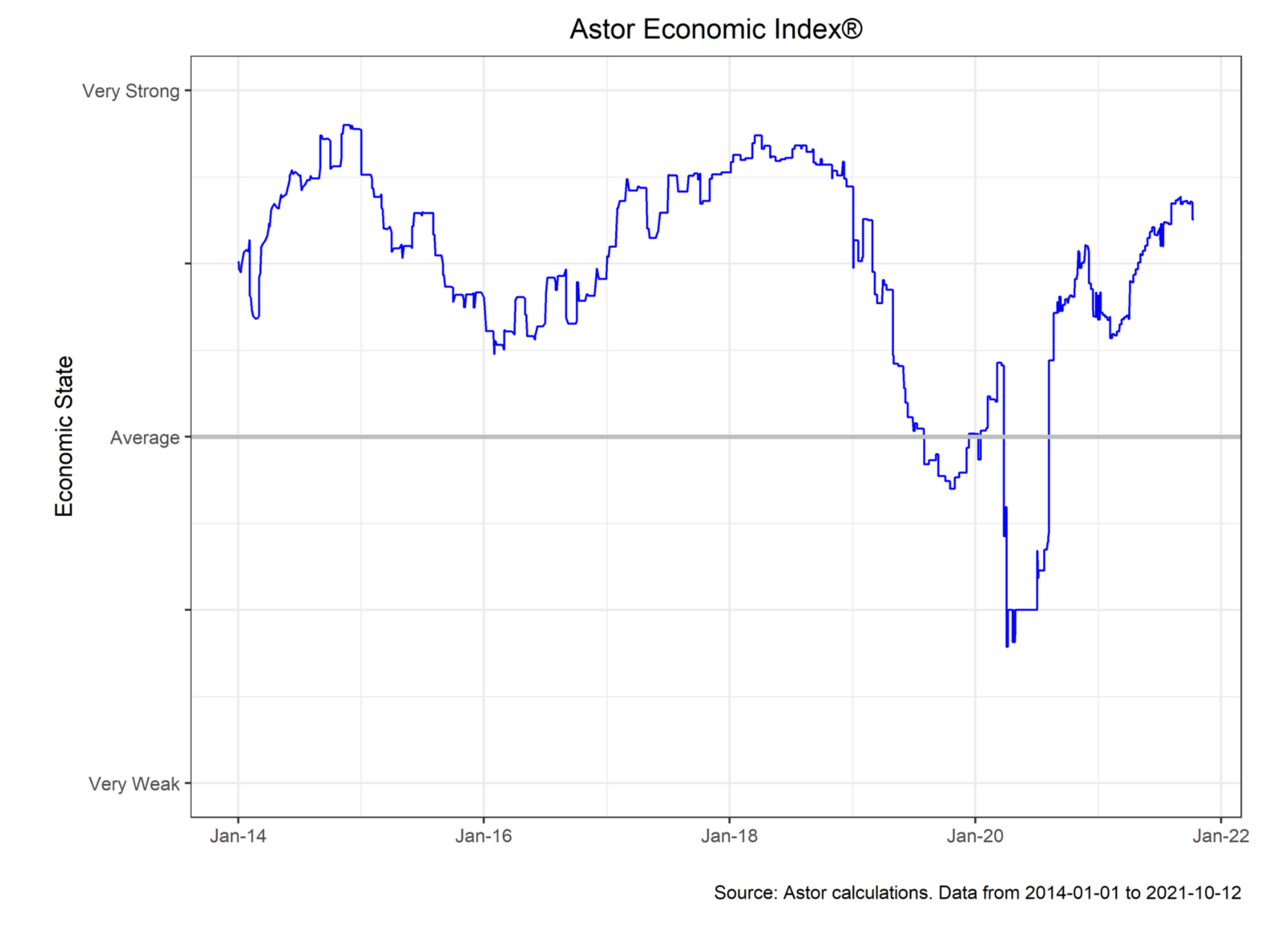

The Astor Economic Index moderated slightly in September after several months of steading readings, perhaps suggesting the peak of output growth during the post-pandemic boom is behind us. Nonetheless, the AEI remains consistent with a strong economic state: we delve into some of the numbers below.

