By Solomon G. Teller, CFA, Chief Investment Strategist, Green Harvest Asset Management

Volatility returned in November. While the ups and downs can be unnerving, they are an unavoidable part of long-term investing. On the bright side, volatility tends to increase opportunities for tax loss harvesting (TLH). Below are TLH highlights for November with accompanying chart and statistics on page 2:

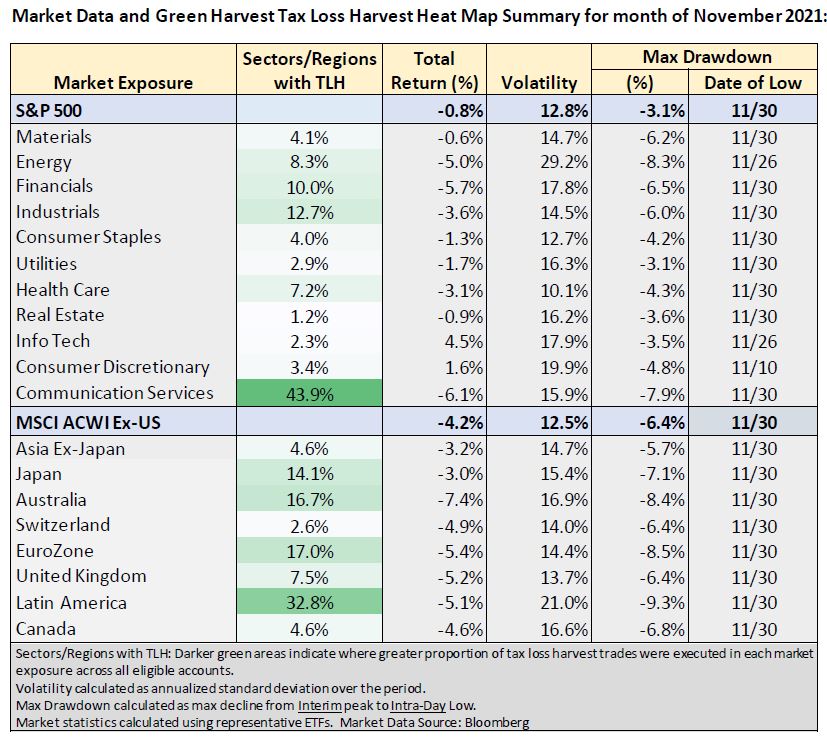

- In the U.S., just under half of all tax benefits captured were in one sector: Communications Services. Opportunities abounded in Communications stocks, as it was not just down the most of all sectors in November but also the worst performing in October.

- After Communications, Financials, Industrials and Energy, the next most harvested sectors, all declined significantly as well.

- Outside the U.S., Green Harvest harvested the most in Latin America, the region with the largest November intra-month drawdown. Latin America declined more than all other regions in October as well.

In the first few days of December, volatility remained and stocks continued to mostly decline. This offered adroit index investors numerous opportunities for systematically capturing realized losses to offset gains from other parts of their portfolios, such as hedge funds or mutual funds. As the year finishes, Green Harvest continues to capitalize on these opportunities, helping clients further their after-tax investment goals.

We wish you a warm and safe holiday season and a new year filled with opportunity. On a personal note, this will be my last post to you. It has been a supreme joy to have had a chance to serve Green Harvest’s clients and contribute to the growing field of after-tax efficient investing. All the best.

Disclaimers:

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when the portfolio is liquidated. Current performance may be higher or lower than that quoted. Performance of an index is not illustrative of any particular investment. It is not possible to invest directly in an index.

GHAM does not provide tax advice and does not employ a Certified Public Accountant on its staff. We work with outside accounting firms and tax counsel that provide guidance and updates on relevant tax law, and we have reviewed the tax treatment of our transaction structures with those professional advisors. Based on those reviews, GHAM is satisfied that our structures support the desired tax results, but we urge clients to consult their own legal and tax advisors regarding the tax treatment of the transactions effected in their GHAM account. Such transactions include ETFs. Federal, state and local tax laws are subject to change. GHAM is not responsible for providing clients updates on any changes in tax laws, rules or statutes. Clients remain fully responsible for their own tax positions. Although GHAM does not provide tax, legal or accounting advice, we stand ready to assist clients and their advisors in reviewing the relevant tax rules.

Reasons to harvest capital losses, sources of capital gains and the suggestion that mutual funds distribute capital gains are for illustrative purposes only. The availability of tax alpha is highly dependent upon the initial date and time of investment as well as market direction and security volatility during the investment period. Tax-loss harvesting outcomes may vary greatly for clients who invest on different days, weeks, months and all other time periods. A client’s tax alpha will depend on the client’s individual circumstances, which are outside of GHAM’s knowledge and control. All performance and tax benefit capture figures are derived from data provided from multiple third-party sources. All estimates were created with the benefit of hindsight and may not be achieved in a live account. The data received by GHAM is unaudited and its reliability and accuracy is not guaranteed.

This material is not intended to be relied upon as legal, investment, or tax advice in any form or for any specific client. The information provided does not take into account the specific objectives, financial situation or particular needs of any specific person. All investments carry a certain degree of risk, and there is no assurance that an investment will perform as expected over any period of time.

As a convenience to our readers, this document may contain links to information created and maintained by third-party sites. Please note that we do not endorse any linked sites or their content, and we are not responsible for the accuracy, timeliness or even the continued availability or existence of this outside information. While we endeavor to provide links only to those sites that are reputable and safe, we cannot be held responsible for the information, products or services obtained from such other sites and will not be liable for any damages arising from your access to such.