The broad equity markets continue to see an increased level of volatility, driven by technology-related securities. While the S&P 500 is in a bullish Market State, it is seeing an increased range of fluctuation, which it has not seen in several months. This increased range of fluctuation is partially due to the S&P 500’s heavy tilt towards technology-related securities and the health care sector. In fact, the S&P 500 has a 55% weighting in technology, communications, and health care. Any increased fluctuation in those sectors, which is the current case, will continue to be the cause of more volatility.

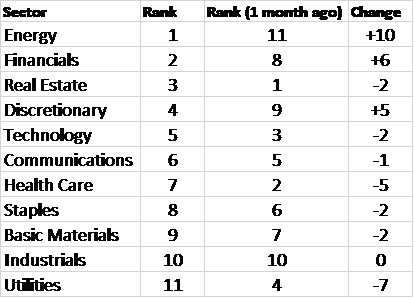

The S&P Sectors are seeing some significant rotations. While we have seen technology fall off, there has been a rise from some of the former bottom feeders of the market. Take a look at Canterbury’s risk-adjusted rankings. At the start of September, Energy and Financials were ranked at or near the bottom, while tech and health care stocks were at the top. As a side note, most of Energy’s fast rise has occurred within the last week and a half.

Relative Strength

I want to highlight a few charts that have recently come into favor with the sector rotation.

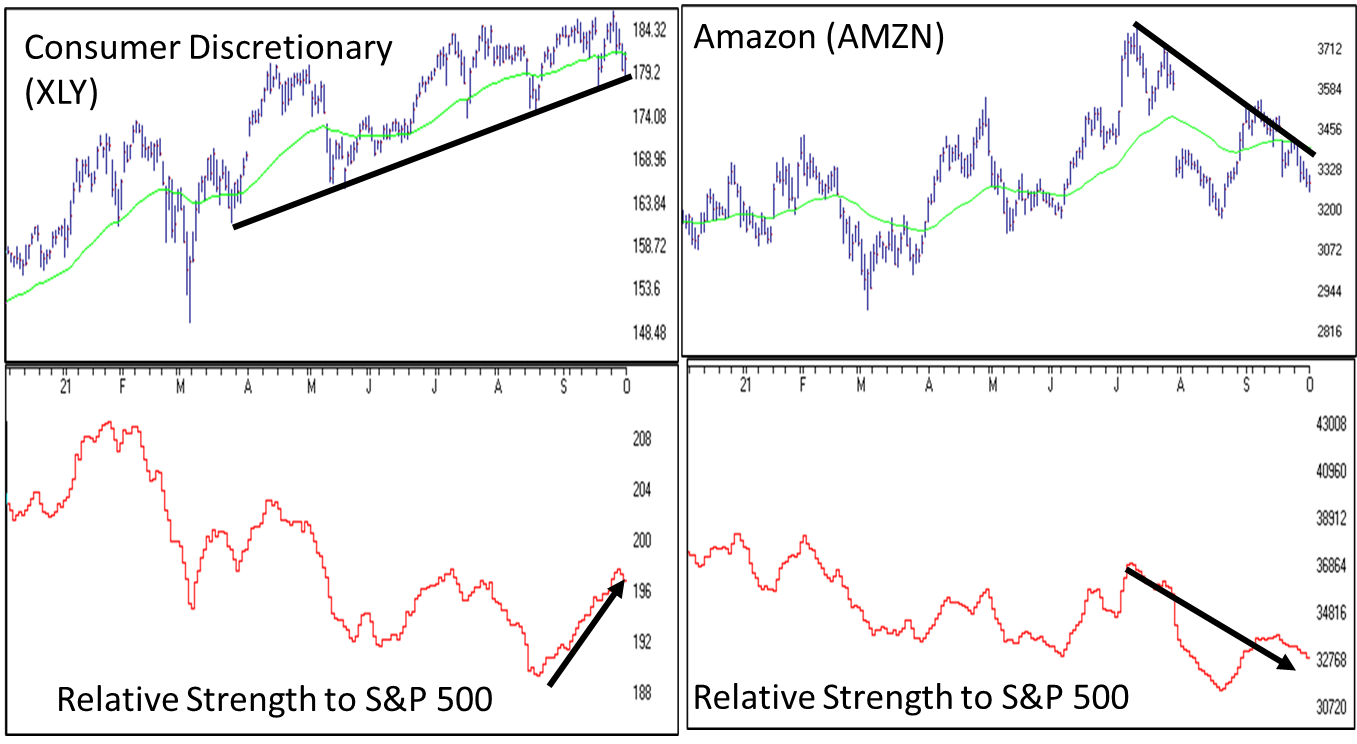

Consumer Discretionary

Consumer Discretionary has also seen an increase in strength. What I find most interesting about Discretionary is that this rise in rank is in spite of the weakness in Amazon. Amazon, which we would largely consider more correlated to technology stocks than the typical Discretionary stock, has moved sideways, and is now declining with higher volatility. Amazon makes up nearly 1/4 of consumer discretionary. This means that the sector is showing some stronger breadth among the other retail securities.

You can see in the charts below, Consumer Discretionary has been rising in an orderly fashion, with rising relative strength over the month of September. Amazon has seen a decline over the last quarter with falling relative strength. Consumer Discretionary has remained strong even with Amazon’s weakness working against the sector’s performance.