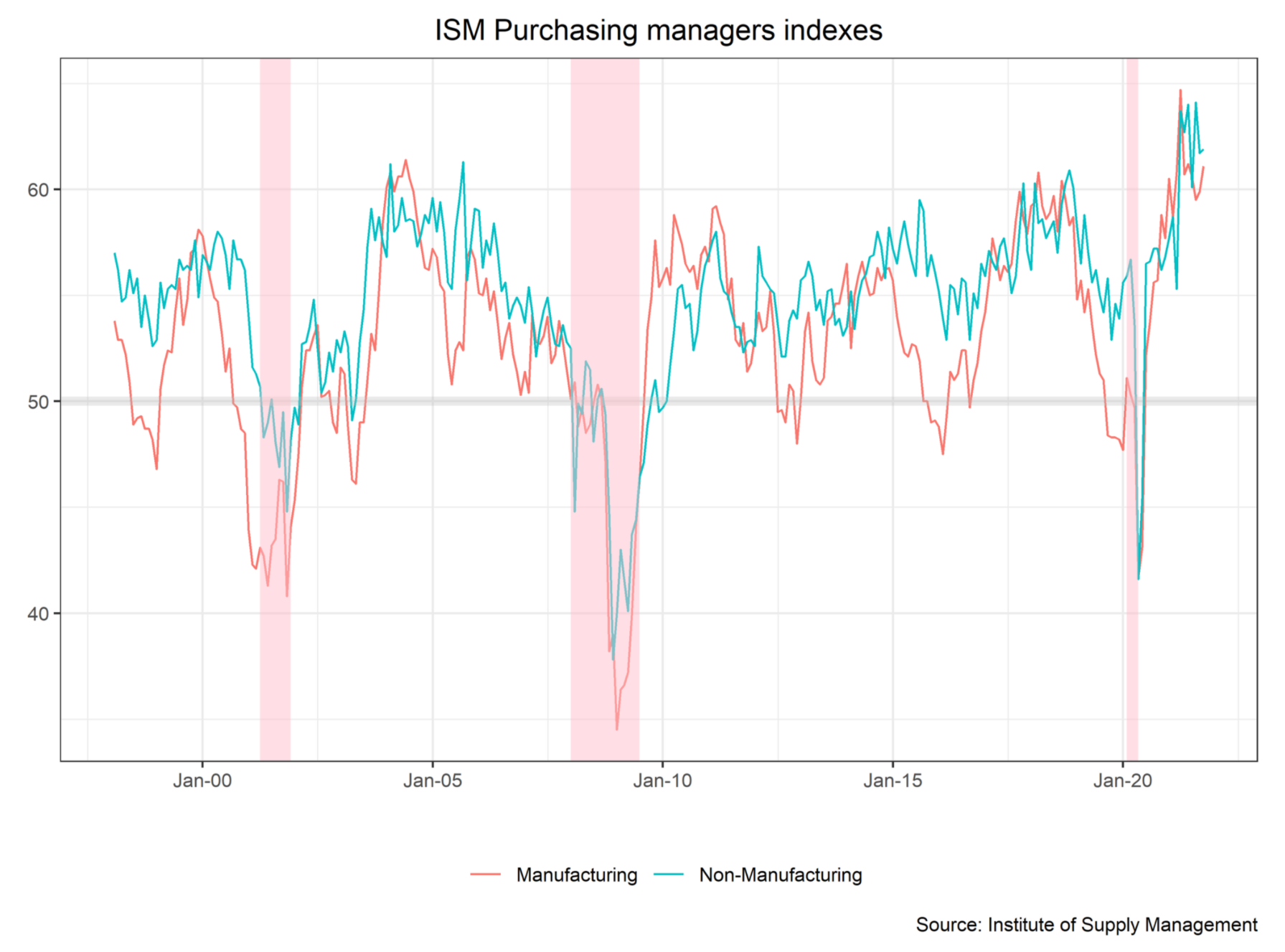

Part of the story behind the AEI’s continued strength are ISM Purchasing Manager Indices, which are at very strong levels for both manufacturing and non-manufacturing. Of late, however, they have begun to decline from their lofty heights from the summer. Respondents note that demand is robust, but that labor and supplies are hard to come by, and that bottlenecks are growing.

