By Thomas Urano, Principal & Managing Director

The money market community is struggling with a 0% yield environment and a mountain of cash threatening to drive money market rates into negative territory. What are the alternatives for short-term investors?

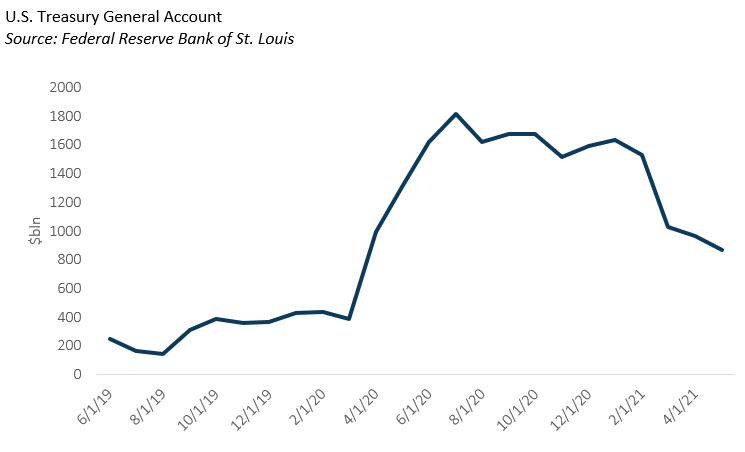

A year ago, the U.S. Treasury funded itself with a war chest of cash ready to spend on fiscal stimulus. Some may argue the Treasury substantially overfunded itself as the Fed’s general account, or “checking” account, topped $1.8 trillion by summer 2020. Over the last three months, the Treasury has spent down a large portion of this, putting over $600 billion back into the private sector.

The wave of cash flooding into bank deposits and money market funds is threatening to test the line in the sand between zero and negative yields. The Treasury has cut T-bill issuance this year, causing a reduction of $424 billion in net T-bill supply available to the market. The reduced supply of Treasury bills is making it difficult for money market funds to find suitable investment options for the inflow of cash. At near 0% yields, it becomes costly to maintain the infrastructure of a money market fund vehicle and incentivizes fund operators to pass costs along as negative yields or initiate a soft close of funds to new investors.

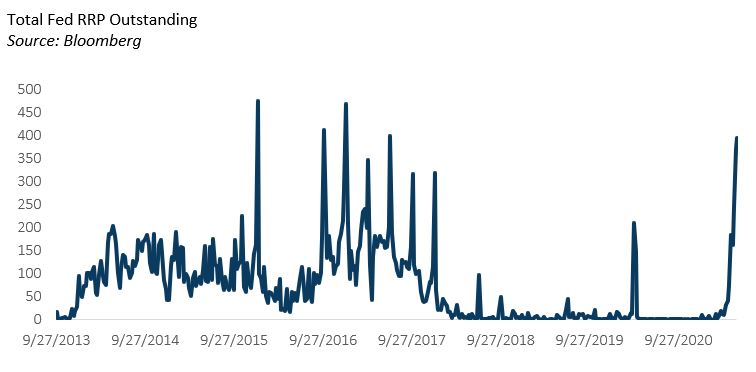

Enter the Fed. Through its Reverse Repo Facility (RRP) the Fed is taking in cash and paying out interest, essentially serving as the last stop investment option for cash. In an effort to prevent overnight rates from venturing into negative territory, the Federal Reserve has expanded its Reverse Repo Facility to almost $400 billion, up from zero in January.

Whether you look at T-bill yields, bank deposits, or RRP usage, all signs point to excess cash desperately in search of a home. Raising interest rates is the simple answer. Increasing RRP rates would drag T-bill yields off the floor and alleviate some pressure on other money market rates.

What are the alternatives for short-term investors? Enhanced Cash or Ultra Short Strategies invest just beyond the investable universe available to money market funds and inside of short-term fixed income strategies (1-3 year). An evaluation of the investment grade corporate bonds that have 1) 3-12 months to maturity, 2) are U.S.-dollar denominated, and 3) have more than $300 million in outstanding issue, shows that an opportunity for cash investors still exists. The size of this market is over $450 billion, the yield to worst is 0.38%, and with only a slight extension of interest rate sensitivity (0.5 year effective duration).

Absent further clarity on Fed policy, cash investors with flexibility would be well served to consider such alternatives to preserve the yield on their short-term investments.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.