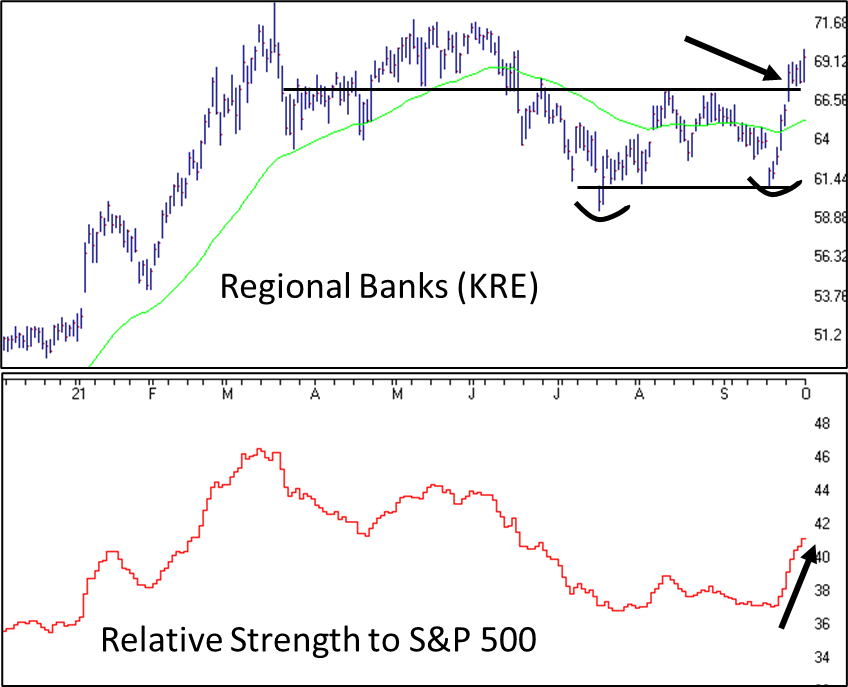

Financials- Regional Banks

The Financials sector has been rising in risk-adjusted relative strength. Below shows a chart of Regional Banks (ETF: KRE). You can see that Regional Banks held support levels and have recently broken above short-term resistance on rising relative strength, despite the recent volatility experienced by the broader markets.

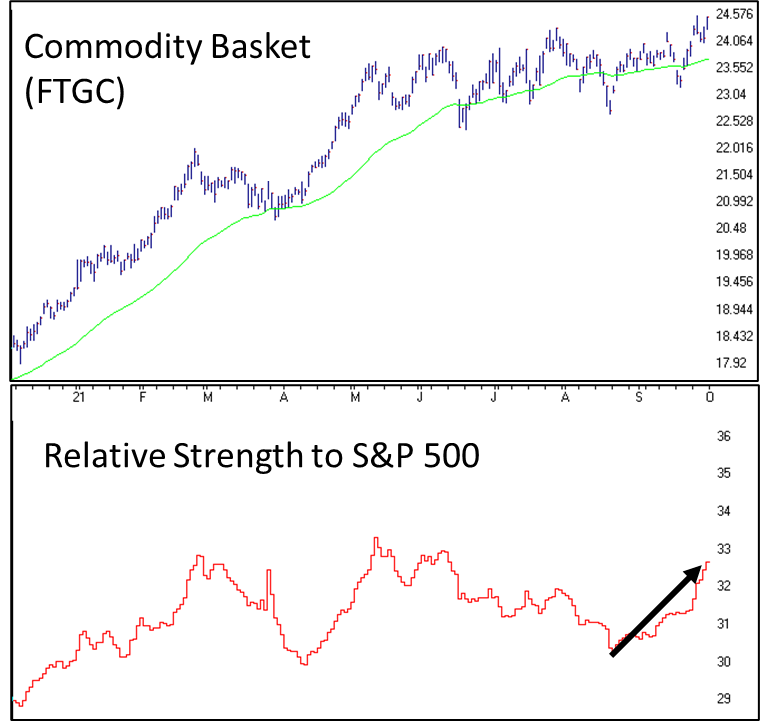

Commodities

Aside from the equity markets, let’s take a look at commodities. Below is a chart of a basket of commodities. Commodities include energy, agriculture, industrial metals, precious metals, and livestock. These commodities have shown positive relative strength compared to equities over this short period of rising stock market volatility.

Bottom Line

The bottom line is that volatility is rising. Rising volatility means that equity markets are becoming increasingly correlated. Increasing correlations is a sign of decreasing market efficiency and an early indications of potential trouble ahead.

That being said, equities are not by any means in a bear market, and we are not saying that we are entering a bear market either. What we are beginning to see is some early signs in rotation of leadership, particularly in the area of technology-related stocks. Technology stocks are the largest component in most major market indexes. Should technology continue to experience higher volatility and future weakness, it would likely pull many market indexes with it.

Keep in mind that market indexes are not diversified portfolios or even diversified baskets of equities. Right now, there are several areas of the market that look good. For example, Small Caps have seen an increase in relative strength. Even though small cap stocks have moved sideways this year, they have seen some outperformance relative to large cap securities in the past few weeks.

If volatility ultimately does increase to higher levels and if we do experience a bear market, having an adaptive portfolio that can rotate to navigate changing markets will be crucial. An Adaptive Portfolio is designed to adjust its holdings in order to maintain low and consistent volatility. The Canterbury Portfolio Thermostat, which is an Adaptive Portfolio, seeks to limit portfolio declines and compound through stabilizing the large fluctuations that can be seen during volatile periods in the markets.