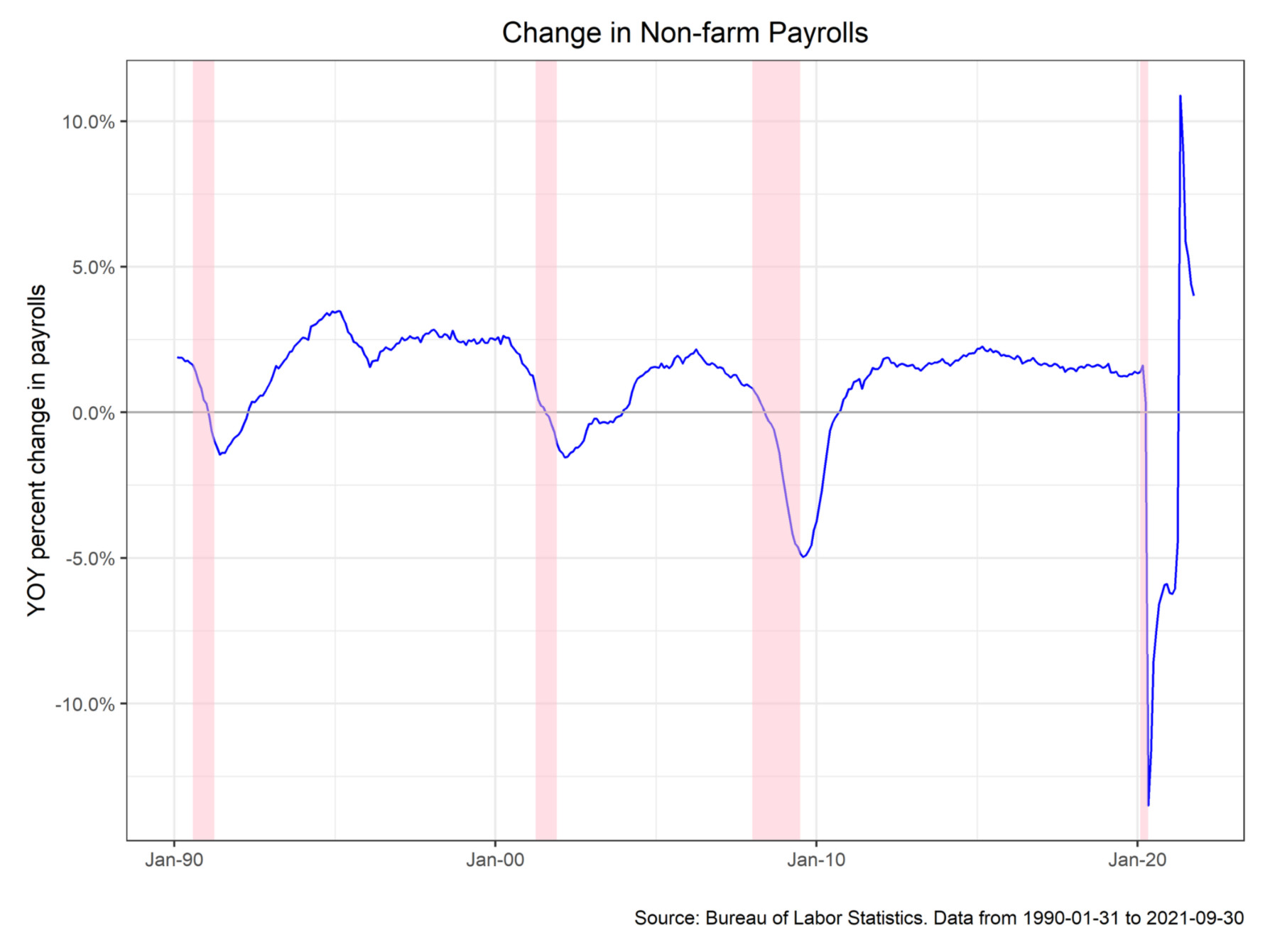

Meanwhile, non-farm payrolls disappointed to the downside in September, gaining a meager 194,000 vs consensus estimates of 474,000. August numbers were revised upwards to 366,000. However, some interesting details behind the payroll number that suggest things are not quite as grim as they look. Job losses were led by declines in local government employment (-144,000), suggesting difficulties with the usual seasonal adjustments from education workers, while private payrolls increased by 317,000. Average hourly earnings, meanwhile, increased strongly by 4.6% y/y, although the inflation adjusted number shows a decline of 0.8%. As a result, the door remains open for the Fed to begin tapering on schedule based on its litmus test of substantial progress towards full employment.

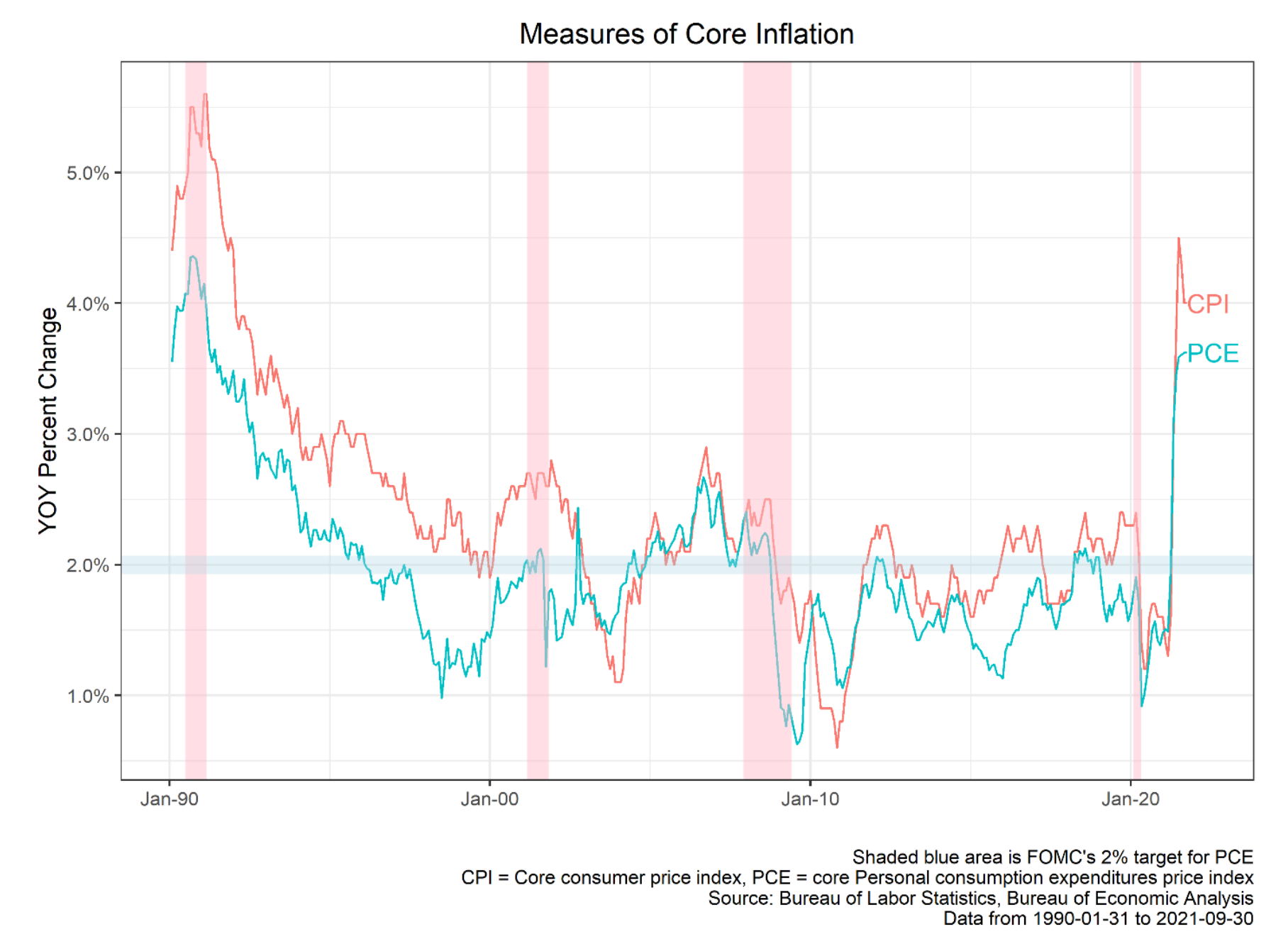

Speaking of tapering, inflation showed little sign of abating, with core CPI printing at 4.0% y/y (0.2% m/m), with headline inflation at 5.4% y/y. Here too, the details reveal some nuance behind the headline numbers that arguably cast some doubts about the transitory narrative. Notably, much of the gains were in “stickier” categories like shelter, which composes about a third of CPI. Price pressures in so called reopening categories like used cars and airfares are now slowing or in outright decline. The question ultimately is to what degree and how quickly supply chain issues abate, and whether the U.S. consumer changes their spending composition from goods to services.

In sum, the U.S. economy continues to show strength on the back of robust consumer demand. The interplay between price pressures and the real economy is an ongoing concern, and so the pace of real wage gains, increases in stickier inflation components, and continued supply chain turmoil will all bear close watching over the coming weeks.

For more news, information, and strategy, visit the ETF Strategist Channel.

Astor Investment Management LLC is a registered investment adviser with the SEC. All information contained herein is for informational purposes only. This is not a solicitation to offer investment advice or services in any state where to do so would be unlawful. Analysis and research are provided for informational purposes only, not for trading or investing purposes. All opinions expressed are as of the date of publication and subject to change. They are not intended as investment recommendations. These materials contain general information and have not been tailored for any specific recipient. There is no assurance that Astor’s investment programs will produce profitable returns or that any account will have similar results. You may lose money. Past results are no guarantee of future results. Please refer to Astor’s Form ADV Part 2A Brochure for additional information regarding fees, risks, and services.

AIM-10/15/21-OP464

All information contained herein is for informational purposes only. This is not a solicitation to offer investment advice or services in any state where to do so would be unlawful. Analysis and research are provided for informational purposes only, not for trading or investing purposes. All opinions expressed are as of the date of publication and subject to change. Astor and its affiliates are not liable for the accuracy, usefulness or availability of any such information or liable for any trading or investing based on such information. Please refer to Astor’s Form ADV Part 2 for additional information regarding fees, risks and services.